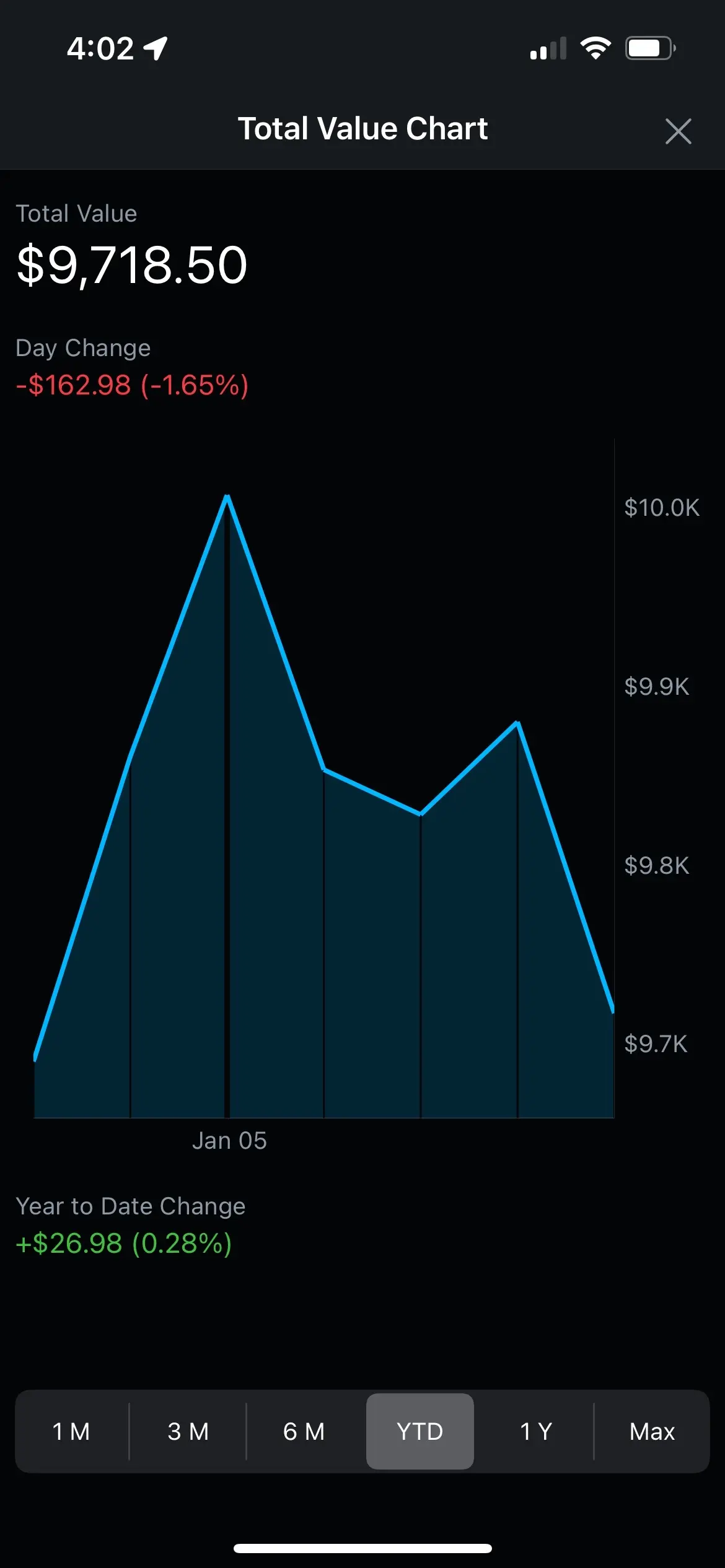

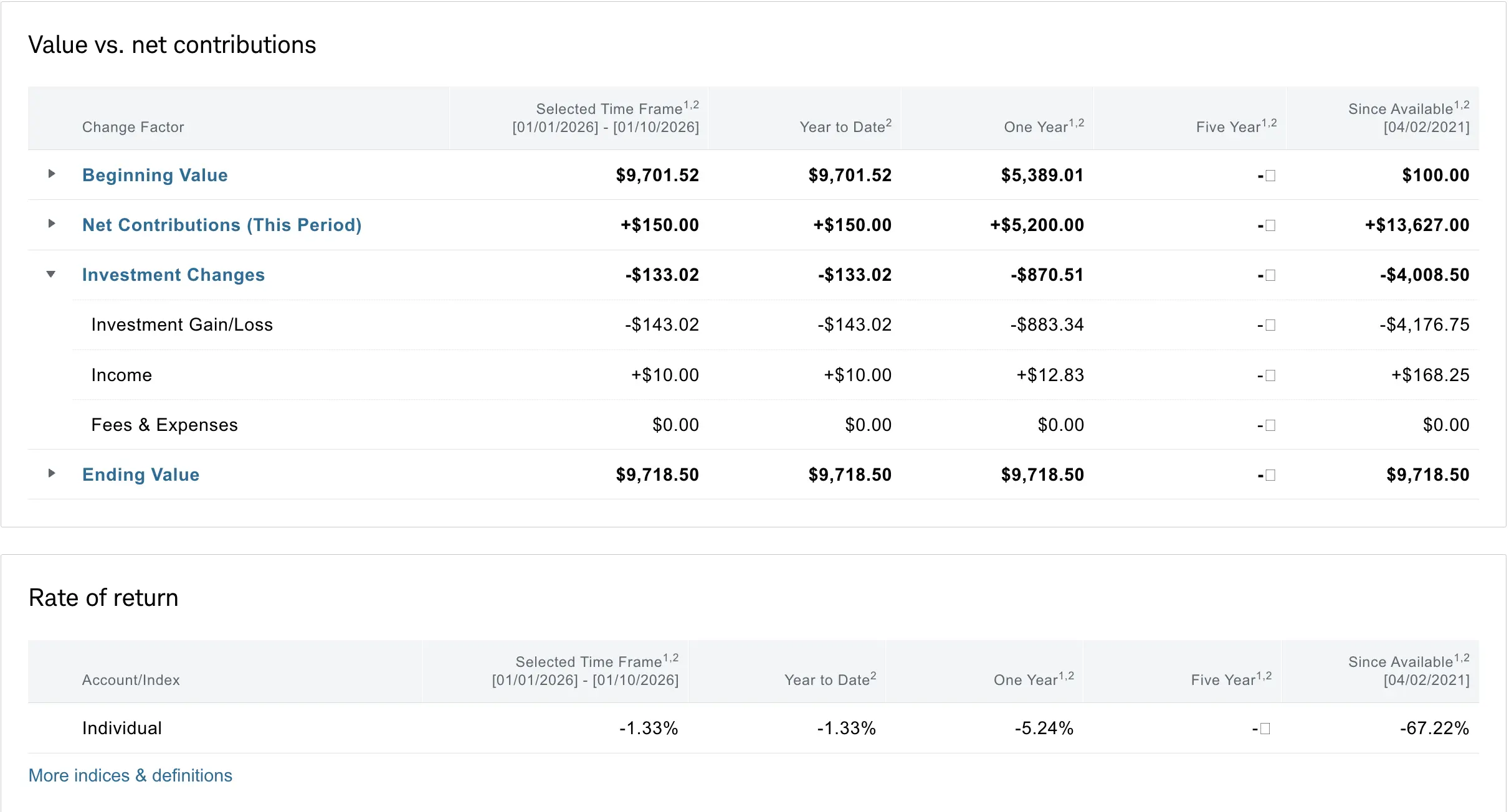

Road to $100k - Week 48

Week 48 Performance Overview

- Cash Balance: $284

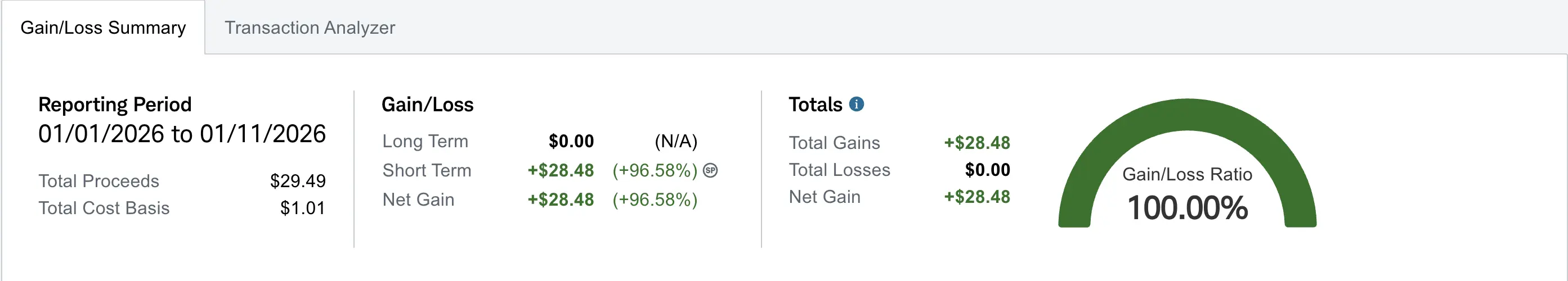

- YTD Realized gain of $28.48

- Trump ordered Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds to artificially drive down mortgage rates

- A proposal to ramp up military spending to $1.5 trillion by 2027 sent defense contractors higher

- Unemployment rate ticked slightly lower to 4.6%

Portfolio Performance

This week I focused on managing my existing positions and opening a new trade in $FVRR. I also successfully closed my $OUST position for a profit.

Market Recap

The most notable headlines this week included Trump ordering Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds to artificially drive down mortgage rates. Additionally, a proposal to ramp up military spending to $1.5 trillion by 2027 sent defense contractors higher, even as the administration pressured firms to halt buybacks and dividends via executive order. The unemployment rate also ticked slightly lower to 4.6%.

