Road to $100k - Week 18

Week 18 Performance Overview

- Current Account Balance: $9,049

- Trump-Elon bromance rekindled

- Tesla Robotaxi announcement scheduled for June 22nd

- Market tumbled due to Israel-Iran conflict uncertainty

- Monitoring oil prices for potential market impact

- All positions closed, holding cash for next opportunities

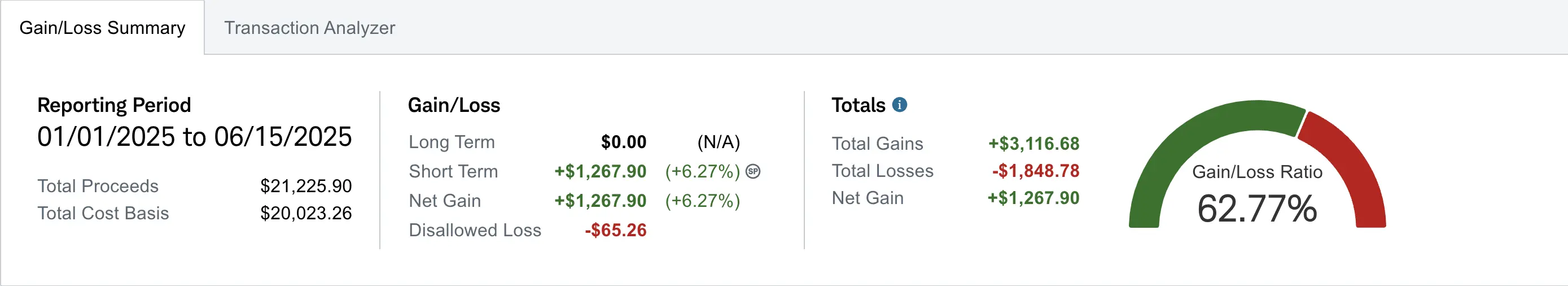

- Realized gain of $1,267.90 (up +$47.94 from Week 17) GME and NBIS realized gain to be updated next week.

