Options Trading Journey: $6K to $100K - Week 28

Week 28 Performance Overview

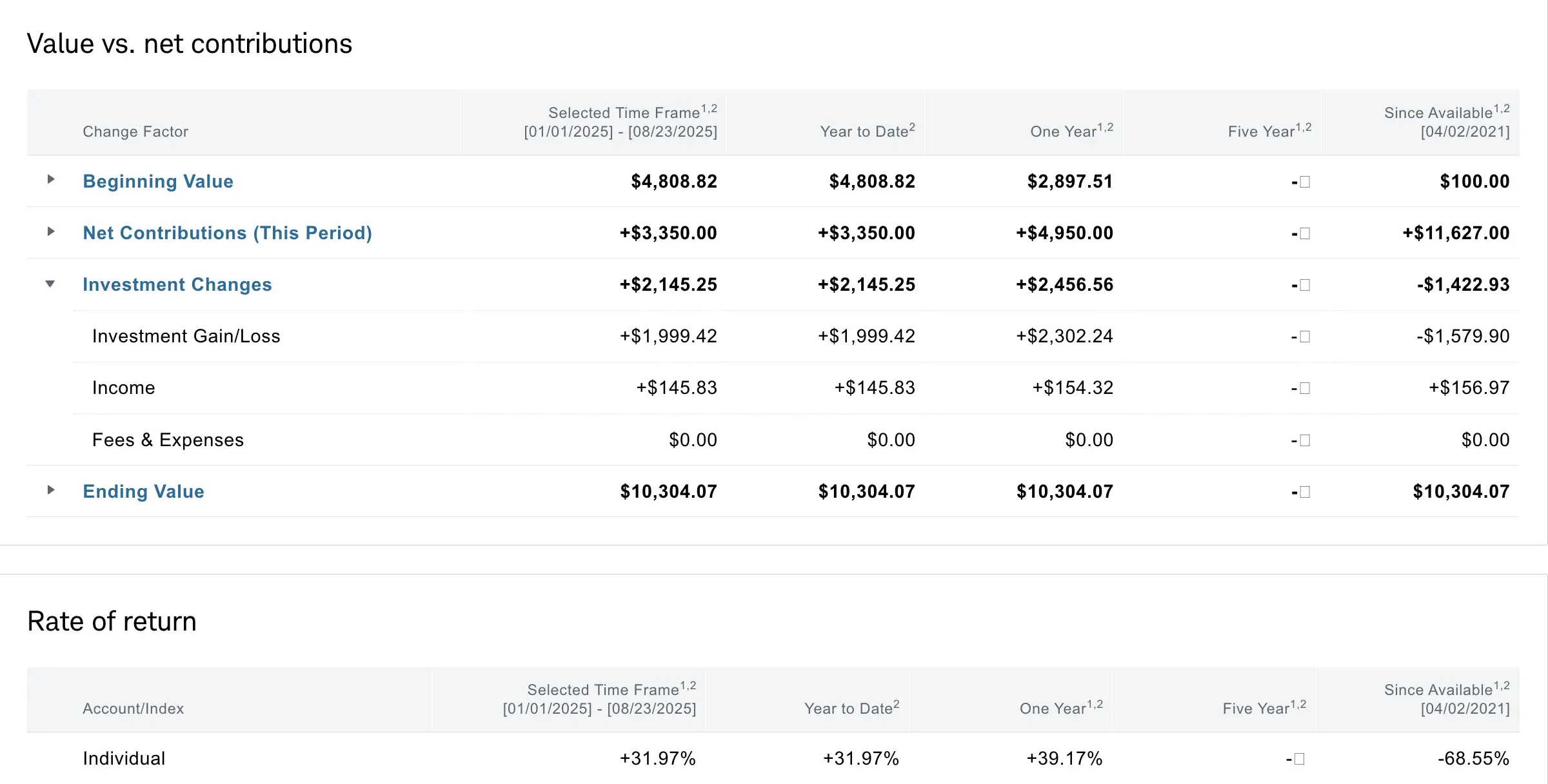

- Current Account Balance: $10,304

- Powell's Jackson Hole speech hinted at possible rate cuts

- Trump administration now has a 10% stake in INTC following meeting with CEO Lip-Bu Tan

