Road to $100k - Week 27

Week 27 Performance Overview

- Current Account Balance: $10,116

- Hotter than expected PPI report

- Bessent stated that the strategic reserve will not buy Bitcoin, rather hold on to all the ones already confiscated

- Managed positions in $LUNR and $MSTX

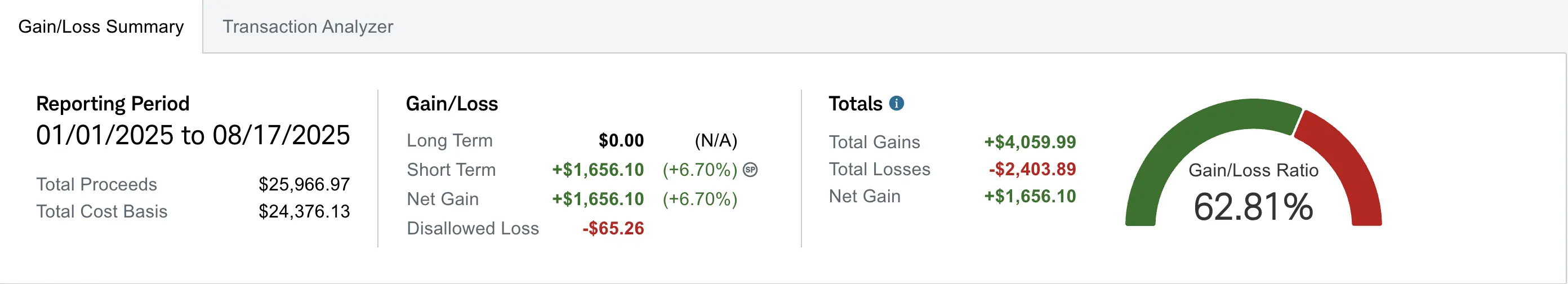

- Realized gain of $1,656 (up +$21 from Week 26)

