Options Trading Journey: $6K to $100K - Week 35

Week 35 Performance Overview

- Current Account Balance: $11,661

- Trump's new 100% tariffs stance on China effective November 1st

- China restricts exports of rare earths and other critical materials

- Significant market volatility due to trade tensions

- Bitcoin dropped to as low as $102k during flash crash

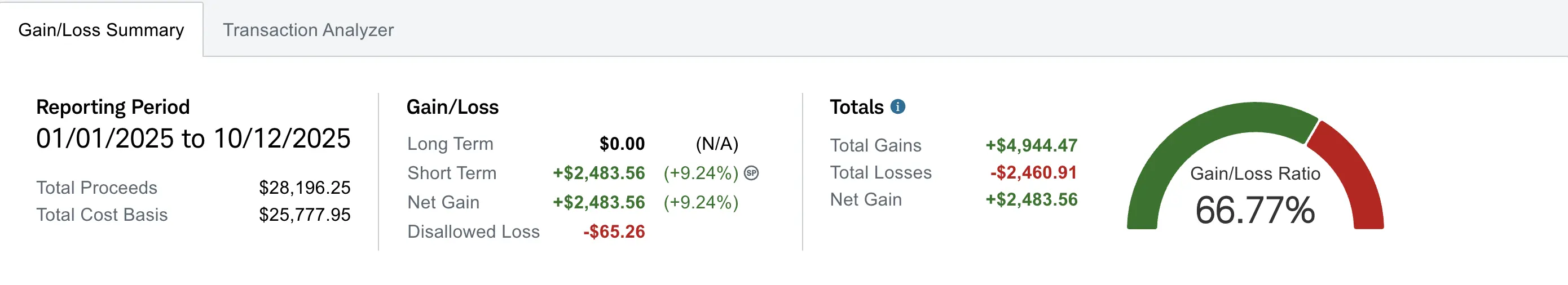

- Realized gain of $2,497 (up +$120 from Week 34)