My Week 48 Trades

$PSKY

I had $13 strike cash secured puts coming into this week. I was assigned early on those shares. Now I have 300 shares with an average cost of $15.51. I also opened an additional $12 strike cash secured puts exp 01/16. If assigned this will help me further lower my cost basis to which I can sell more aggressive covered calls to free up this position. I am currently waiting in limbo on how the Paramount Skydance and WBD / Netflix merger situation plays out.

-

12/29/2025 Sell to Open:

- PSKY 01/16/2026 12.00 P

- Quantity: 1

- Premium: $0.20

- Fees: $0.51

- Net Credit: +$19.49

$OUST

I opened $19 strike cash secured puts exp 01/09 last week for +$30. This week I was able to close it for a debit of -$1. Bringing my total to +$29 before fees.

-

12/29/2025 Sell to Open:

- OUST 01/09/2026 19.00 P

- Quantity: 1

- Credit: $29.49 (Net)

-

01/09/2026 Buy to Close:

- OUST 01/09/2026 19.00 P

- Quantity: 1

- Debit: -$1.01 (Net)

$FVRR

This week I opened a new position in $FVRR as it is approaching 2019 lows. The company is profitable and although slowing down in terms of user growth. Their latest earnings calls indicated that they are pivoting to AI related task works. I am looking for a bounce off on FVRR so I opened $17.5 strike cash secured puts exp 01/16 for a credit of +$20.

-

01/09/2026 Sell to Open:

- FVRR 01/16/2026 17.50 P

- Quantity: 1

- Credit: $19.49 (Net)

$MSTX

I still have 300 shares of MSTX which remains my largest unrealized loss. I did not sell any covered calls on the position this week. This was most notable MSCI indicated that they would not delist treasury focused companies such as MSTR.

$BULL

I still have my 200 shares of $BULL that I did not sell any covered calls on this week.

What I'm Holding Now

As of January 11, 2026, here's what's in my portfolio:

- $284 Cash balance

- $MSTX 300 shares

- $PSKY 300 shares

- $BULL 200 shares

- $PSKY 12.00 P exp 01/16

- $FVRR 17.50 P exp 01/16

- Weekly $100 deposit on Wed and Fri splits