Road to $100k - Week 24

Week 24 Performance Overview

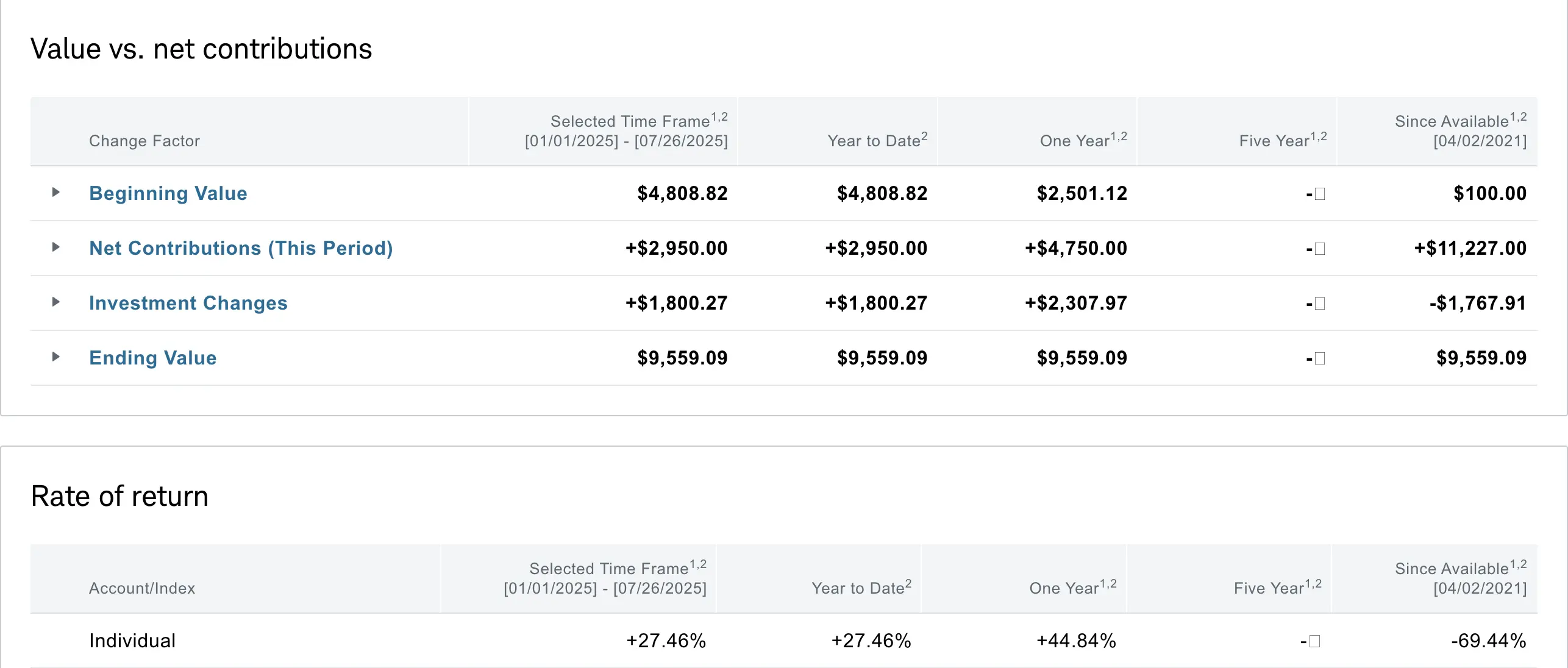

- Current Account Balance: $9,559

- Big tech earnings week with GOOG and TSLA

- GOOG reported increased usage in AI search and further Capex increases

- TSLA slumped on declining Y/Y sales, citing AV expansion and Robotics production plans

