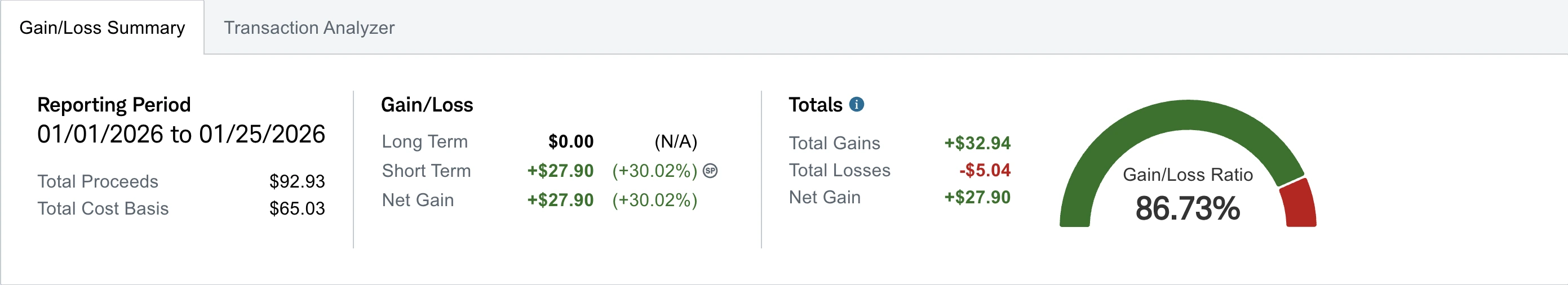

Road to $100k - Week 50

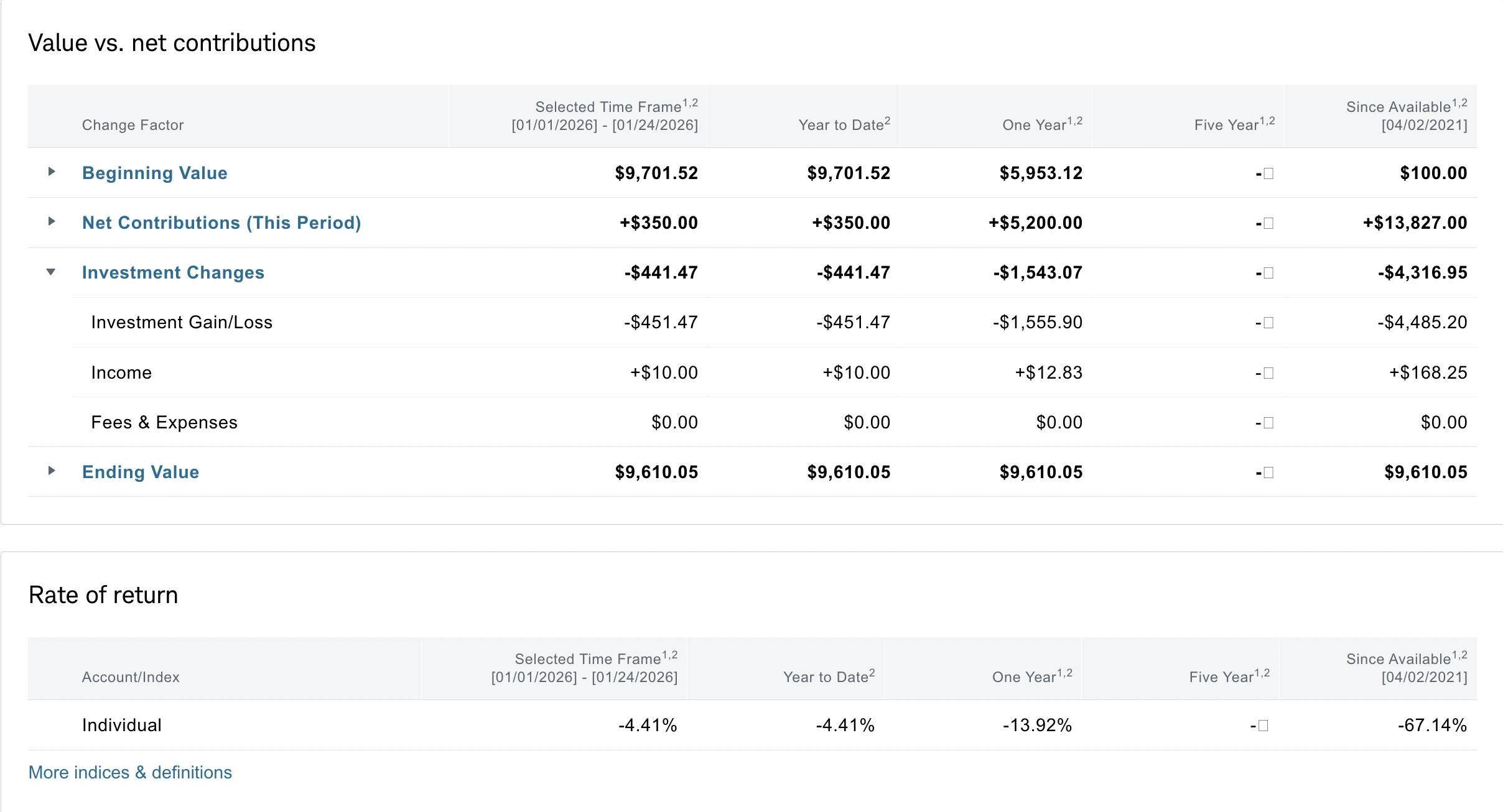

Week 50 Performance Overview

- Cash Balance: $162

- Portfolio Balance: $9,610

- Market News: No major market-moving headlines this week.

Portfolio Performance

This week not much happened in terms of market-moving headlines. The majority of my capital is still tied up, so progress has been extremely slow.

Market Recap

This week was relatively quiet in terms of major market headlines.

My Week 50 Trades

$FVRR

I got assigned on $17.5 strike cash secured puts last week. This week I opened $18 strike covered calls exp 02/20 for +$45. The rationale behind getting into FVRR is that the company is pivoting towards an AI-first strategy, offering AI solutions in addition to being profitable the past 2 years. Although the annual active buyers have been declining, I believe the pivot into AI-first will serve the company well.

-

01/20/2026 Sell to Open:

- FVRR 02/20/2026 18.00 C

- Quantity: 1

- Premium: $45.00

- Fees: -$0.51

- Net Credit: $44.49

$MBLY

This week I entered into a 01/21/2028 LEAP on MBLY. The thesis behind this is that MBLY recently acquired Mentee Robotics, which I believe is awaiting a market-wide physical AI wave. Per their latest earnings call, Mobileye stated they don’t expect full-scale Mentee Robotics production until late 2027 heading into 2028. Right now they are in the testing stage of commercialization in terms of what Mentee Robotics can do for companies. I believe the market will have its Physical AI wave between now and 2028.

-

01/20/2026 Buy to Open:

- MBLY 01/21/2028 10.00 C

- Quantity: 1

- Premium: -$415.00

- Fees: -$0.51

- Net Debit: -$415.51

$PSKY

