Road to $100k - Week 30

Week 30 Performance Overview

- Current Account Balance: $10,791

- Jobs report signals a cooling US labor market

- Lululemon slashed outlook for consecutive 3 quarters signaling slowing consumer spending

- Trump indicates upcoming tariffs on semiconductors

- NASDAQ to implement crypto treasury rule requiring shareholder approval before issuing new shares to buy crypto assets

- Managed positions in $BITX, $BMNR, $MSTX, and $LUNR

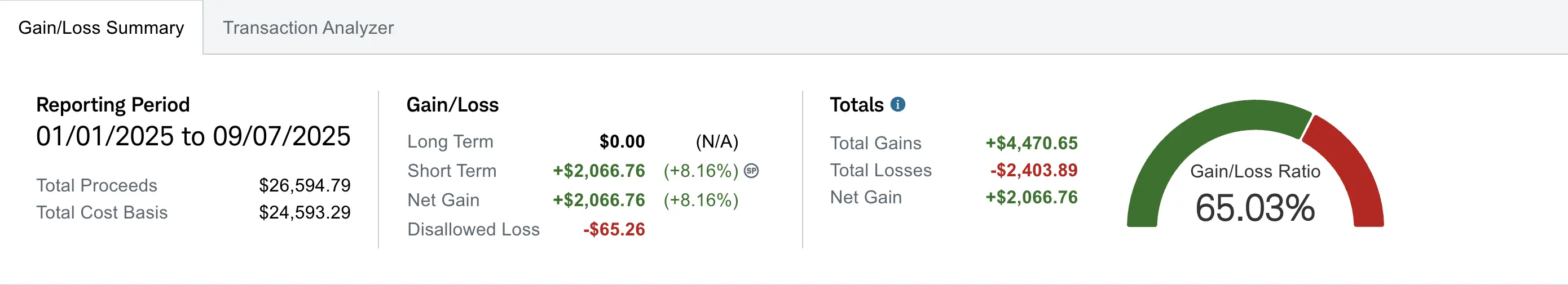

- Realized gain of $2,066 (up +$221 from Week 29)

