Road to $100k - Week 45

Week 45 Performance Overview

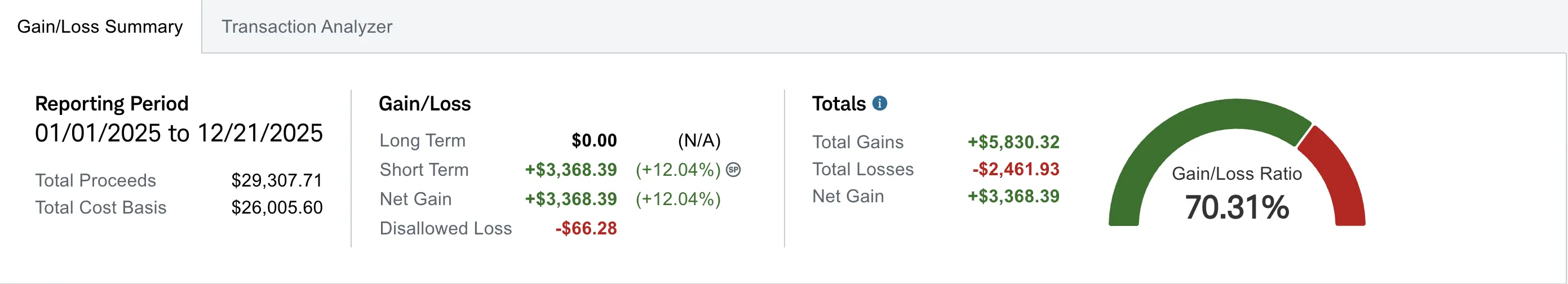

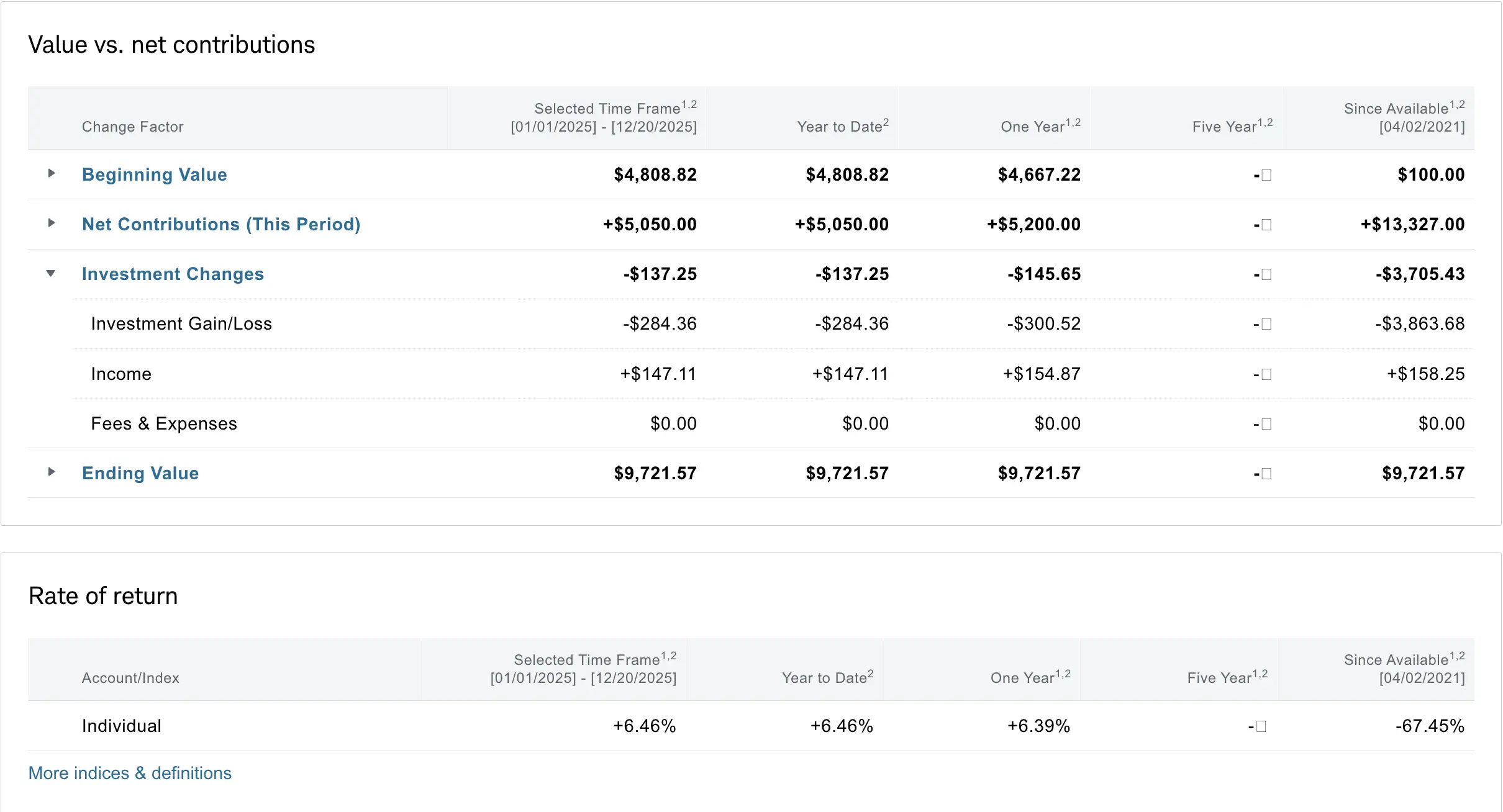

- Current Account Balance: $9,711

- Realized gain of $3,368 (up +$109 from Week 44)

- November CPI came in lower than expected.

- ORCL finalizes TikTok deal.

- Executive orders signed to have America back onto the Moon in 2028.

Portfolio Performance

This week was marked by some exciting news, including a lower-than-expected CPI report and a finalized deal between Oracle and TikTok. The announcement of a permanent moon base by 2028 also caught my attention, leading to a profitable trade in $LUNR.

Market Recap

The market reacted positively to the lower-than-expected CPI numbers, and the news of Oracle finalizing its deal with TikTok also made headlines. The big news for me, however, was the executive order to establish a permanent moon base, which created a great trading opportunity in $LUNR.

My Week 45 Trades

$LUNR

I sold a cash-secured put on $LUNR with a $9.50 strike, collecting a premium of +$32. After the news of the moon mission, I closed the position for a small profit. I'll be keeping an eye on $LUNR for future opportunities.

-

12/15/2025 Sell to Open:

- LUNR 12/26/2025 9.50 P

- Quantity: 1

- Premium: $0.32

- Fees: $0.51

- Net Credit: +$31.49

-

12/19/2025 Buy to Close:

- LUNR 12/26/2025 9.50 P

- Quantity: 1

- Premium: $0.03

- Fees: $0.01

- Net Debit: -$3.01

$AES

