Road to $100k - Week 41

Week 41 Performance Overview

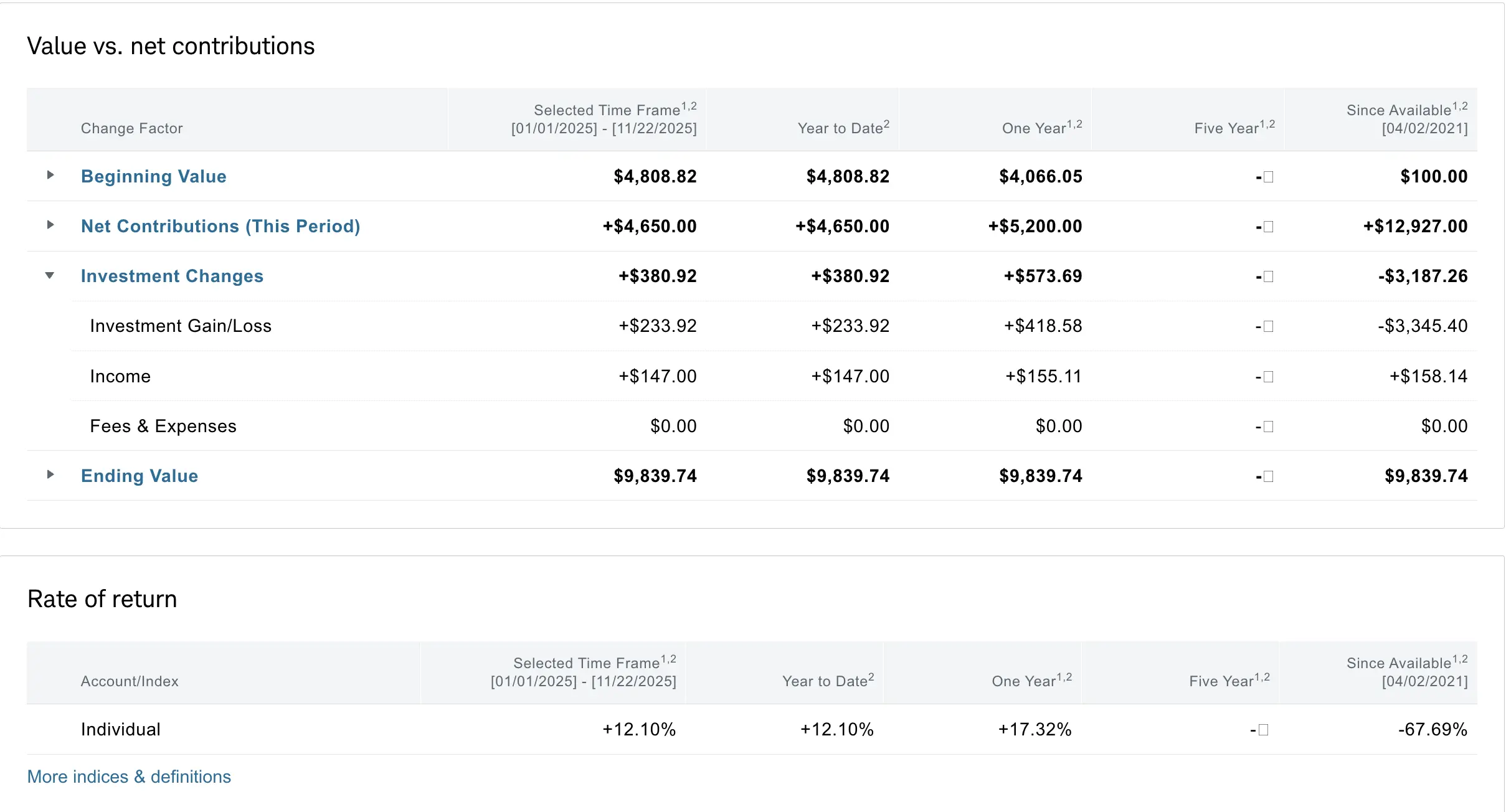

- Current Account Balance: $9,839

- Cash Balance: $710

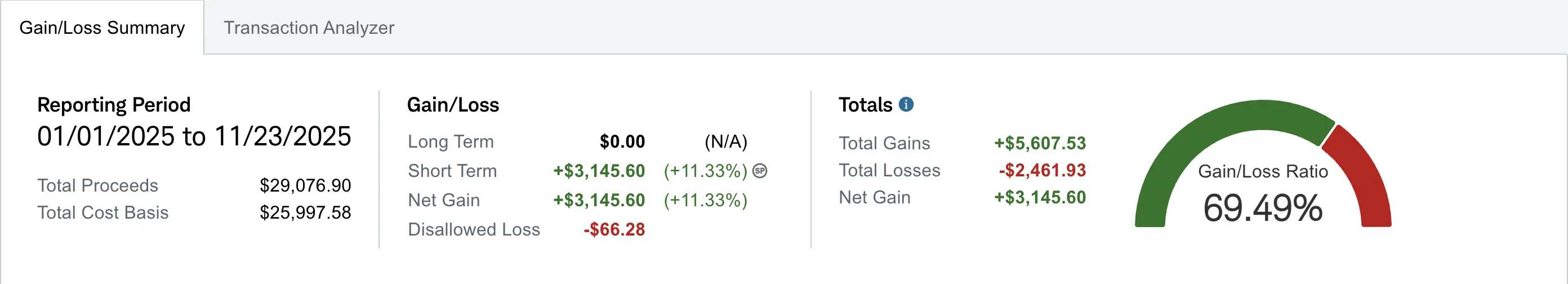

- Realized gain of $3,145 (up +$38 from Week 40)

- Fed minutes signal patience on rate cuts, leading to market chop.

- NVDA beat earnings and most recently announced deals for Saudi. Growth continues, putting the AI bubble narrative to rest

- Japan to raise interest rates, yen carry trade in effect

- October CPI will not be released because of government shutdown

- Focused on selling covered calls to collect something better than nothing.

- Closed the week with a small gain in a volatile market.

It was a choppy week in the market, I collected what I could by selling covered calls. The Fed minutes indicated that they are in no rush to cut rates, which contributed to the market volatility. Despite the chop.

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about -$3,187 despite contributing over $12.9K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+12.10%) and YTD (+17.32%) performance metrics are what truly matter for tracking this journey.

My Week 41 Trades

$MSTX

I did not execute any covered call sales on $MSTX this week. The recent downturn in the Bitcoin sector has increased downward pressure on MSTR, and consequently the 2x leveraged product, MSTX. With 300 shares still in my position, I am waiting for a more favorable bounce before writing covered calls. To capture a meaningful premium under current conditions, I might have to pivot from my standard weekly/biweekly strategy to using monthly expirations.

