Road to $100k - Week 47

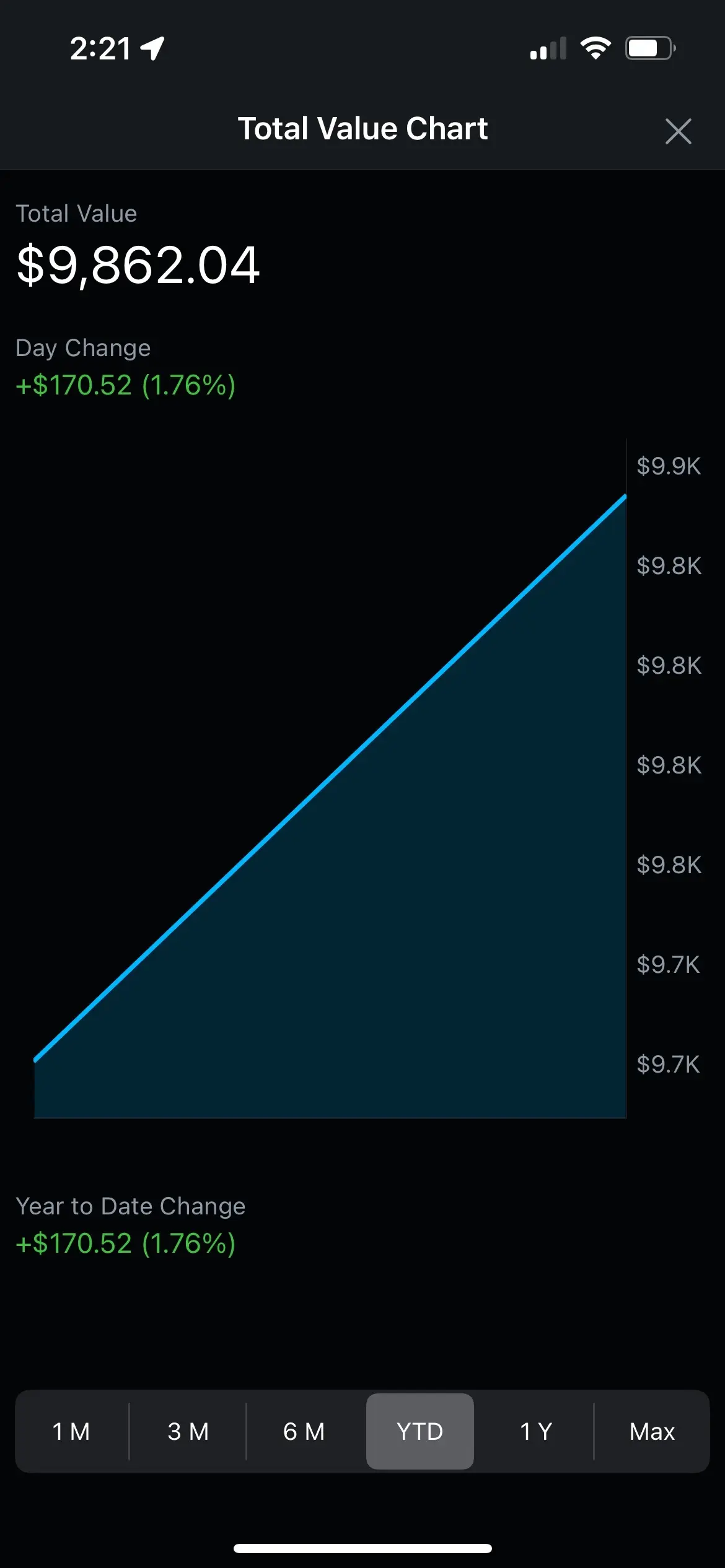

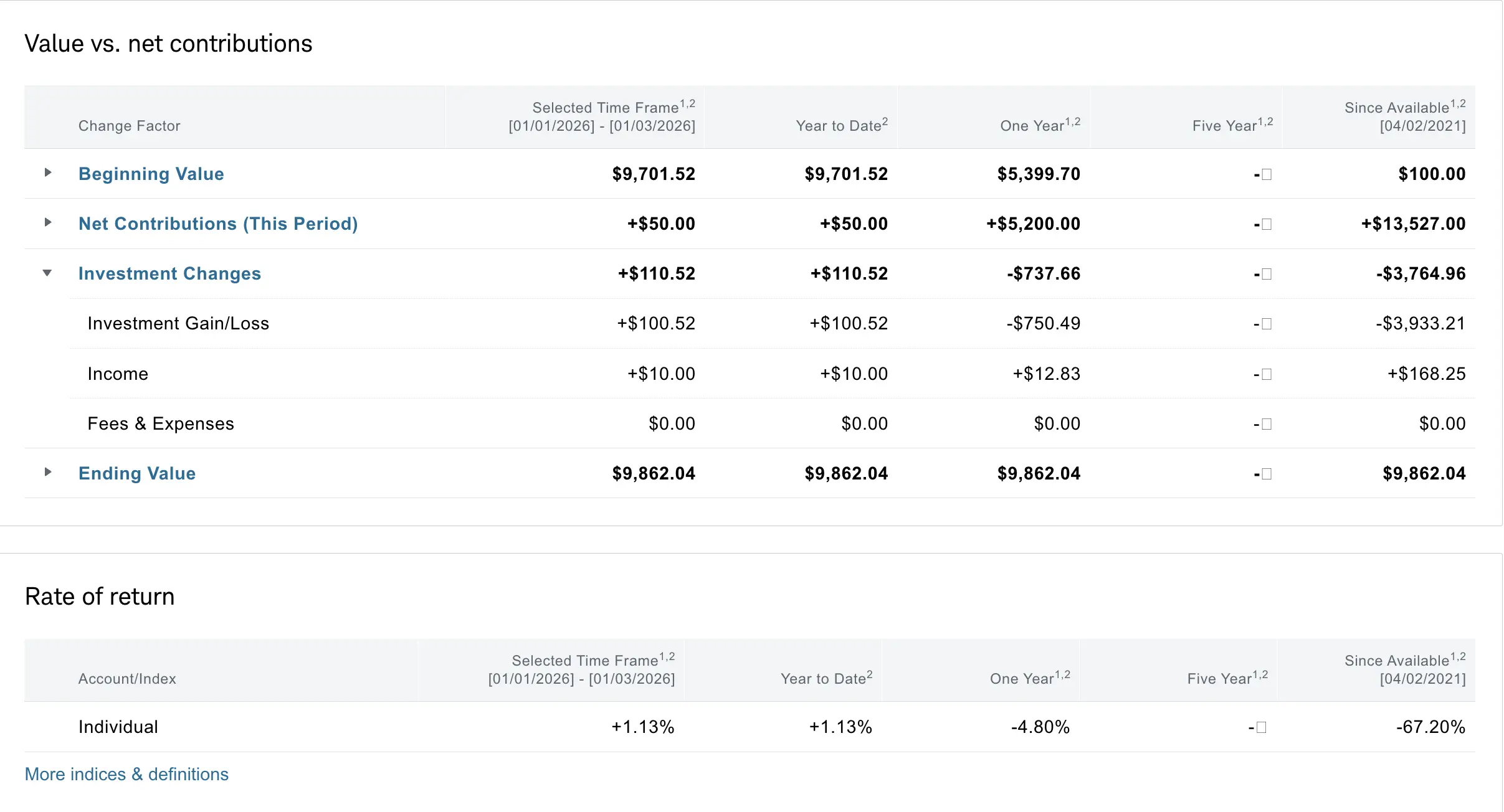

Week 47 Performance Overview

- Cash Balance: $1,196

- Realized gain of $0.00 (Happy New Year!)

Portfolio Performance

It was a quiet week for the market, with not much in the way of major headlines. I put some of my available capital to work by opening new cash-secured puts on $PSKY and $OUST.

My Week 47 Trades

$PSKY

I sold a cash-secured put on $PSKY with a $13 strike, expiring on January 9th, for a credit of +$27. If I get assigned, it will lower my cost basis on the shares I already own.

-

12/29/2025 Sell to Open:

- PSKY 01/09/2026 13.00 P

- Quantity: 1

- Premium: $0.27

- Fees: $0.51

- Net Credit: +$26.49

$OUST

I opened a new position in $OUST by selling a cash-secured put with a $19 strike, expiring on January 9th, for a credit of +$30. Ouster provides lidar sensors for the robotics industry, and I believe they are well-positioned to capitalize on the growth of this sector.

-

12/29/2025 Sell to Open:

- OUST 01/09/2026 19.00 P

- Quantity: 1

- Premium: $0.30

- Fees: $0.51

- Net Credit: +$29.49

$BULL

I'm still holding my 200 shares of BULL and did not sell any covered calls this week.

$MSTX

I still have 300 shares of $MSTX and did not sell any covered calls this week.

What I'm Holding Now

As of January 04, 2026, here's what's in my portfolio:

- $1,196 cash on hand

- 300 shares of MSTX

- 200 shares of PSKY

- 200 shares of BULL

- 1 contract of PSKY $13 cash secured puts exp 01/09

- 1 contract of OUST $19 cash secured puts exp 01/09

- Weekly $100 deposit on Wed and Fri splits