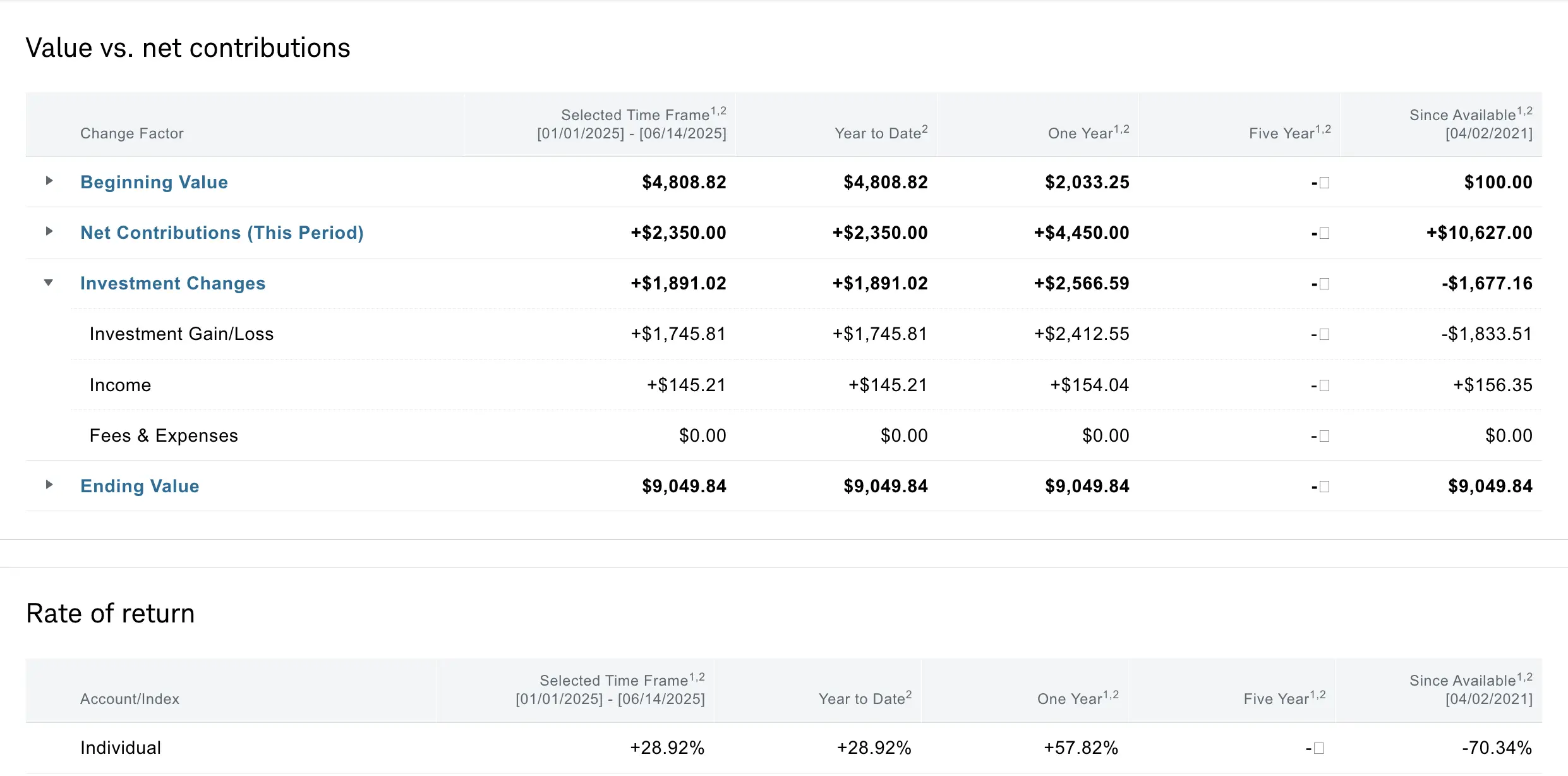

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,677 despite contributing over $10.6K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year and YTD performance metrics are what truly matter for tracking this journey.

Market Outlook

This week, tensions eased between Trump and Elon Musk, reigniting their high-profile alliance. Tesla also announced the official rollout date for its long-awaited Robotaxi—set for June 22nd. However, markets slid toward the end of the week amid renewed uncertainty surrounding the Israel-Iran conflict. I’m closely monitoring oil prices, as a sharp increase could trigger a broader market pullback.

My Week 18 Trades

$TSLL Position

I held $11 strike cash-secured puts opened the previous week. This week, I rolled them down and out—from $11 expiring 06/13 to $10.70 expiring 06/20—for a net credit of $12. This move reduced my risk by $30 while still collecting a credit, further lowering my adjusted cost basis in the event of assignment.

-

06/09/2025 Sell to Open:

- TSLL 06/20/2025 10.70 P

- Net Credit: $83

-

06/09/2025 Buy to Close:

- TSLL 06/13/2025 11.00 P

- Debit: -$71

- Total Net Credit: $12

I also had $9.50 strike TSLL puts opened from the previous week with a net credit of $30. I closed the position this week for a debit of $8, locking in a total net profit of $22.

-

06/10/2025 Buy to Close:

- TSLL 06/13/2025 9.50 P

- Debit: -$8

- Net Profit: $22

Later in the week, I closed my $10.70 cash-secured puts, which I had previously rolled down from the $11 strike.

-

06/11/2025 Buy to Close:

- TSLL 06/20/2025 10.70 P

- Debit: -$17

- Net Profit: $28 (original premium of $33 + $12 from the roll – $17 to close the position)

$GME Position

Following GameStop’s earnings this week, the company announced a convertible notes offering, triggering a sharp decline in the stock. I took advantage of the dip by selling cash-secured puts at the $19 and $21 strikes, anticipating a rebound based on the daily oversold RSI, an extended 20SMA on the 4-hour chart, and a strong demand zone near $19 on the weekly chart.

-

06/12/2025 Sell to Open:

- GME 06/13/2025 19.00 P

- Net Credit: $8

-

06/12/2025 Sell to Open:

- GME 06/13/2025 21.00 P

- Net Credit: $26

Both contracts expired worthless this week, resulting in a net profit of $34 on GME.

$NBIS Position

From last week's covered call rolls, I collected a net credit of $52. I was assigned on Friday, and while the exact profit on the overall NBIS trade is still pending Schwab’s realized gains update, the position is in the green. This outcome is the result of cumulative net credits from a series of strategic rolls—starting with cash-secured puts and continuing with covered calls after assignment. These adjustments ultimately turned the trade into a win. I expect Schwab’s dashboard to reflect the finalized gains for both NBIS sometime first thing Monday.

What I'm Holding Now

As of June 15, 2025, here's what's in my portfolio:

- $9,049 all cash. No open positions

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

Looking ahead, I’ll be keeping a close eye on Tesla’s Robotaxi announcement set for June 22nd, along with ongoing developments in the Israel-Iran conflict. Oil prices will remain a key indicator—sharp increases could point to broader market pullbacks. With my portfolio currently fully in cash, I’m well-positioned to capitalize on any new opportunities that emerge.

I'll be using our options scanner to identify potential trades for the upcoming weeks.