$PSKY

I sold a covered call against my 200 shares to collect premium for thanksgiving week since it is a short week next week.

-

11/17/2025 Sell to Open:

- PSKY 11/28/2025 17 C

- Quantity: 2

- Premium: $0.17

- Fees: $1.03

- Net Credit: +$32.97

$AES

My $14 strike cash-secured put expiring on 11/21 was assigned, adding another 100 shares to my position. On the 100 shares I already held from last week, I sold a covered call with a $14 strike for 11/21 expiration. This contract expired worthless, allowing me to collect a +$25 premium. I now hold 200 shares of AES and will sell covered calls against the full position next week.

-

11/17/2025 Sell to Open:

- AES 11/21/2025 14.00 C

- Quantity: 1

- Premium: $0.25

- Fees: $0.51

- Net Credit: +$24.49

$BULL

I refrained from selling any covered calls this week on WeBull. Despite the current low market sentiment, WeBull delivered decent earnings. I remain confident that if the company maintains its current growth trajectory, the share price will eventually align with its fundamentals. I still hold 200 shares.

Looking Ahead

My plan is to continue selling covered calls on my existing positions to generate income. I'll be keeping a close eye on $BULL's earnings and will decide on a strategy for that stock after the announcement.

What I'm Holding Now

As of November 23, 2025, here's what's in my portfolio:

- $710 cash on hand

- 300 shares of MSTX

- 200 shares of PSKY (2 covered calls exp 11/28)

- 200 shares of BULL

- 200 shares of AES

- Weekly $100 deposit on Wed and Fri splits