Road to $100k - Week 31

Week 31 Performance Overview

- Current Account Balance: $10,791

- Took a week off for vacation - limited trading activity

- Managed positions in $LUNR and $MSTX

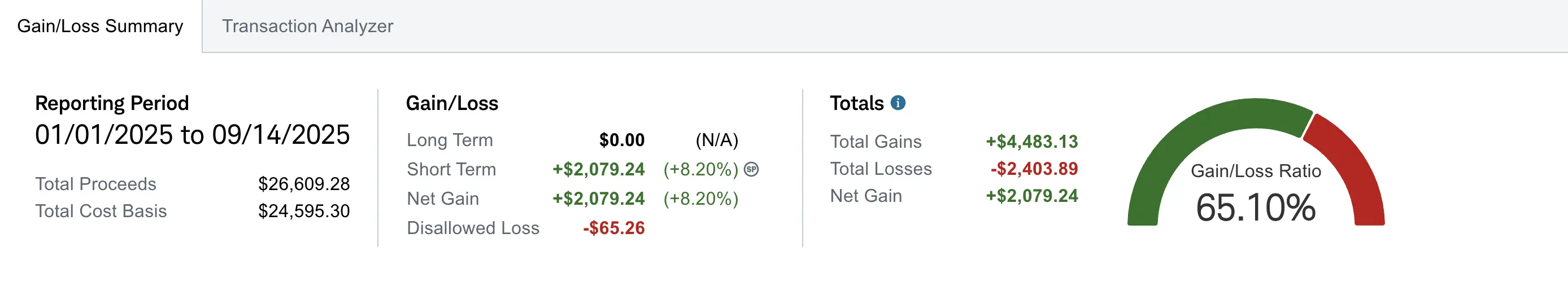

- Realized gain of $2,079 (up +$13 from Week 30 MSTX will reflect next week)

