Road to $100k - Week 34

Week 34 Performance Overview

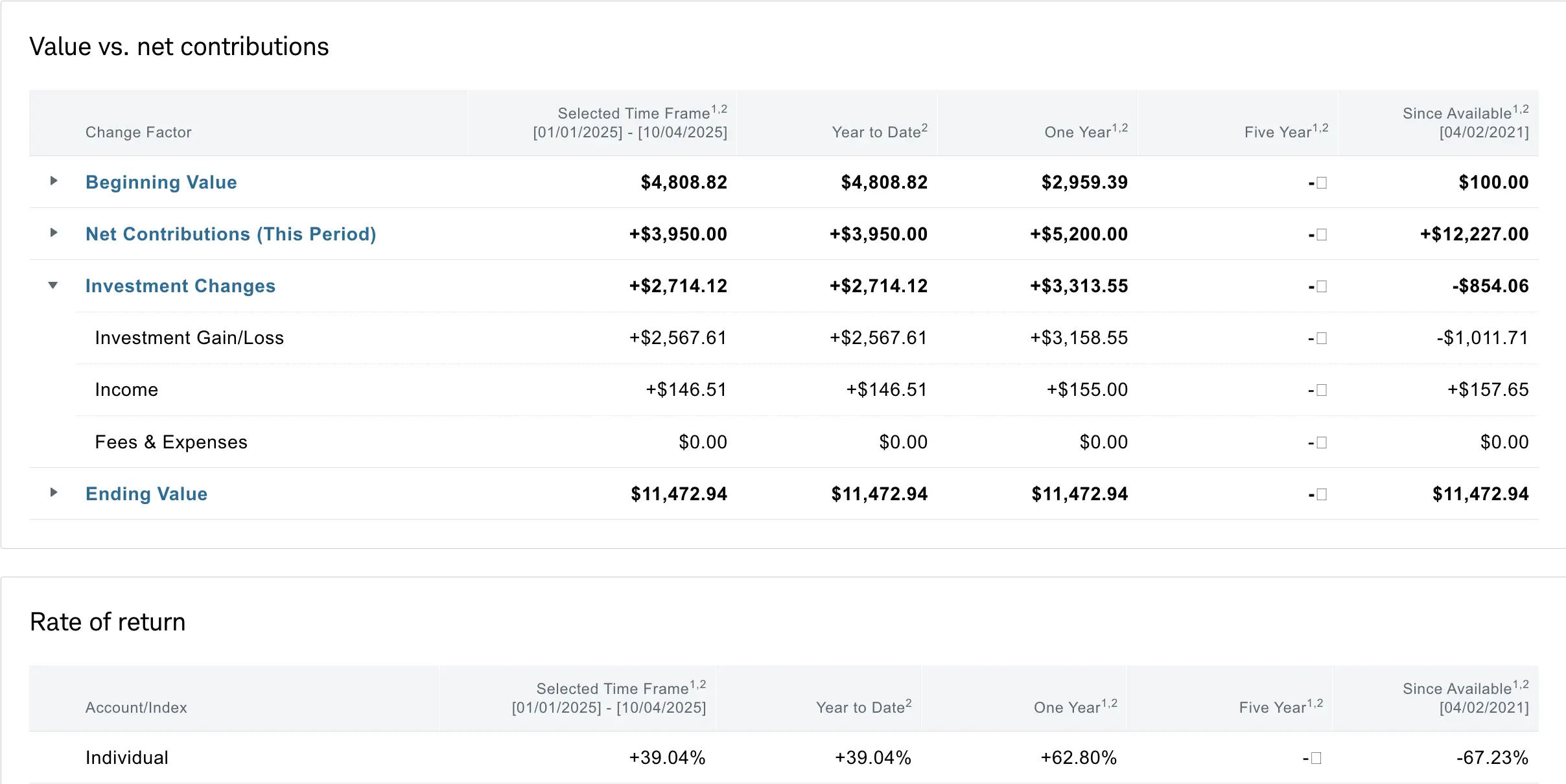

- Current Account Balance: $11,472

- Government shutdown with no end in sight

- Labor data release delayed due to shutdown

- Market moving blindly on uncertain data

- Bitcoin reached new all-time high of $125k

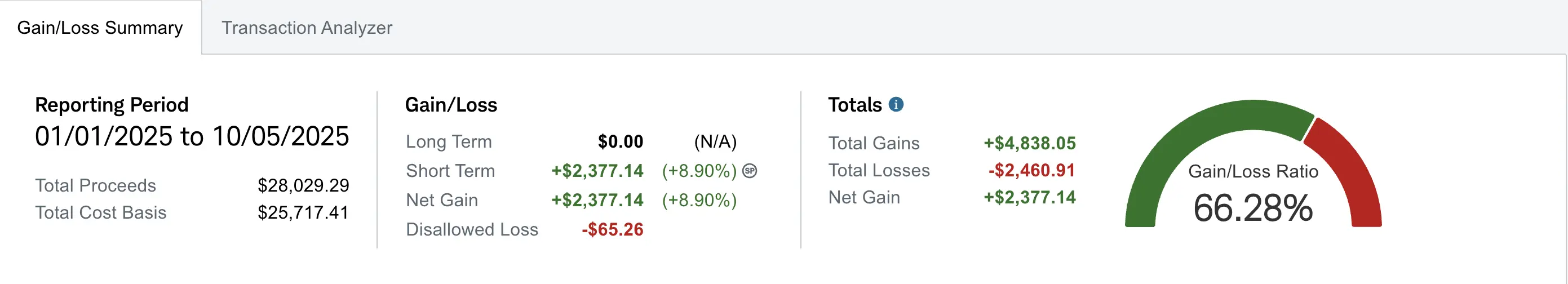

- Realized gain of $2,377 (up +$123 from Week 33)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $854 despite contributing over $12.2K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+62.80%) and YTD (+39.04%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week's most notable headline is the Government shutdown which has no end in sight. This caused the labor data that was supposed to be released on Friday to be further delayed. The stock market is currently moving blindly on uncertain data, so I'll be treading lightly until we get the jobs data.

In the crypto space, Bitcoin reached another all-time high of $125k.

My Week 34 Trades

$MSTX

At the start of the week, I opened a MSTX $18 cash secured put expiring 10/10 for a $53 credit. I closed the trade for a $22 debit the same week as crypto bounced back. The trade was over 50% profitable with more than a week left, resulting in a net profit of $31.

-

09/29/2025 Sell to Open:

- MSTX 10/10/2025 18.00 P

- Quantity: 1

- Credit: +$53

-

10/01/2025 Buy to Close:

- MSTX 10/10/2025 18.00 P

- Quantity: 1

- Debit: -$22

- Net Profit: +$31

Last week I had opened a $16 strike cash secured put expiring 10/03 for a $40 credit. This week I closed that trade for a $6 debit, bringing my net profit to $34, which is 85% of the original $40 captured.

-

09/25/2025 Sell to Open:

- MSTX 10/03/2025 16.00 P

- Quantity: 1

- Credit: +$40

-

09/29/2025 Buy to Close:

- MSTX 10/03/2025 16.00 P

- Quantity: 1

- Debit: -$6

- Net Profit: +$34

