Road to $100k - Week 25

Week 25 Performance Overview

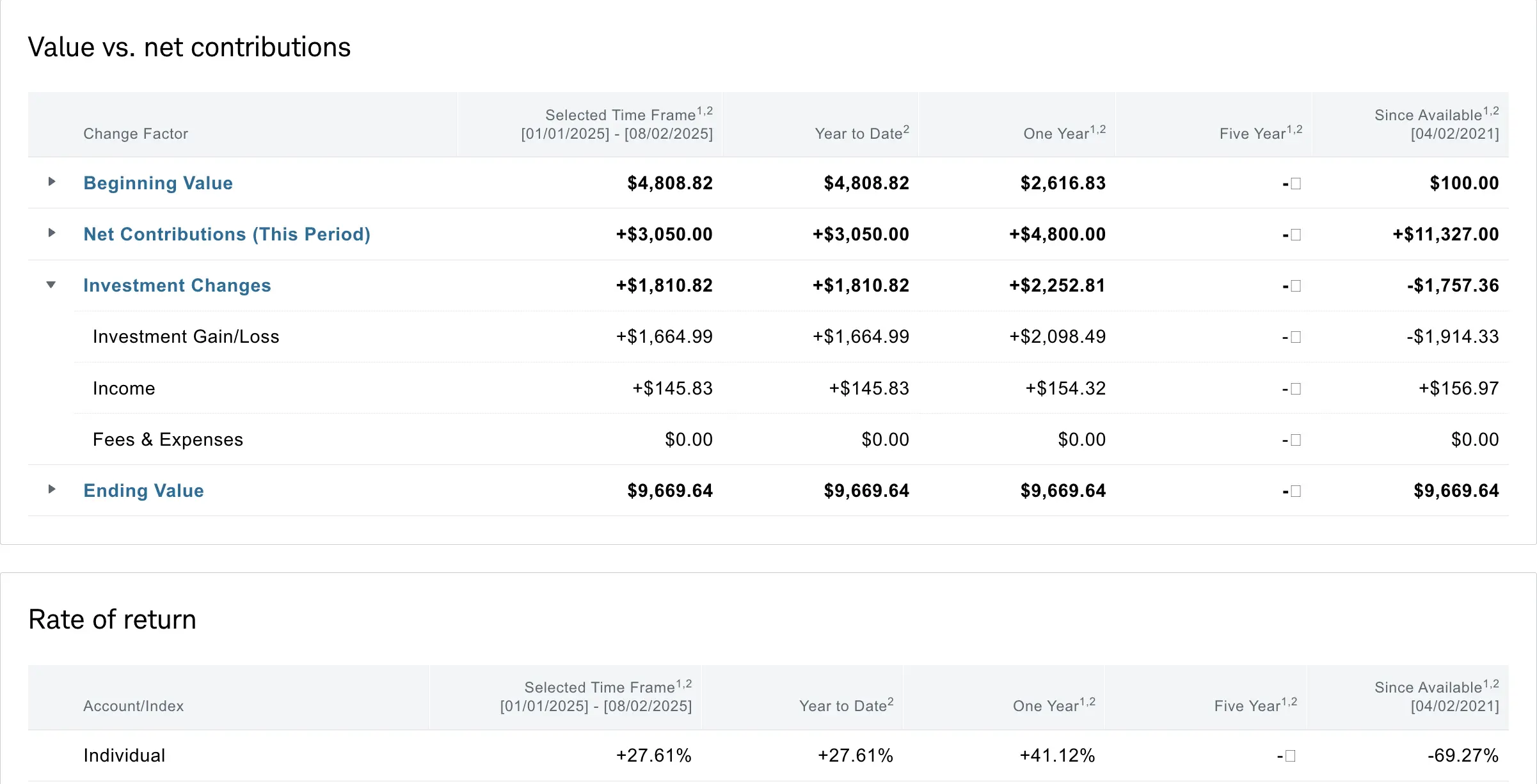

- Current Account Balance: $9,669

- "Liberation day 2.0" with Tariffs rates set amongst many nations

- Core CPI rises M/M and job's data revision worse than expected

- Broader indices finally experienced the pullback we've been waiting for

- Managed positions in $HIMS, $MSTX, and $LUNR

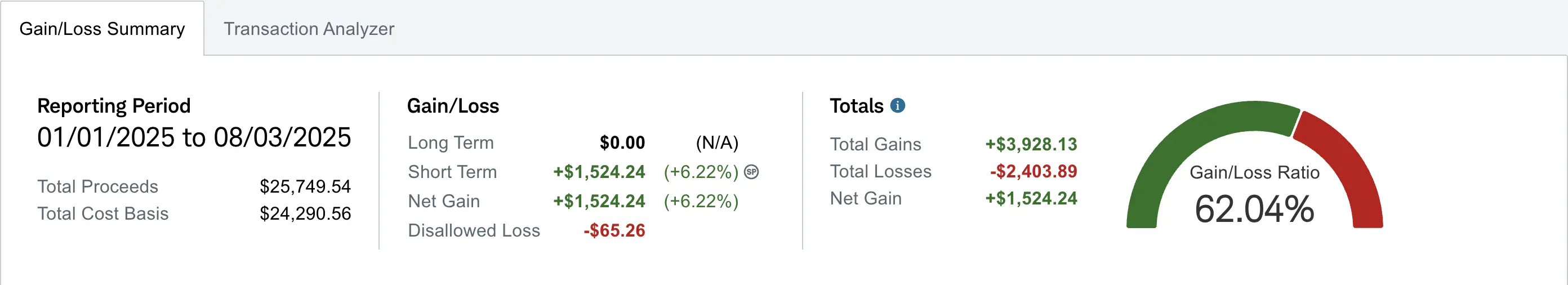

- Realized gain of $1,524 (up +$67.18 from Week 24)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,757 despite contributing over $11.3K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+41.12%) and YTD (+27.61%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week was considered "Liberation day 2.0" because of the Tariffs rates set amongst many nations due to the August 1st deadline. Core CPI rose month over month and job's data revision turned out to be drastically worse than expected. All of these headlines finally gave the broader indices the pullback that we've been waiting for.

My Week 25 Trades

$HIMS

I opened and closed this cash secured put for a net profit of $21 (55% of the premium captured) with more than a week left to go. Generally my rule of thumb is to close the trade if it's over 50% with more than a week left until expiration. The premiums were juiced due to $HIMS having earnings next week so I took advantage of the opportunity.

-

07/29/2025 Sell to Open:

- HIMS 08/08/2025 36.00 P

- Quantity: 1

- Credit: $38

-

07/30/2025 Buy to Close:

- HIMS 08/08/2025 36.00 P

- Quantity: 1

- Debit: -$17

- Net Profit: +$21

$MSTX

I had two separate contracts of MSTX at different strikes. One contract at $29 strike and another one at $26 strike from last week. I rolled down and out $29 strike MSTX to $25 exp 08/08 ahead of MSTR earnings to further derisk and give myself room to continue to roll for net credits as needed. I collected net credits of +$25 from this roll.

-

07/30/2025 Buy to Close:

- MSTX 08/01/2025 29.00 P

