Road to $100k - Week 14

Week 14 Performance Overview

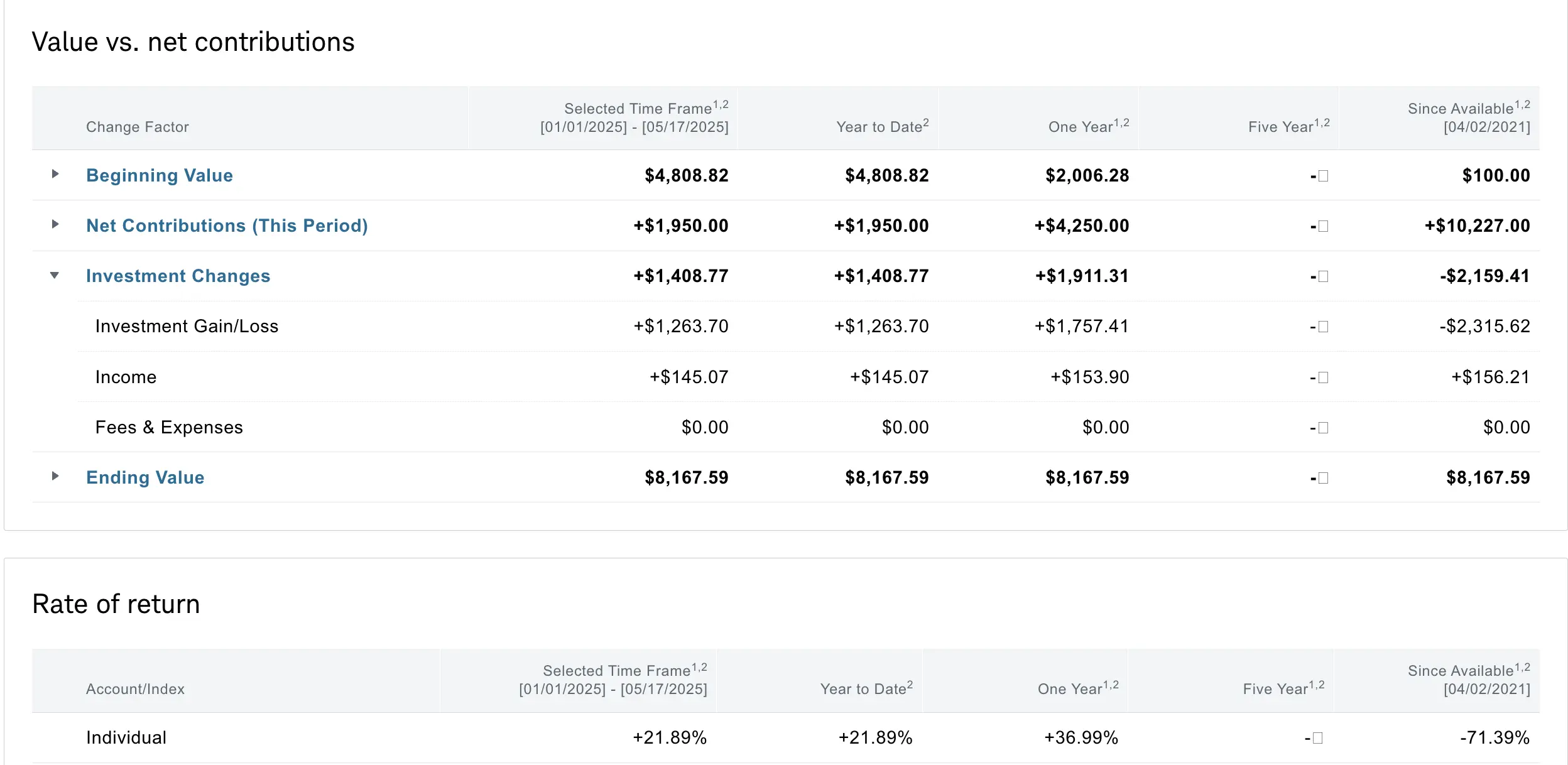

- Current Account Balance: $8,167

- Major portfolio restructuring this week - liquidated SOXL and EVGO positions

- Shifted strategy to increase cash position in anticipation of market pullback

- Same week LUNR cash-secured puts for quick premium capture

- Continued rolling NBIS covered calls ahead of earnings announcement

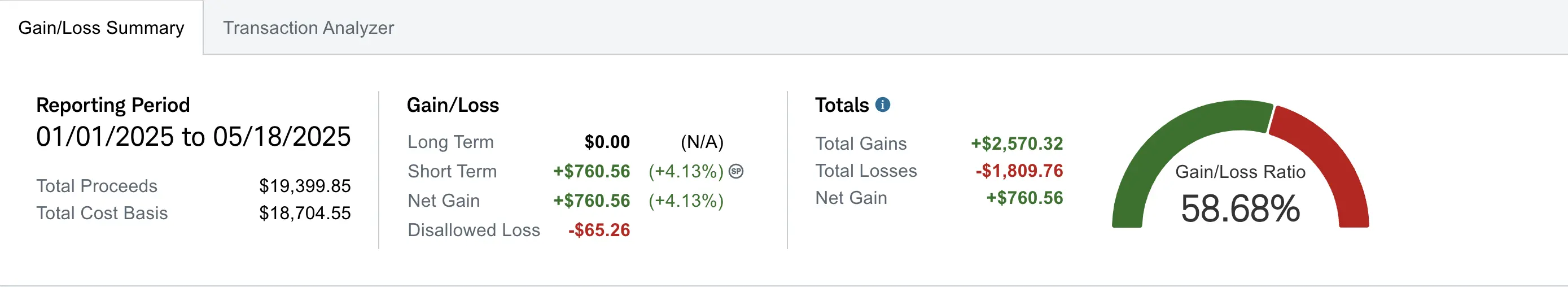

- Realized gain of $760.56 down -$180.27 from Week 13 due to taking realized losses on SOXL and NBIS to roll up and out.

- Win/loss ratio of 58.68% realized

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $2,150 despite contributing over $10K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year and YTD performance metrics are what truly matter for tracking this journey.

My Week 14 Trades

$SOXL Position

I had several trades on SOXL this week, ultimately closing the entire position. First, I rolled up and out my covered calls from 05/16 $16 strike to 05/23 $16.5 strike for a net credit of $16.

Later in the week, I decided to close the position entirely by buying back my covered calls and selling all shares at market. I wanted to free up cash in anticipation of a market pullback while locking in profits from the semiconductor sector's recent rally.

Trade details:

-

05/12/2025 Sell to Open:

- 2 SOXL 05/23/2025 16.50 C

- Credit: $243

-

05/12/2025 Buy to Close:

- 2 SOXL 05/16/2025 16.00 C

- Debit: -$229

-

05/14/2025 Buy to Close:

- 2 SOXL 05/23/2025 16.50 C

- Debit: -$537

-

05/14/2025 Sell Shares:

- 200 SOXL @ $18.72

- Proceeds: $3,744

$NBIS Position

With Nebius earnings approaching, I made strategic adjustments to my position. I rolled up and out my covered calls from 05/16 $31 strike to 05/23 $33 strike for a net credit of $30, despite taking a realized loss on the roll.

Later in the week, I rolled again from 05/23 to 05/30 expiration (maintaining the $33 strike) for an additional $38 credit. While this involved another realized loss, my strategy is to collect as much premium as possible while anticipating potential market pullback.

Trade details:

-

First Roll:

- Buy to Close: 1 NBIS 05/16/2025 $31 C

- Sell to Open: 1 NBIS 05/23/2025 $33 C

- Net Credit: $30

-

Second Roll:

- Buy to Close: 1 NBIS 05/23/2025 $33 C

- Sell to Open: 1 NBIS 05/30/2025 $33 C

- Net Credit: $38