Portfolio Performance

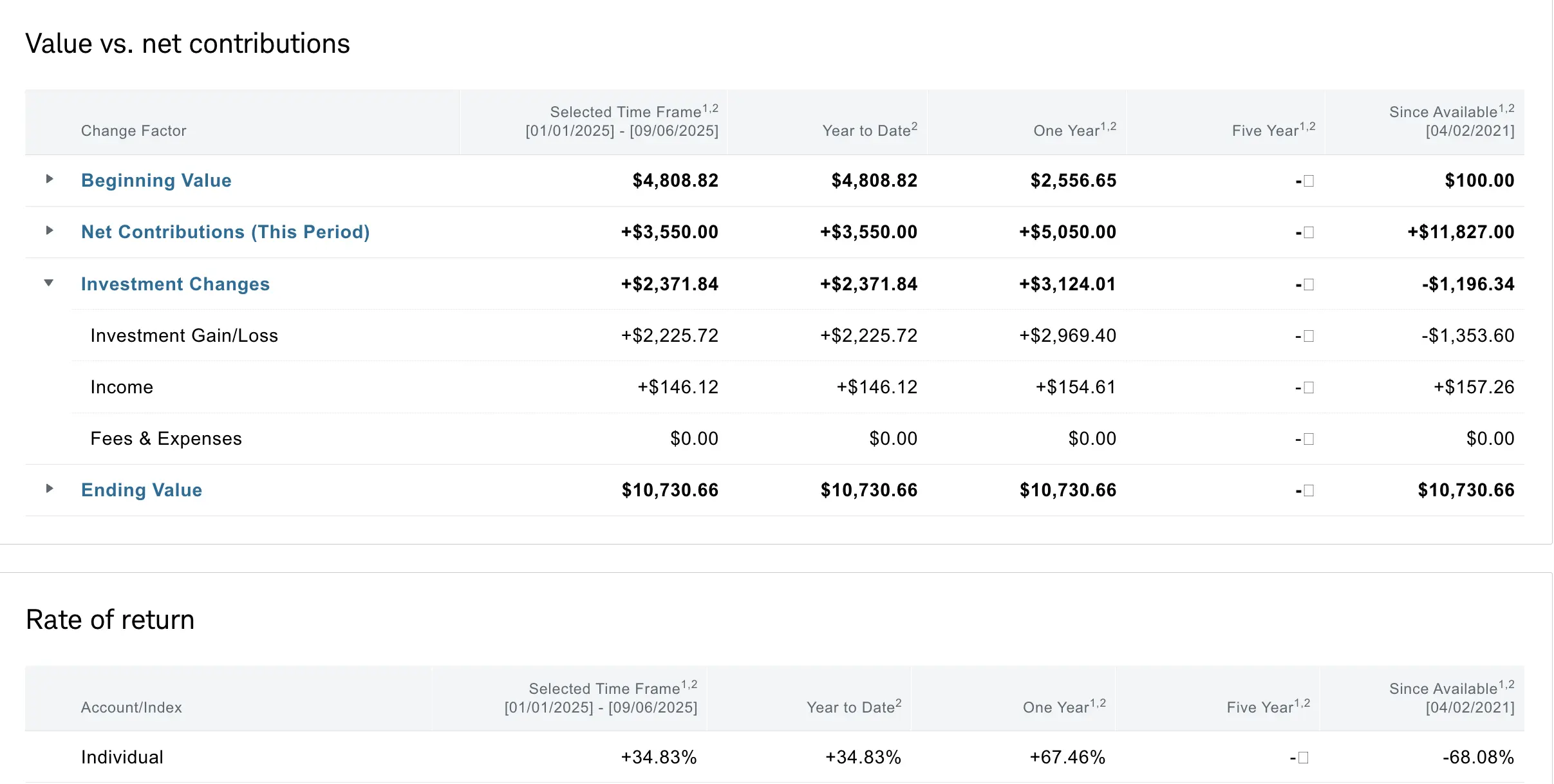

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,196 despite contributing over $11.8K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+67.46%) and YTD (+34.83%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week's most notable headlines included the jobs report signaling a cooling US labor market, which could influence the Fed's rate cut decisions. Lululemon slashed its outlook for consecutive three quarters, indicating slowing consumer spending. Additionally, Trump indicated upcoming tariffs on semiconductors, creating uncertainty in the semiconductors sector. The NASDAQ also announced implementation of a crypto treasury rule requiring shareholder approval before companies can issue new shares or convert existing financial instruments to buy cryptocurrencies, potentially affecting companies like MSTR (NASDAQ) that use this strategy. BMNR which is on the NYSE may soon have similar rule as well.

My Week 30 Trades

$BITX

Entering this week, I had a $46 strike cash secured put on $BITX for a +$66 credit. I closed it Monday for a debit of -$12, bringing my total net profit to +$54.

-

08/29/2025 Sell to Open:

- BITX 09/05/2025 46.00 P

- Quantity: 1

- Credit: $66

-

09/02/2025 Buy to Close:

- BITX 09/05/2025 46.00 P

- Quantity: 1

- Debit: -$12

- Net Profit: +$54

$BMNR

The crypto market was very volatile this week with swings in both directions, which created excellent trading opportunities. I opened a $36 strike cash secured put on $BMNR for a net credit of +$65. I closed it the next day for a -$30 debit, bringing my net profit to +$35, which is over 50% of the premium captured with more than a week left until expiration.

-

09/02/2025 Sell to Open:

- BMNR 09/12/2025 36.00 P

- Quantity: 1

- Credit: $65

-

09/03/2025 Buy to Close:

- BMNR 09/12/2025 36.00 P

- Quantity: 1

- Debit: -$30

- Net Profit: +$35

I also had a $37.5 strike cash secured put entering this week for a +$40 credit. I closed it for a debit of -$8, bringing my net profit to +$32.

-

08/27/2025 Sell to Open:

- BMNR 09/05/2025 37.50 P

- Quantity: 1

- Credit: $40

-

09/03/2025 Buy to Close:

- BMNR 09/05/2025 37.50 P

- Quantity: 1

- Debit: -$8

- Net Profit: +$32

As the week progressed, the entire market began to slump ahead of the Jobs report on Friday. I sold another cash secured put on $BMNR at $35 strike expiring 09/12 for a net credit of +$46. I was able to close it the next day for a debit of -$19, which is over 50% profit with more than a week left, for a net profit of +$27.