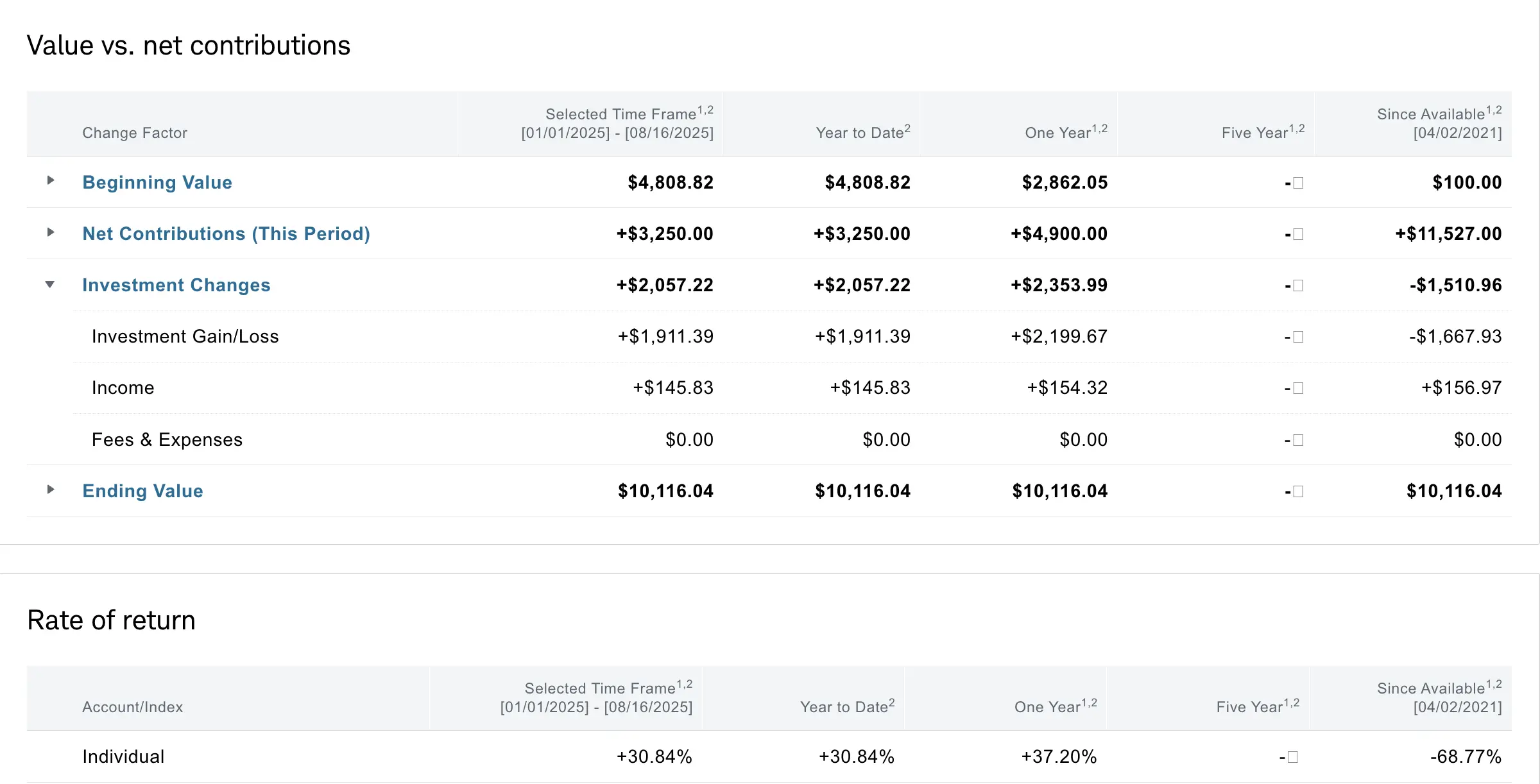

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,510 despite contributing over $11.5K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+37.20%) and YTD (+30.84%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week's most notable headlines included a hotter than expected PPI report. This was followed by Bessent stating that the strategic reserve will not buy Bitcoin, but rather hold on to all the ones already confiscated.

My Week 27 Trades

$MSTX

I misclicked this week and opened a $22 strike cash secured put for $8, at a much lower credit than I originally planned for, but this worked out. This contract along with the previous $22 strike cash secured puts both expired worthless this week. I had one of these contracts from last week 08/08:

-

08/11/2025 Sell to Open:

- MSTX 08/15/2025 22.00 P

- Quantity: 1

- Credit: $8

-

08/08/2025 Sell to Open:

- MSTX 08/15/2025 22.00 P

- Quantity: 1

- Credit: $27

Both the $22 strike opened this week and the one from last week expired worthless. This will reflect on my realized gain on Monday due to how Schwab updates their metrics if the options expire on Friday. It will increase my realized gain by $35.

Later during the week I opened another cash secured put for 08/22 with a $20 strike for a net credit of +$24.

-

08/14/2025 Sell to Open:

- MSTX 08/22/2025 20.00 P

- Quantity: 1

- Credit: $24

I also still had $21 strike cash secured puts from last week, which I rolled down and out to the following week with an 08/22 $18 strike to derisk while collecting a net credit of +$28.

-

08/14/2025 Buy to Close:

- MSTX 08/15/2025 21.00 P

- Quantity: 1

- Debit: -$1

-

08/14/2025 Sell to Open:

- MSTX 08/22/2025 18.00 P

- Quantity: 1

- Credit: $29

- Net Credit from rolling: +$28

$LUNR

Intuitive Machines announced a $300M convertible notes offering, so I took the opportunity to sell cash secured puts because I am still bullish ahead of the IM-3 launch, which has now been pushed back to late 2026. With the recent dilution announcement, LUNR has now broken previous support around $9.5. I will be monitoring this closely and will roll as needed.

-

08/14/2025 Sell to Open:

- LUNR 08/22/2025 8.50 P

- Quantity: 1

- Credit: $19

What I'm Holding Now

As of August 17, 2025, here's what's in my portfolio:

- 2 cash secured puts on $MSTX: $18 and $20 strikes (08/22 expiry)

- 1 cash secured put on $LUNR: $8.50 strike (08/22 expiry)

- $5,507.18 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I wanted to open more cash secured puts going into next week but I believe more market downside is coming. So I am patiently waiting for setups at much lower risk levels and higher premiums. With a healthy cash balance of over $5,500, I'm well-positioned to take advantage of any new opportunities that arise. I'll continue to use the options scanner to identify new setups while managing my existing positions.