- Managed positions in $OSCR, $MSTX, $TSLL, and $LUNR

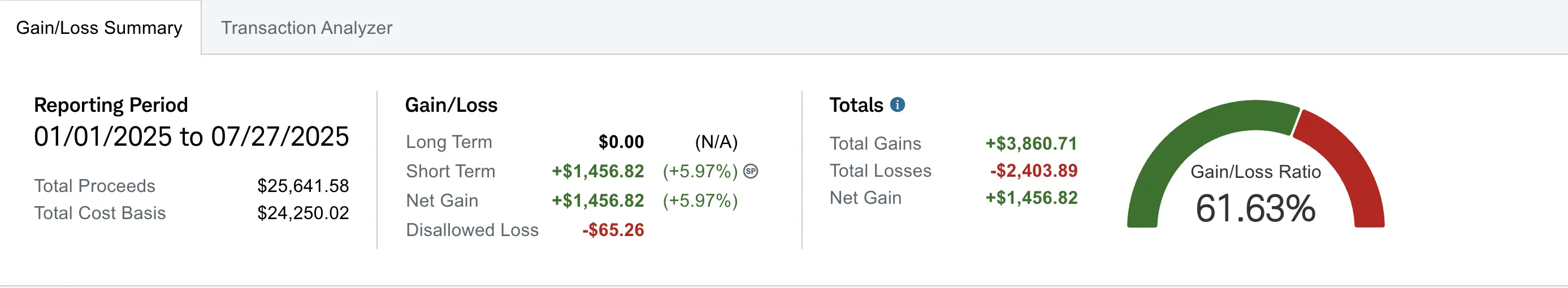

- Realized gain of $1,456.82 (up +$104.88 from Week 23)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,767 despite contributing over $11.2K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+44.84%) and YTD (+27.46%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week kicked off big tech earnings with most notably GOOG and TSLA. GOOG reported increased usage in AI search and further increases in Capex to accelerate AI infrastructure and growth ahead. TSLA slumped on earnings showing declining Y/Y sales, though the company cited further autonomous vehicles expansion towards the end of the year and plans for Robotics mass production to start in 2026.

My Week 24 Trades

$OSCR

I had multiple OSCR cash secured puts going into this week and was able to close all of them for profits.

I closed out my $11 strike for $5 debit bringing my net profit to +$19:

-

07/18/2025 Sell to Open:

- OSCR 07/25/2025 11.00 P

- Quantity: 1

- Credit: $24

-

07/21/2025 Buy to Close:

- OSCR 07/25/2025 11.00 P

- Quantity: 1

- Debit: -$5

- Net Profit: +$19

I closed my $11.5 strike for $5 debit bringing my net profit to +$15:

-

07/18/2025 Sell to Open:

- OSCR 07/25/2025 11.50 P

- Quantity: 1

- Credit: $20

-

07/21/2025 Buy to Close:

- OSCR 07/25/2025 11.50 P

- Quantity: 1

- Debit: -$5

- Net Profit: +$15

I closed my $13.5 strike which has been rolled down and out multiple times from the initial cash secured puts at $15 strike. I was able to close it for a debit of $2 bringing my net profit from all the previous rolls to +$34:

-

07/24/2025 Buy to Close:

- OSCR 07/25/2025 13.50 P

- Quantity: 1

- Debit: -$2

- Total Net Profit: +$34 (including previous rolls)

$MSTX

I had a MSTX $31 strike cash secured put which I opened last week. I was able to close it earlier this week for a debit of $5 bringing my net profit to +$20:

-

07/18/2025 Sell to Open:

- MSTX 07/25/2025 31.00 P

- Quantity: 1

- Credit: $25

-

07/21/2025 Buy to Close:

- MSTX 07/25/2025 31.00 P

- Quantity: 1

- Debit: -$5

- Net Profit: +$20

Later on during the week I opened more MSTX cash secured puts amid the Bitcoin / MSTR pullback. I opened $29 strike cash secured puts later followed by $26 strike cash secured puts. I chose these strikes citing the support zone I saw on MSTR around $360 area and translated the percentage onto MSTX. I gave myself enough wiggle room to roll as needed for net credits.

-

07/23/2025 Sell to Open:

- MSTX 08/01/2025 29.00 P

- Quantity: 1

- Credit: $30

-

07/25/2025 Sell to Open:

- MSTX 08/01/2025 26.00 P

- Quantity: 1

- Credit: $25

$TSLL

Following TSLA's earnings slump I sold cash secured puts the next day to take advantage of the pullback:

-

07/24/2025 Sell to Open:

- TSLL 08/01/2025 9.00 P

- Quantity: 1

- Credit: $16

I later closed it the same week for a net profit of +$10 following Tesla's announcement to expand their autonomous vehicles to San Francisco as early as this weekend.

-

07/25/2025 Buy to Close:

- TSLL 08/01/2025 9.00 P

- Quantity: 1

- Debit: -$6

- Net Profit: +$10

$LUNR

I opened a $9.5 strike cash secured put this week citing the demand zone around 9.5-10 range. I will continue to bid these ranges as the opportunity presents itself. I was able to close the same day for a net profit of $10 which was over 50% in one day. A general rule of thumb I have been sticking to is that if the trade is up over 50% in a day or over 50% with a week left to go, I will close it and redeploy the capital elsewhere.

-

07/22/2025 Sell to Open:

- LUNR 08/01/2025 9.50 P

- Quantity: 1

- Credit: $17

-

07/22/2025 Buy to Close:

- LUNR 08/01/2025 9.50 P

- Quantity: 1

- Debit: -$7

- Net Profit: +$10

What I'm Holding Now

As of July 27, 2025, here's what's in my portfolio:

- 1 cash secured put on $MSTX at $29.00 strike (08/01 expiry)

- 1 cash secured put on $MSTX at $26.00 strike (08/01 expiry)

- $4,107.10 Cash reserves awaiting potential market pullback opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

Going into next week, I'll be closely monitoring my open positions in $MSTX, particularly with MSTR earnings coming up. I'll be watching Bitcoin and MSTR price action closely to manage my positions effectively. I'll continue to use the options scanner to identify new opportunities while managing my existing positions.