-

09/04/2025 Sell to Open:

- BMNR 09/12/2025 35.00 P

- Quantity: 1

- Credit: $46

-

09/05/2025 Buy to Close:

- BMNR 09/12/2025 35.00 P

- Quantity: 1

- Debit: -$19

- Net Profit: +$27

After the jobs report came out and the market had time to digest it, prices began to pull back once again. Since I closed my previous $BMNR trade at over 50% profit, I was able to reenter at the same strike and expiration for a slightly higher premium of +$48. I closed it the same day for a debit of -$22, bringing my net profit to +$26, again capturing over 50% of the premium with more than a week left.

-

09/05/2025 Sell to Open:

- BMNR 09/12/2025 35.00 P

- Quantity: 1

- Credit: $48

-

09/05/2025 Buy to Close:

- BMNR 09/12/2025 35.00 P

- Quantity: 1

- Debit: -$22

- Net Profit: +$26

$MSTX

As the new NASDAQ rule came out affecting crypto treasury companies such as MSTR, I saw an opportunity. The new ruling states "The 'Nasdaq crypto treasury rule' refers to a new policy requiring companies, particularly those in crypto, to obtain shareholder approval before issuing new shares or converting existing financial instruments to buy cryptocurrencies." It is unclear how this new ruling may impact Michael Saylor and his Bitcoin accumulation strategy.

I opened a $20 strike cash secured put on $MSTX for a net credit of +$48 expiring 09/12 and will roll as needed for next week.

-

09/03/2025 Sell to Open:

- MSTX 09/12/2025 20.00 P

- Quantity: 1

- Credit: $48

As the crypto market began to slump more, I opened an additional cash secured put at $18 strike expiring 09/12 for a net credit of +$37. I was able to close the $18 strike the same week following the jobs report for a debit of -$16, bringing my net profit to +$21, which again is over 50% with more than a week left.

-

09/03/2025 Sell to Open:

- MSTX 09/12/2025 18.00 P

- Quantity: 1

- Credit: $37

-

09/05/2025 Buy to Close:

- MSTX 09/12/2025 18.00 P

- Quantity: 1

- Debit: -$16

- Net Profit: +$21

$LUNR

I had purchased 100 shares of LUNR last week at $9 and began selling in-the-money covered calls. I initially sold $9 covered calls for a +$37 credit, bringing my adjusted cost basis to $8.63. This week I rolled the same $9 strike for an additional net credit of +$11, bringing my adjusted cost basis down to $8.52 (accounting for the buy-to-close debit of -$4).

-

09/03/2025 Buy to Close:

- LUNR 09/05/2025 9.00 C

- Quantity: 1

- Debit: -$4

-

09/03/2025 Sell to Open:

- LUNR 09/12/2025 9.00 C

- Quantity: 1

- Credit: $15

- New adjusted cost basis: $8.52

I remain bullish on LUNR ahead of their IM-3 launch which is now scheduled for the second half of 2026 and will continue to sell covered calls and roll as needed to further lower my adjusted cost basis.

What I'm Holding Now

As of September 7, 2025, here's what's in my portfolio:

- $MSTX 09/12/2025 20.00 P (1 contract)

- $LUNR 100 shares with 09/12/2025 9.00 C (1 contract)

- $7,925 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I'll be closely monitoring my open positions in $MSTX and $LUNR,

with particular attention to how the new NASDAQ crypto treasury rule

might affect $MSTX and if NYSE will implement something similar in

which will affect $BMNR.

For $LUNR, I'll continue my strategy of selling covered calls to

reduce my cost basis. With the inflation report coming up on

Thursday, I'll be looking for new opportunities that might arise

from market volatility. My substantial cash position of $7,925 gives

me flexibility to take advantage of any setups that present

themselves. As always, I'll be using the

options scanner

to identify high-probability trades while maintaining my disciplined

approach to risk management.