I sold two covered calls on $AES with a $14 strike, collecting a premium of +$35. I'll continue to sell covered calls on my shares to generate income until they are called away.

-

12/15/2025 Sell to Open:

- AES 12/26/2025 14.00 C

- Quantity: 2

- Premium: $0.18

- Fees: $1.03

- Net Credit: +$34.97

$PSKY

With the news that WBD is favoring a deal with NFLX over PSKY, I'm looking to free up my capital from this position. In the meantime, I'll continue to sell covered calls. I sold two covered calls with a $17 strike for a small credit and also sold a cash-secured put with a $12.50 strike. If assigned on the cash secured puts, this will lower my average cost on the stock.

-

12/15/2025 Sell to Open:

- PSKY 12/19/2025 17.00 C

- Quantity: 2

- Premium: $0.03

- Fees: $1.03

- Net Credit: +$4.97

-

12/19/2025 Sell to Open:

- PSKY 12/26/2025 12.50 P

- Quantity: 1

- Premium: $0.15

- Fees: $0.51

- Net Credit: +$14.49

$BULL

I'm still holding my 200 shares of WeBull and did not sell any covered calls this week. I was unable to get filled at my desired strike price.

$MSTX

This remains my largest unrealized loss this year. With the crypto sector taking a hit, so has my portfolio. I still have 300 shares of $MSTX and did not sell any covered calls this week.

What I'm Holding Now

As of December 21, 2025, here's what's in my portfolio:

- $87 cash on hand

- 300 shares of MSTX

- 1 contract of PSKY $12.5 cash secured puts exp 12/26

- 200 shares of BULL

- 2 contract of AES $14 covered calls exp 12/26

- Weekly $100 deposit on Wed and Fri splits