Road to $100k - Week 19

Week 19 Performance Overview

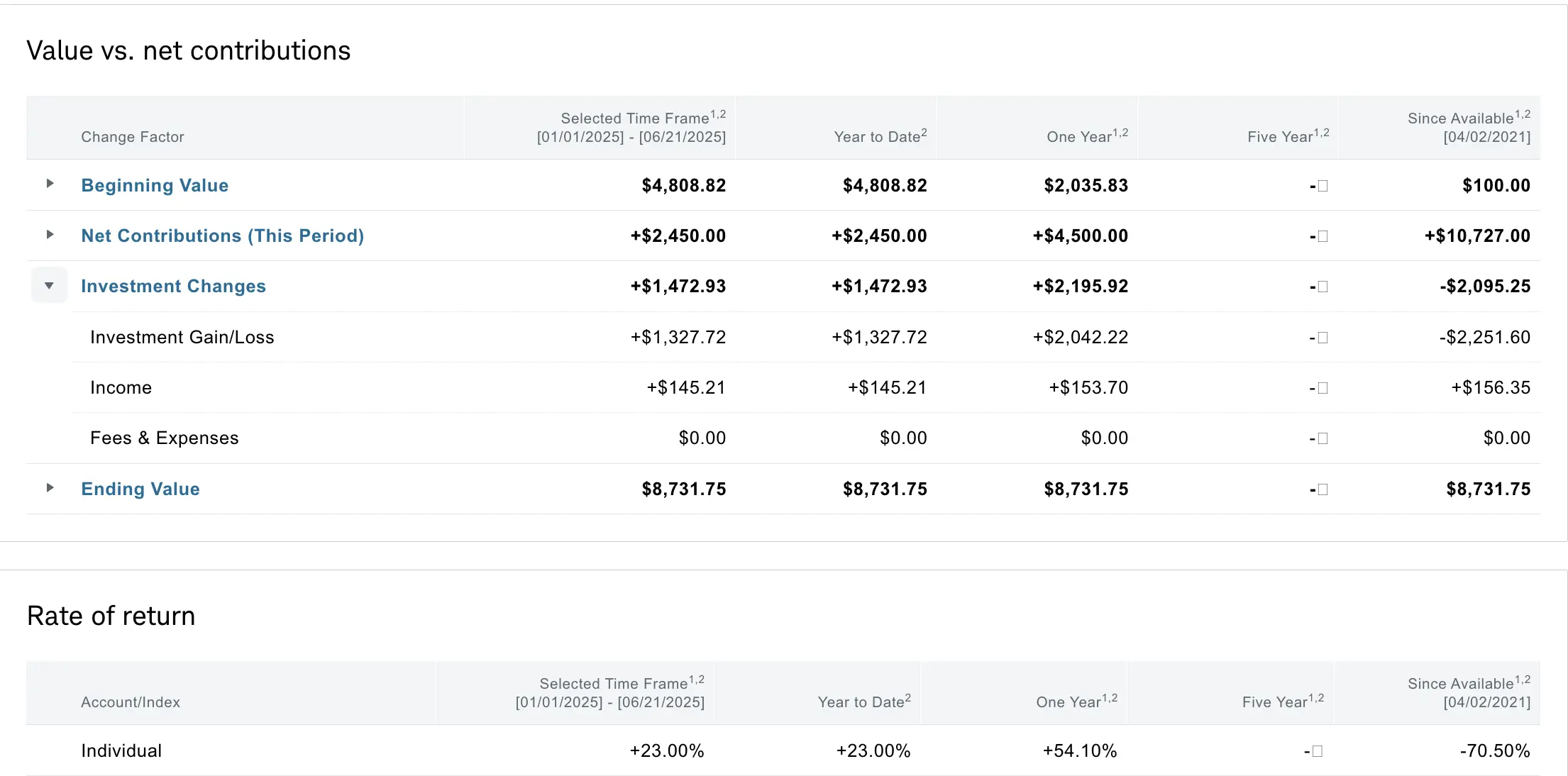

- Current Account Balance: $8,731

- Geopolitical tension escalated after U.S. strikes on Iran nuclear sites

- Monitoring oil prices as potential catalyst for market pullback

- Watching for a potential gap fill in SPX/QQQ after the insane April's tariff rally