- Market retraced slightly ahead of Powell's speech, then rallied after

- Managed positions in $LUNR and $MSTX

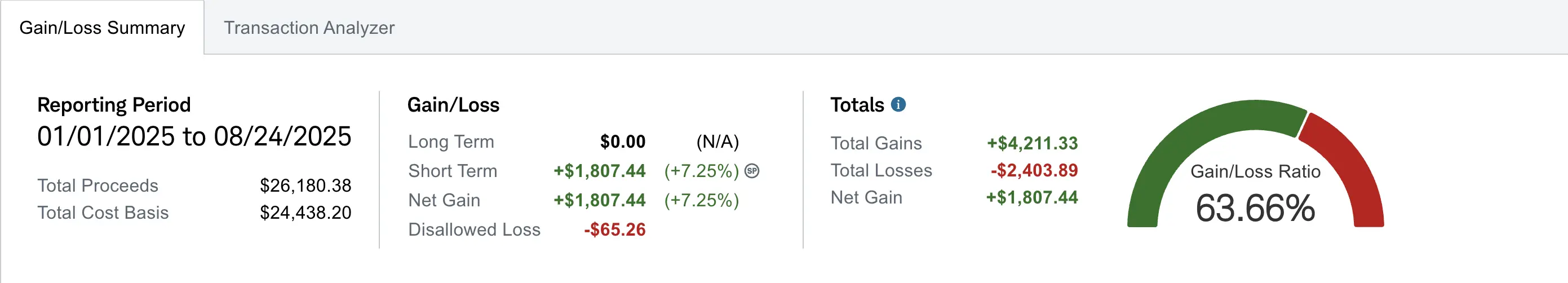

- Realized gain of $1,807 (up +$151 from Week 27)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,422 despite contributing over $11.6K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+39.17%) and YTD (+31.97%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week's most notable news was that Powell was open to rate cuts but did not give a definite answer. Powell's commentary emphasized the Fed's readiness to adjust its policy in light of evolving economic conditions, notably the risks emerging from the labor market. Prior to the Jackson Hole speech, the market retraced slightly ahead of his speech. After the speech, the market rallied in response to his semi-dovish tone. Additionally, the Trump administration now has a 10% stake in INTC following a meeting with CEO Lip-Bu Tan.

My Week 28 Trades

$MSTX

Starting off the week, I sold to open $MSTX $16 strike cash secured puts expiring 08/29 for a credit of +$30.

-

08/18/2025 Sell to Open:

- MSTX 08/29/2025 16.00 P

- Quantity: 1

- Credit: $30

Later during the week as the market began to retrace, I opened an additional contract for the same $16 strike expiring 08/29 for an additional credit of +$30.

-

08/19/2025 Sell to Open:

- MSTX 08/29/2025 16.00 P

- Quantity: 1

- Credit: $30

I had $18 and $20 strike cash secured puts from last week, which I closed early ahead of Powell's speech at Jackson Hole due to the high uncertainty going into the meeting.

The $18 strike was previously rolled down from $21 strike the week prior. I closed the roll down for a -$3 debit, bringing my net profit of that roll down and out to +$25.

-

08/14/2025 Rolled down from $21 to $18:

- MSTX 08/22/2025 18.00 P

- Quantity: 1

- Net Credit From Roll: +$28

-

08/20/2025 Buy to Close:

- MSTX 08/22/2025 18.00 P

- Quantity: 1

- Debit: -$3

- Net Profit: +$25

I opened the $20 strike last week for a net credit of +$24. I closed the trade for a debit of -$5, bringing my net profit to +$19.

-

08/14/2025 Sell to Open:

- MSTX 08/22/2025 20.00 P

- Quantity: 1

- Credit: $24

-

08/20/2025 Buy to Close:

- MSTX 08/22/2025 20.00 P

- Quantity: 1

- Debit: -$5

- Net Profit: +$19

After Powell's Jackson Hole speech, the market spiked in response to his semi-dovish speech giving hints to a possible rate cut in September. The market responded bullishly, and I was able to close out my two $16 strike cash secured puts for a total net profit of +$38. Both of the original contracts were sold to open for a net credit of $30 each.

-

2 Contract of MSTX

- MSTX 08/29/2025 16.00 P

- Quantity: 2

- Credit: $60 ($30 per contract)

-

08/22/2025 Buy to Close:

- MSTX 08/29/2025 16.00 P

- Quantity: 1

- Debit: -$12

-

08/22/2025 Buy to Close:

- MSTX 08/29/2025 16.00 P

- Quantity: 1

- Debit: -$10

- Net profit: +$38

$LUNR

Last week I had 1 contract of $LUNR cash secured puts at $8.5 strike for an original net credit of +$19. I closed that contract at the start of this week for a debit of -$5, bringing my net profit to +$14.

-

08/14/2025 Sell to Open:

- LUNR 08/22/2025 8.50 P

- Quantity: 1

- Credit: $19

-

08/18/2025 Buy to Close:

- LUNR 08/22/2025 8.50 P

- Quantity: 1

- Debit: -$5

- Net Profit: +$14

The next day, as the market began to retrace, I opened $LUNR cash secured puts again but for 08/29 expiry for a net credit of +$21.

-

08/19/2025 Sell to Open:

- LUNR 08/29/2025 8.50 P

- Quantity: 1

- Credit: $21

As the market continued to retrace, I opened an additional contract at $8.5 strike with the mindset of getting assigned on one contract to start selling covered calls next week and rolling the other contract to further derisk as needed.

-

08/19/2025 Sell to Open:

- LUNR 08/29/2025 8.50 P

- Quantity: 1

- Credit: $30

After Powell's speech, the market rallied, so I was able to close both of these contracts for a total profit of +$26.

-

08/22/2025 Buy to Close:

- LUNR 08/29/2025 8.50 P

- Quantity: 1

- Debit: -$13

-

08/22/2025 Buy to Close:

- LUNR 08/29/2025 8.50 P

- Quantity: 1

- Debit: -$12

- Net profit: +$26

As I've been citing for the past few weeks, I am bullish on Intuitive Machines ahead of their IM-3 launch scheduled for the second half of 2026. The recent drop in price was due to a $300M convertible notes offering. That offering has since been closed, so I will continue to look to sell cash secured puts as opportunities permit.

What I'm Holding Now

As of August 24, 2025, here's what's in my portfolio:

- No open positions

- $10,304 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I'll be looking for new opportunities to sell cash secured puts on both $MSTX, $LUNR or other tickers as the market conditions allow. With a substantial cash balance of over $10,300, I'm well-positioned to take advantage of any new setups that arise. I'll continue to use the options scanner to identify new opportunities while maintaining my disciplined approach to risk management.

Join the FREE trading community focused on selling options, sharing setups, and building consistent income:

Selling Options Discord