Options Trading Journey: $6K to $100K - Week 2

Week 2 Performance Overview

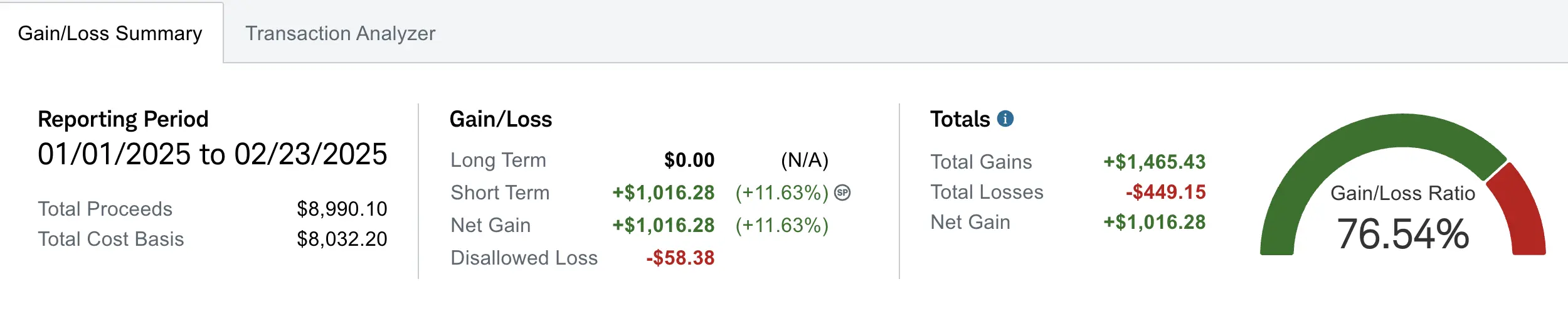

- YTD Total Gain: $1,016 (11.63%)

- Win/Loss Ratio: 76.54%

- Current Account Balance: $6,582

My Week 2 Trades

This week, I executed trades on both $EVGO and $NBIS. Here's what I did:

$EVGO Covered Calls Strategy

While holding my $EVGO position, I executed a covered calls trade that netted $3.49 after fees and commissions. I know what you're thinking - only $3.49? But here's the power of consistency: if I can make $3.49 every week for 50 trading weeks, that's $174.50 in additional income just from this one position. Small, consistent wins add up over time.

I'm maintaining this position despite the recent decline, which was primarily triggered by the pause in EV infrastructure funding.

The temporary suspension of the National Electric Vehicle Infrastructure (NEVI) Formula Program, which originally allocated nearly $5 billion for national EV charging infrastructure, has impacted the sector. The new Department of Transportation leadership has paused the program for a comprehensive policy review. While this has created some short-term uncertainty, there's a clear timeline: updated guidance will be released for public comment this spring, followed by a final version that incorporates stakeholder feedback (Source).

I'm continuing to sell covered calls on my position while awaiting further updates on the NEVI program, as this spring announcement could be a significant catalyst for the sector.

$NBIS Earnings Play

I implemented an earnings-based strategy on $NBIS, targeting increased IV (Implied Volatility) before their earnings reprot:

-

Initial Position:

- Sold CSP at $39 strike (0.14 delta)

- Expiration: February 21st

- Premium received: $80

- Buy to Close cost: -$59.51

- Initial trade net profit: $20.49

-

Post-Earnings Management:

- Stock declined after earnings

- Rolled position to following week

- Buy to Close: -$59.51 (Feb 21st expiry)

- Sell to Open: +$188.48 (Feb 28th expiry)

- Net credit from roll: $128.97

I selected $NBIS for several strategic reasons:

- Strong technical support in the $39-40 range (validated on 4H/daily timeframes)

- Elevated IV due to upcoming earnings provided higher premium opportunities

- Comfortable with potential assignment due to solid support level and the desire to sell covered calls if assigned

Long-term Bullish Outlook

Beyond the technical setup, NBIS presents compelling growth potential:

- Fresh start as Nebius Group (formerly Yandex NV) after completing a $5.4B split from Russian assets

- Secured $700M investment from major players including Nvidia and Accel

-

Committed to investing $1B+ in AI infrastructure by mid-2025,

focusing on:

- GPU clusters

- Cloud platforms

- AI development tools

- Expanding beyond AI: Their subsidiary Avride recently partnered with Uber for autonomous delivery services

- Strategic focus on European AI market with planned expansion into US markets

What I'm Holding Now

As of February 23, 2025, here's what's in my portfolio:

- 43 shares of $MSTX (My average cost is $39.11)

- 6 shares of $AMD (I got in at an average of $112.77)

- 115 shares of $EVGO (My average cost here is $3.47)

- 1 NBIS CSP

- 1 EVGO CC

My Next Moves

My strategy for the coming week focuses on several key positions:

- $NBIS: Actively managing my cash secured puts position.

- $MSTX: Keeping capital ready for potential swing trades, particularly given the bullish BTC outlook with increasing institutional adoption and discussions about a U.S. strategic crypto reserve

- $EVGO: Continuing my "manufacture the win" strategy - consistently selling covered calls to collect premiums and lower my cost basis, working toward essentially free shares

- $AMD: Maintaining position for swing trade opportunities

To identify my next opportunity, I'll be leveraging our options scanner to find trades with optimal premium-to-risk ratios. This tool has consistently helped me identify the most promising opportunities in the market.

Join our community of traders and investors to share ideas and learn together:

Selling Options Discord