Portfolio Performance

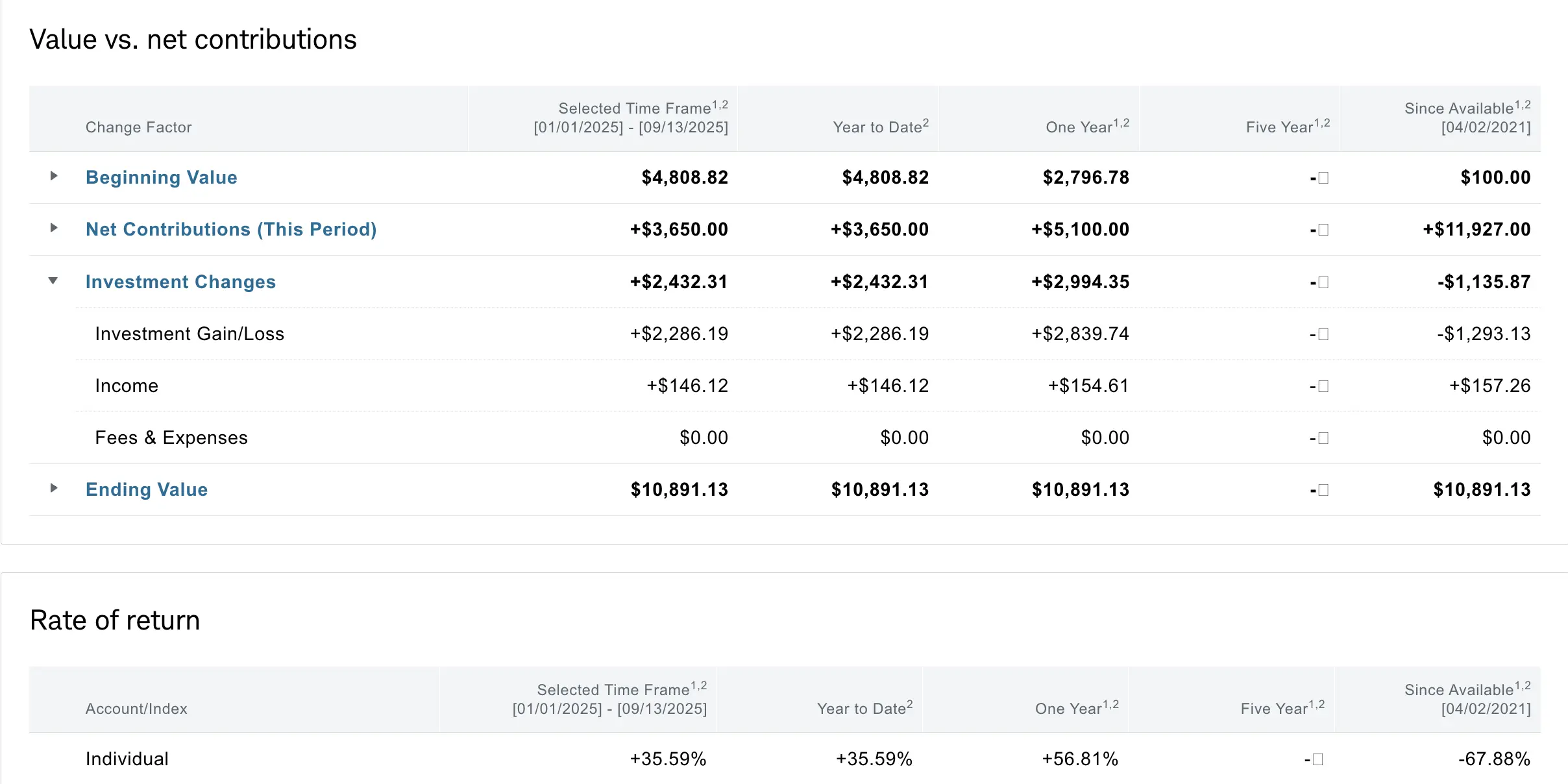

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,135 despite contributing over $11.9K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+56.81%) and YTD (+35.59%) performance metrics are what truly matter for tracking this journey.

Market Recap

I took a week off for vacation during Week 31, so I didn't actively follow market headlines or engage in significant trading activities. This was a good opportunity to step back and recharge while maintaining a few existing positions.

My Week 31 Trades

$LUNR

I continued my strategy with LUNR by rolling my $9 strike covered calls. I initially purchased 100 shares at $9 and have been selling in-the-money covered calls to reduce my cost basis. After previous rolls that brought my adjusted cost basis down to $8.52, this week I rolled my $9 strike covered calls from 09/12 to 09/19 for an additional +$12 credit, further reducing my adjusted cost basis to $8.40.

-

09/12/2025 Buy to Close:

- LUNR 09/12/2025 9.00 C

- Quantity: 1

- Debit: -$2.0

-

09/12/2025 Sell to Open:

- LUNR 09/19/2025 9.00 C

- Quantity: 1

- Credit: +$14

- Net Credit: +$12

- New adjusted cost basis: $8.40

I remain bullish on LUNR ahead of their IM-3 launch scheduled for the second half of 2026 and will continue to roll these covered calls to further lower my adjusted cost basis over time.

$MSTX

Entering this week, I had a $20 strike cash secured put on $MSTX expiring 09/12 for which I had collected a +$48 credit. This position expired worthless at the end of the week, allowing me to keep the full premium as profit.

-

09/03/2025 Sell to Open:

- MSTX 09/12/2025 20.00 P

- Quantity: 1

- Credit: +$48

- Net Profit: +$48 (position expired worthless)

What I'm Holding Now

As of September 14, 2025, here's what's in my portfolio:

- $LUNR 9.00 covered calls exp 09/19 (1 contract)

- $10,037 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

After taking a week off, I'll be getting back into more active

trading in the coming FOMC week. I expect heighten volatility going

into and around the federal reserve meeting.

With a substantial cash position of over $10,000, I'm

well-positioned to take advantage of new opportunities that present

themselves in the market. As always, I'll be using the

options scanner

to identify high-probability trades while maintaining my disciplined

approach to risk management.