I also initiated a new cash secured put position with a $28.5 strike expiring 05/23, timed strategically before Nebius earnings next Tuesday. While I'm anticipating positive results, current market conditions suggest a potential pullback, making this strike price attractive. I collected a $50 premium and would be comfortable either rolling the position or taking assignment if necessary.

Trade details:

-

05/15/2025 Sell to Open:

- 1 NBIS 05/23/2025 28.50 P

- PUT NEBIUS GROUP N V A $28.5 EXP 05/23/25

- Credit: $50

$EVGO Position

I closed my EVGO position this week after several trades. Initially, I rolled out my covered calls but had to pay a debit due to a misclick. Later, I decided to buy back the calls and sell all shares at market, which allowed me to manufacture a win with a total net profit of $25.90 across all the EVGO trades.

Trade details:

-

05/14/2025 Buy to Close:

- 1 EVGO 05/30/2025 3.50 C

- Debit: -$63.51

-

05/14/2025 Sell Shares:

- 115 EVGO @ $4.065

- Proceeds: $467.46

$LUNR

I opened a new position with LUNR this week, selling a cash-secured put at the $10.5 strike expiring 05/23. I was able to close this position within the same week for a quick $13 profit as the stock moved favorably.

Trade details:

-

05/15/2025 Sell to Open:

- 1 LUNR 05/23/2025 10.50 P

- Credit: $18

-

05/16/2025 Buy to Close:

- 1 LUNR 05/23/2025 10.50 P

- Debit: -$5.00

What I'm Holding Now

As of May 18, 2025, here's what's in my portfolio:

- 3 shares of $GOOG (average cost: $167.69)

- 100 shares of $NBIS (average cost: $33.94) with 1 covered call at $33 strike (05/30 expiry) and 1 cash secured put at $28.5 strike (05/23 expiry)

- $1,687 in cash - significantly increased from previous weeks

Looking Ahead

My decision to liquidate SOXL and EVGO positions reflects my cautious outlook on the market. I've substantially increased my cash position to prepare for potential buying opportunities if we see the pullback I'm anticipating.

Once Nebius have reported earnings, I'll be evaluating whether to continue with covered calls or potentially adjust my strategy based on the results and market reaction. The increased cash position also gives me flexibility to explore new opportunities, particularly if we see the market volatility I'm expecting.

I'll continue to look for quick premium capture opportunities like the LUNR trade while maintaining a more defensive posture overall using our options scanner.