Road to $100k - Week 29

Week 29 Performance Overview

- Current Account Balance: $10,454

- NVDA beat earnings but growth is not as fast as prior

- China H2O chip sales guidance not included as Trump administration still holding up export license

- Core CPI print came in-line on Friday

- Federal appeals court struck down Trump tariffs but delayed enforcement until October

- Managed positions in $MSTX, $BMNR, $LUNR, and $BITX

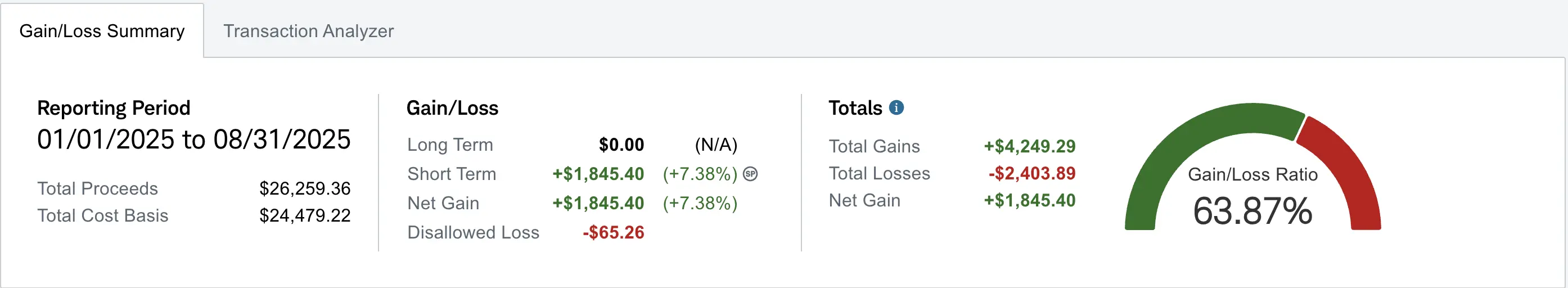

- Realized gain of $1,845 (up +$38 from Week 28)

