Road to $100k - Week 33

Week 33 Performance Overview

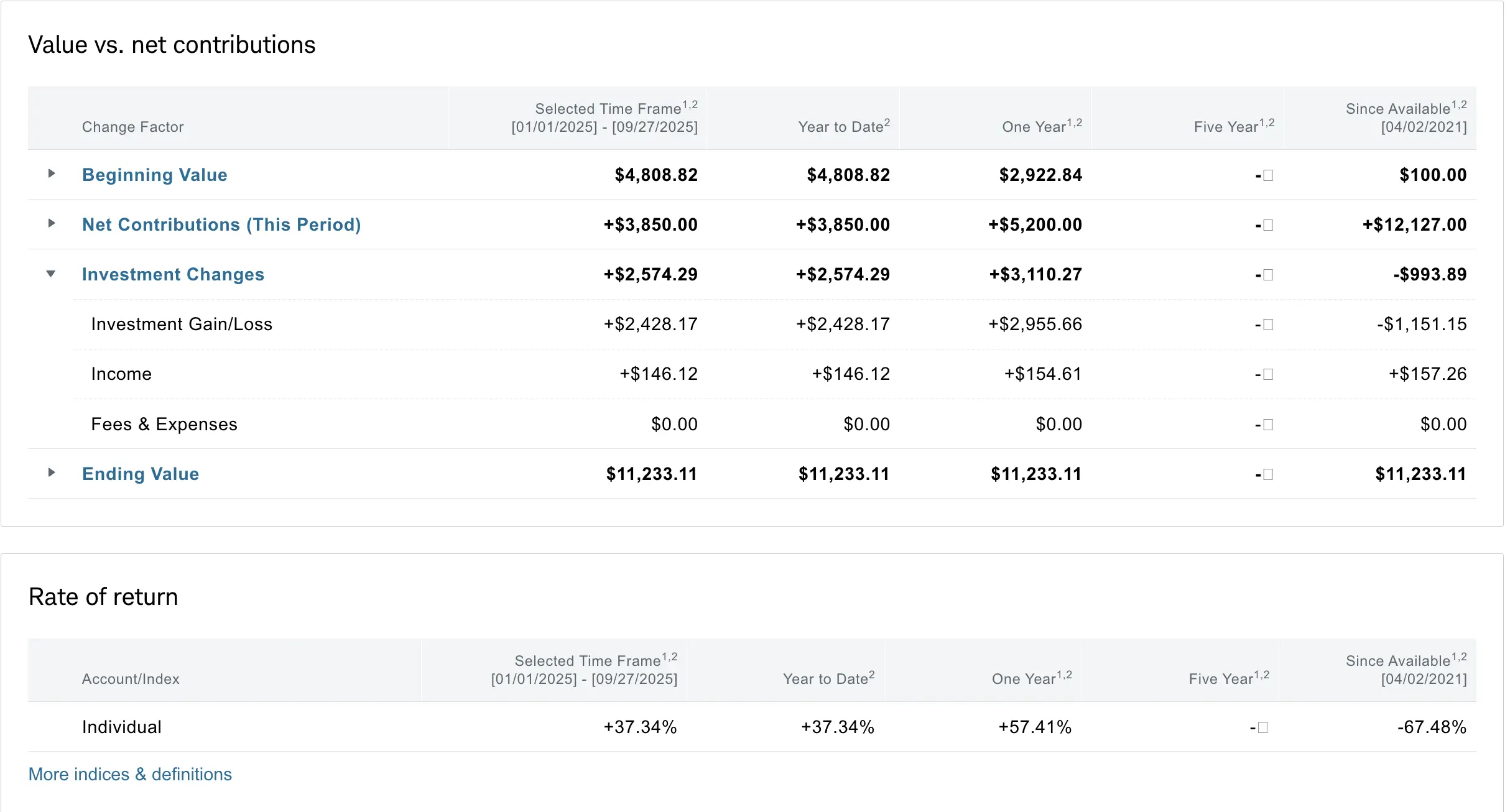

- Current Account Balance: $11,233

- Powell reiterated concerns about weakening labor market

- Fed in "wait and see" mode regarding further rate cuts

- Core CPI came in line at 0.2% month over month

- Small market pullback following Powell's speech

- Managed multiple positions in $MSTX, $LUNR, and $BMNR

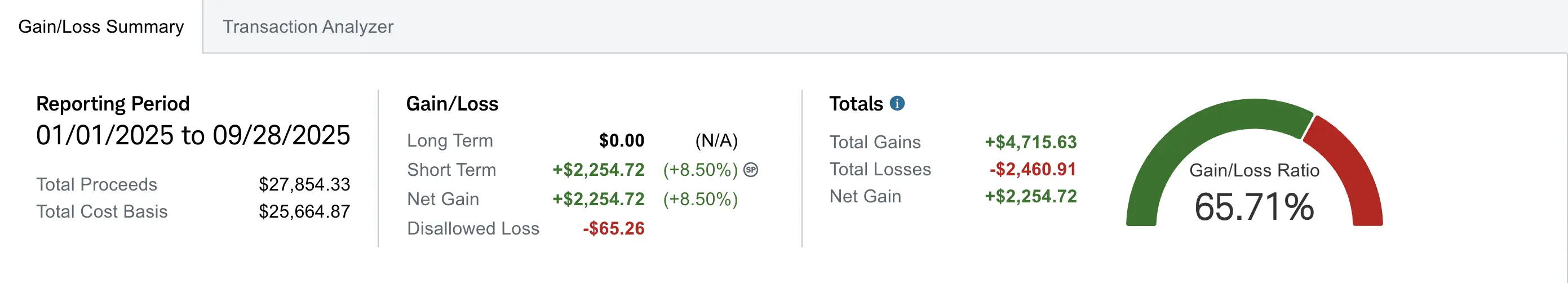

- Realized gain of $2,254 (up +$90 from Week 32)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $993 despite contributing over $12.1K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+57.41%) and YTD (+37.34%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week we saw a small pullback following Powell's speech. The Fed Chair reiterated concerns surrounding the weakening labor market and indicated a "wait and see" approach regarding further rate cuts. Core CPI data came in line with expectations at 0.2% month over month, providing some stability to inflation expectations.

The crypto market experienced significant volatility, with prices dropping notably mid-week. This created several trading opportunities in crypto related stocks, which I was able to capitalize on.

My Week 33 Trades

$MSTX

At the start of this week, I saw an opportunity on $MSTX and opened an $18 strike cash secured put expiring 10/03. I closed this position prior to Powell's speech on Tuesday with over 50% profit and more than a week left until expiration.

-

09/22/2025 Sell to Open:

- MSTX 10/03/2025 18.00 P

- Quantity: 1

- Credit: +$40

-

09/23/2025 Buy to Close:

- MSTX 10/03/2025 18.00 P

- Quantity: 1

- Debit: -$17

- Net Profit: +$23

By closing the trade when it was over 50% profitable, I was able to re-enter the same trade with the same strike and expiration for slightly higher premiums.

-

09/24/2025 Sell to Open:

- MSTX 10/03/2025 18.00 P

- Quantity: 1

- Credit: +$30

In hindsight, I should have waited a bit longer, but timing the market perfectly is impossible. As the entire market, including crypto, started to decline shortly after, I took advantage of the situation by opening additional positions. I closed the $14 strike next day for over 50% profit with more than a week left.