- Quantity: 1

- Debit: -$10

-

07/30/2025 Sell to Open:

- MSTX 08/08/2025 25.00 P

- Quantity: 1

- Credit: $35

- Net Credit from rolling: +$25

Later on in the week I rolled down and out my remaining contract of $26 strike exp 08/01 to $25 strike exp 08/08 to further derisk and collect additional net credits. I received a net credit of +$30 from this roll.

-

07/31/2025 Buy to Close:

- MSTX 08/01/2025 26.00 P

- Quantity: 1

- Debit: -$5

-

07/31/2025 Sell to Open:

- MSTX 08/08/2025 25.00 P

- Quantity: 1

- Credit: $35

- Net Credit from rolling: +$30

$LUNR

I opened and closed one contract of LUNR this week for over 50% and redeployed the capital back into LUNR when the pullback finally happened.

My first LUNR cash secured put I opened for a net credit of +$17 for 08/08 exp. I later closed this trade for a debit of $7 bringing my total net profit to +$10 (58% of premium captured) with more than a week left to go.

-

07/30/2025 Sell to Open:

- LUNR 08/08/2025 9.50 P

- Quantity: 1

- Credit: $17

-

07/31/2025 Buy to Close:

- LUNR 08/08/2025 9.50 P

- Quantity: 1

- Debit: -$7

- Net Profit: +$10

I waited until the pullback happened and redeployed the capital back into the same strike and expiration but for more premiums. I sold to open $9.5 strike cash secured puts for a net credit of +$25 exp 08/08.

-

08/01/2025 Sell to Open:

- LUNR 08/08/2025 9.50 P

- Quantity: 1

- Credit: $25

What I'm Holding Now

As of August 3, 2025, here's what's in my portfolio:

- 2 cash secured puts on $MSTX at $25.00 strike (08/08 expiry)

- 1 cash secured put on $LUNR at $9.50 strike (08/08 expiry)

- $3,864.34 Cash reserves awaiting potential market pullback opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

Looking ahead I have a good size cash balance ready for more opportunities ahead. I'm expecting a bounce relief but I am expecting more downside ahead. I'll continue to use the options scanner to identify new opportunities while managing my existing positions.