Portfolio Performance

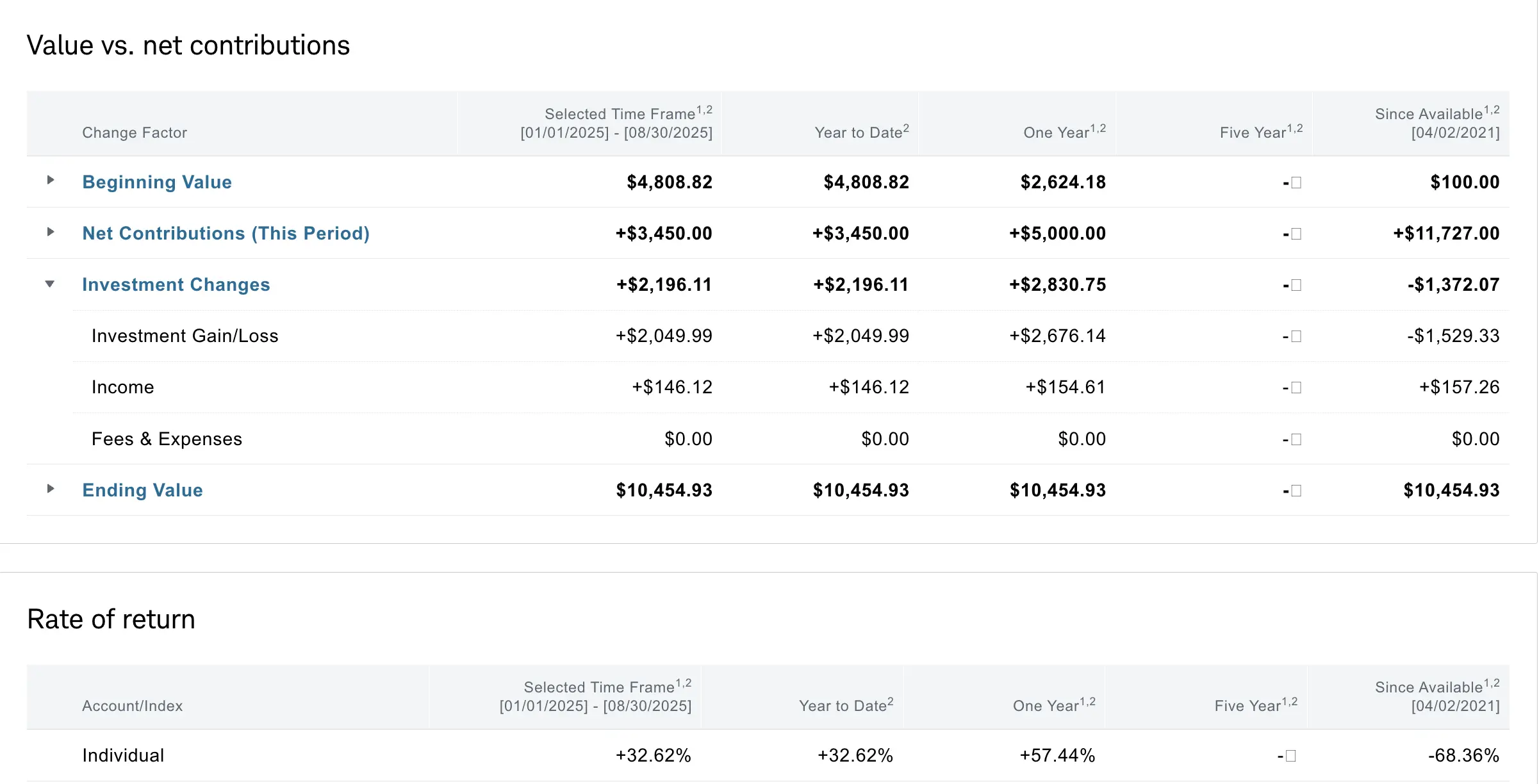

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,372 despite contributing over $11.7K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+57.44%) and YTD (+32.62%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week's most notable headlines included NVIDIA beating earnings, though growth wasn't as fast as in previous quarters. China H2O chip sales guidance was not included in their report as the Trump administration is still holding up export licenses. The Core CPI print came in in-line on Friday, providing some stability to market expectations. Additionally, a federal appeals court struck down Trump tariffs but delayed enforcement until October, creating some uncertainty in the trade environment.

My Week 29 Trades

$MSTX

I sold to open $MSTX $16 strike cash secured puts expiring 09/05 for a credit of +$30. I closed the position the next day for a debit of -$15, bringing my net profit to +$15 with 50% of the premium captured with more than a week left. A general rule of thumb I've been sticking to is that if the trade is over 50% with more than a week left, I like to close it and redeploy the capital elsewhere.

-

08/25/2025 Sell to Open:

- MSTX 09/05/2025 16.00 P

- Quantity: 1

- Credit: $30

-

08/26/2025 Buy to Close:

- MSTX 09/05/2025 16.00 P

- Quantity: 1

- Debit: -$15

- Net Profit: +$15

$BMNR

I opened a $37.50 strike cash secured put expiring 09/05 for a net credit of +$40, citing the slight pullback that ETH and BTC were having. I'll be looking to roll these down and out next week to further derisk as I believe there is more downside ahead on BTC and ETH.

BMNR is an Ethereum-based treasury that mirrors MSTR’s strategy, raising funds to accumulate more cryptocurrency. Unlike MSTR, BMNR stakes its ETH to earn revenue as ETH validators, who receive fees for staking their ETH and verifying transactions on the network. Etheremum operates as a proof of stake mechanism.

-

08/27/2025 Sell to Open:

- BMNR 09/05/2025 37.50 P

- Quantity: 1

- Credit: $40

As ETH and BTC continued to pull back that day, I sold to open $35 strike cash secured puts expiring 09/05 for a net credit of +$50. I closed the trade the next day for a net profit of +$25, capturing 50% of the premium.

-

08/27/2025 Sell to Open:

- BMNR 09/05/2025 35.00 P

- Quantity: 1

- Credit: $50

-

08/28/2025 Buy to Close:

- BMNR 09/05/2025 35.00 P

- Quantity: 1

- Debit: -$25

- Net Profit: +$25

$LUNR

I bought 100 shares of $LUNR at $9 for $900. I then sold an ITM covered call at $9 strike for a net credit of +$37. If assigned, my net profit on this trade would be +$37 on $900 for a return on capital of 4%. If unassigned, my adjusted cost basis would be $8.63. I plan to continue to collect premiums to further lower my adjusted cost basis as I am bullish on LUNR ahead of their IM-3 launch scheduled for the second half of 2026.

-

08/28/2025 Buy to Open:

- LUNR Shares

- Quantity: 100

- Price: $9.00

- Total: $900

-

08/28/2025 Sell to Open:

- LUNR 09/05/2025 9.00 C

- Quantity: 1

- Credit: $37

- Adjusted cost basis: $8.63

$BITX

As BTC continued its pullback, I saw an opportunity and sold $46 strike cash secured puts on BITX, which is equivalent to $103k on Bitcoin. I will be looking to roll these down and out as needed.

-

08/29/2025 Sell to Open:

- BITX 09/05/2025 46.00 P

- Quantity: 1

- Credit: $66

What I'm Holding Now

As of August 31, 2025, here's what's in my portfolio:

- $BMNR 09/05/2025 37.50 CSP

- $BITX 09/05/2025 46.00 CSP

- $LUNR 09/05/2025 9.00 CC

- $1,333 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I'll be closely monitoring my open positions in $BMNR and $BITX, potentially rolling them down and out if the crypto market continues to show weakness. For $LUNR, I'll evaluate whether my covered call gets assigned, and if not, I'll look to sell another call to further reduce my cost basis. With the market showing mixed signals from tech earnings and economic data, I'll remain cautious but opportunistic, using the options scanner to identify new setups while maintaining my disciplined approach to risk management.