-

09/25/2025 Sell to Open:

- MSTX 10/03/2025 16.00 P

- Quantity: 1

- Credit: +$40

-

09/25/2025 Sell to Open:

- MSTX 10/03/2025 14.00 P

- Quantity: 1

- Credit: +$30

-

09/26/2025 Buy to Close:

- MSTX 10/03/2025 14.00 P

- Quantity: 1

- Debit: -$15

- Net Profit: +$15

$LUNR

At the beginning of the week, I opened a $9 strike cash secured put on $LUNR and closed it the same day for over 50% profit with more than a week left until expiration.

-

09/22/2025 Sell to Open:

- LUNR 10/03/2025 9.00 P

- Quantity: 1

- Credit: +$28

-

09/22/2025 Buy to Close:

- LUNR 10/03/2025 9.00 P

- Quantity: 1

- Debit: -$13

- Net Profit: +$15

A few days later, after the market had declined, I jumped back into $LUNR with a higher strike price and again closed the position the same day.

-

09/25/2025 Sell to Open:

- LUNR 10/03/2025 9.50 P

- Quantity: 1

- Credit: +$30

-

09/25/2025 Buy to Close:

- LUNR 10/03/2025 9.50 P

- Quantity: 1

- Debit: -$15

- Net Profit: +$15

$BMNR

As the crypto market started to decline, I saw an opportunity with Bitmine, the largest ETH treasury (similar to how $MSTR is the biggest BTC treasury). I opened a $39 strike cash secured put expiring 10/03 and closed it the next day for over 50% profit with more than a week left until expiration.

-

09/25/2025 Sell to Open:

- BMNR 10/03/2025 39.00 P

- Quantity: 1

- Credit: +$48

-

09/26/2025 Buy to Close:

- BMNR 10/03/2025 39.00 P

- Quantity: 1

- Debit: -$21

- Net Profit: +$27

What I'm Holding Now

As of September 28, 2025, here's what's in my portfolio:

- $7,920 Cash reserves for potential opportunities

- MSTX 10/03/2025 18.00 CSP

- MSTX 10/03/2025 16.00 CSP

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

Looking ahead to next week, I will be closely monitoring crypto

market conditions as I navigate through my $MSTX positions. The $18

strike may need to be rolled down and out, while I'm feeling more

confident about the $16 strike as crypto rebounds.

I will continue to look for opportunities with $LUNR, as I remain

bullish ahead of their IM-3 launch scheduled for the second half of

2026.

As always, I'll be using the

options scanner

to identify potential trades.