I had $12 strike cash secured puts exp 01/23 heading into this past week. I rolled it at the money once again to 01/30 at the same 12 strike for an additional credit of +$20. The reason being I yield more by rolling as opposed to trying to selling covered calls on my holdings next week. This past weekend was the premier launch of UFC on Paramount and so far it has mixed reviews. The UFC fans argue that there are way too many ads being displayed which causes a decline in the UFC experience. Meanwhile, Paramount+ reached #1 in top apps this past weekend on the iOS store on the UFC event and in addition to the AFC championship. This upcoming earnings will determine if PSKY can continue to scale its DTC platform and achieve consistent profitability.

-

01/22/2026 Buy to Close:

- PSKY 01/23/2026 12.00 P

- Quantity: 1

- Premium: -$43.00

- Fees: -$0.51

- Net Debit: -$43.51

-

01/22/2026 Sell to Open:

- PSKY 01/30/2026 12.00 P

- Quantity: 1

- Premium: $63.00

- Fees: -$0.51

- Net Credit: $62.49

I also sold 3 contracts of covered calls exp 01/30 at $15 strike for a net credit of +$9. This is barely anything but it is also better than collecting nothing while I wait.

-

01/22/2026 Sell to Open:

- PSKY 01/30/2026 15.00 C

- Quantity: 3

- Premium: $9.00

- Fees: -$1.54

- Net Credit: $7.46

$MSTX

I still have 300 shares of MSTX that I did not sell any covered calls on this week.

$BULL

I still have 200 shares of BULL that I did not sell any covered calls on this week.

What I'm Holding Now

As of January 25, 2026, here's what's in my portfolio:

- $162 Cash balance

- $MSTX 300 shares

- $PSKY 300 shares, 12.00 CSP exp 01/30, 15.00 CC exp 01/30 (3 contracts)

- $BULL 200 shares

- $FVRR 100 shares, 18.00 CC exp 02/20

- $MBLY 10.00 Call exp 01/21/2028

- Weekly $100 deposit on Wed and Fri splits