I also had an $18 strike cash secured put from last week expiring 10/03 that I opened for a $30 credit. I closed it this week for a $3 debit, bringing my net profit to $27.

-

09/24/2025 Sell to Open:

- MSTX 10/03/2025 18.00 P

- Quantity: 1

- Credit: +$30

-

10/01/2025 Buy to Close:

- MSTX 10/03/2025 18.00 P

- Quantity: 1

- Debit: -$3

- Net Profit: +$27

$OUST

I opened a new position this week on OUST. They are a lidar company that recently came onto my radar as a potential play for physical AI real-world uses. I opened a $24 strike cash secured put expiring 10/10 for a $54 credit. I later closed it the same week for a $20 debit, resulting in a net profit of $34, which is 62% of the original $54 captured with more than a week left. Moving forward, I will be bidding OUST more and keeping a close eye on the company as the next wave of AI will be Physical AI integrations.

-

09/30/2025 Sell to Open:

- OUST 10/10/2025 24.00 P

- Quantity: 1

- Credit: +$54

-

10/02/2025 Buy to Close:

- OUST 10/10/2025 24.00 P

- Quantity: 1

- Debit: -$20

- Net Profit: +$34

$BULL

I opened a $12.5 strike cash secured put for 10/10 expiration. The reason being that the IPO lockup expires next week and the market is pricing in a dump. I will be more than happy to get assigned at $12.5 and start selling covered calls if needed.

-

10/02/2025 Sell to Open:

- BULL 10/10/2025 12.50 P

- Quantity: 1

- Credit: +$34

What I'm Holding Now

As of October 5, 2025, here's what's in my portfolio:

- $10,257 cash balance awaiting opportunities

- BULL 10/10/2025 12.50 CSP

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I'll be monitoring the crypto market closely as Bitcoin reached another all-time high of $125k. I will also be monitoring the US government shutdown closely as that can further delay key data leading up to the October FOMC meeting that may or may not impact further rate cuts.