- Added positions in $LUNR, $GME, $IREN; took a loss on $ENPH

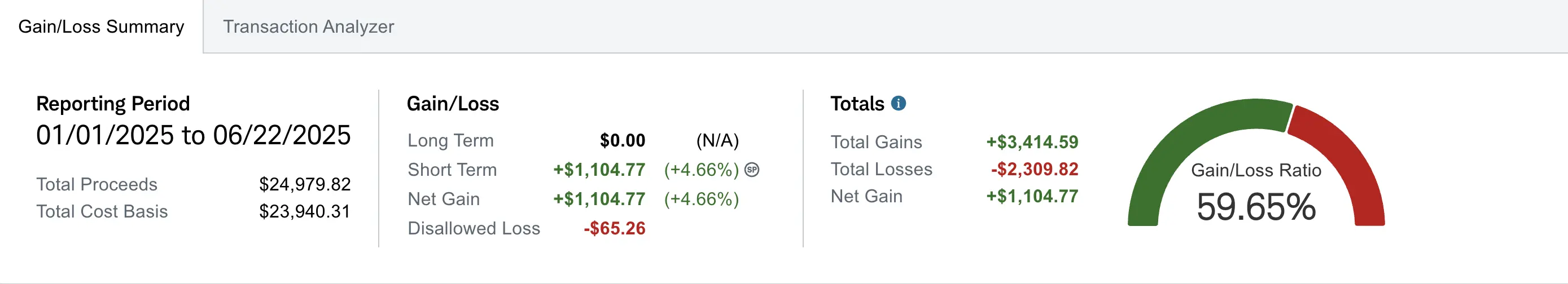

- Realized gain of $1,104.77 (down -$163.13 from Week 18) due to significant realized loss on $ENPH.

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $2,095 despite contributing over $10.7K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year and YTD performance metrics are what truly matter for tracking this journey.

Market Outlook

This week brought renewed geopolitical volatility as the U.S. carried out strikes on Iranian nuclear facilities. Headlines escalated quickly, with Iran's parliament reportedly backing the closure of the Strait of Hormuz. I'm monitoring oil closely, as a shutdown could spark a major supply shock and drive markets lower.

My Week 19 Trades

$ENPH

I opened a cash secured puts on $ENPH $39 strike 06/20 expiry for a $39 credit. Premiums were unusually high—which made sense in hindsight. The Senate released revisions to a proposed tax bill that would eliminate residential solar credits (25D) within 180 days of Trump signing. The solar sector sold off tremendously off this news.

I considered rolling down and out to reduce my cost basis and manufacture the win. But after reviewing sector headwinds from the elimination of the 25D residential credit, I decided not to force it. It wasn't worth the effort or additional risk. Sometimes, the best move is to take the loss and move on.

-

06/16/2025 Sell to Open:

- ENPH 06/20/2025 39.00 P

- Net Credit: $39

-

06/17/2025 Buy to Close:

- Debit: -$490

- Net Loss: -$452

$LUNR

I've been watching Intuitive Machines ($LUNR) for a while, particularly as we approach its IM-3 lunar mission in 2026. Space and Moon missions are increasingly viewed as national defense priorities.

I opened a $10 CSP for $16 credit, I rolled out one week for an additional $21 in credit, setting up for a lower-cost reentry if the stock dips further.

-

06/16/2025 Sell to Open:

- LUNR 06/20/2025 10.00 P

- Net Credit: $16

-

06/17/2025 Buy to Close:

- Debit: -$24

-

06/17/2025 Sell to Open:

- LUNR 06/27/2025 10.00 P

- Credit: $45

- Net Credit from rolling: $21

$BULL

Entered and exited a short put on BULL in the same day for a quick profit. My rule of thumb: if a position is up 50%+ and there's still a week or more on the clock, I take it and move on. Capital efficiency over greed.

-

06/16/2025 Sell to Open:

- BULL 06/20/2025 10.00 P

- Net Credit: $21

-

06/16/2025 Buy to Close:

- Debit: -$8

- Net Profit: $13

$GME

GameStop dropped after announcing a convertible notes offering. I entered a $21.50 CSP (06/27 expiry) for $24 credit near the demand zone. I'll keep rolling and milking this for premium as long as I can.

-

06/18/2025 Sell to Open:

- GME 06/27/2025 21.50 P

- Net Credit: $24

$IREN

IREN caught my attention as a potential $NBIS-like play in the AI datacenter space. With industry leaders like NVIDIA and CRWV forecasting massive growth, IREN looks like it could be a sleeper that benefits from scale. I sold a 06/27 $9.50 CSP for $14 credit. I'm open to assignment and wheeling this one over time.

-

06/20/2025 Sell to Open:

- IREN 06/27/2025 9.50 P

- Net Credit: $14

What I'm Holding Now

As of June 22, 2025, here's what's in my portfolio:

- 1 cash secured put on $GME at $21.5 strike (06/27 expiry)

- 1 cash secured put on $IREN at $9.5 strike (06/27 expiry)

- 1 cash secured put on $LUNR at $10 strike (06/27 expiry)

- $4,682 cash

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

With no major assignments this week, I've got plenty of dry powder. Oil volatility could heat up fast if the Strait of Hormuz headlines evolve, and Tesla's Robotaxi launch (June 22) might offer trade setups next week. I'll be scanning daily using the options scanner and staying flexible.