Portfolio Performance

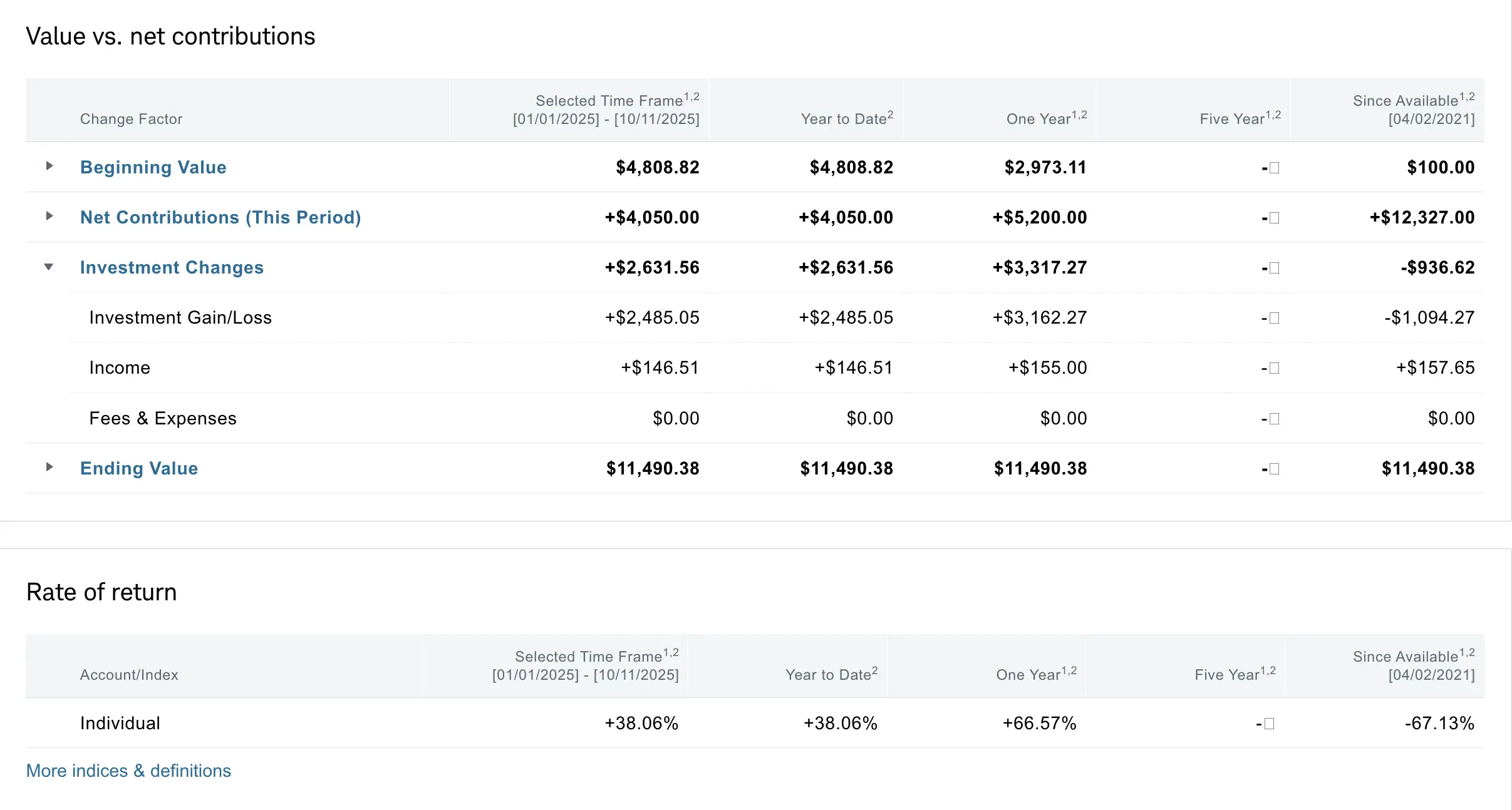

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $936 despite contributing over $12.3K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+66.57%) and YTD (+38.06%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week was exceptionally eventful with significant volatility created by Trump's new 100% tariffs stance on China effective November 1st. Trump threatened to cancel his meeting with Xi scheduled in two weeks. China responded by restricting exports of rare earths and other critical materials, though they later clarified that this doesn't amount to an export ban and eligible applications will continue to receive licenses.

I expect continued volatility in the coming weeks as this situation develops, particularly regarding whether Trump will extend the November 1st deadline or if a deal will be reached when Xi and Trump are scheduled to meet. As of Friday, Trump indicated that meeting has not been fully cancelled.

The crypto market experienced a flash crash with Bitcoin dropping to as low as $102k on Robinhood. Some other cryptocurrencies like SOL and ETH dropped as much as 20%, wiping out many leveraged positions.

My Week 35 Trades

$AES

I started a position in $AES as there have been recent Blackrock buyout rumors. Amidst the global AI race, energy is the bottleneck, and I'm more than willing to get assigned on $AES given the Blackrock exposure and its global energy foothold in renewable and natural gas. I will continue to monitor and bid $AES as opportunities arise.

I opened a $14 strike cash secured put expiring 10/10 and closed it a day prior to free up cash for a net profit of +$21.

-

10/06/2025 Sell to Open:

- AES 10/10/2025 14.00 P

- Quantity: 1

- Credit: +$23

-

10/09/2025 Buy to Close:

- AES 10/10/2025 14.00 P

- Quantity: 1

- Debit: -$2

- Net Profit: +$21

I opened an additional 10/17 expiration $14 strike cash secured put for a credit of +$50. I'll be monitoring this closely this upcoming week. If the market pulls back further, I may consider rolling it down and out to collect additional credits while derisking.

-

10/06/2025 Sell to Open:

- AES 10/17/2025 14.00 P

- Quantity: 1

- Credit: +$50

$HIMZ

I opened a $13 strike cash secured put expiring 10/17 and closed it once it was over 50% profitable with more than a week left for a net profit of +$15.

-

10/06/2025 Sell to Open:

- HIMZ 10/17/2025 13.00 P

- Quantity: 1

- Credit: +$30

-

10/07/2025 Buy to Close:

- HIMZ 10/17/2025 13.00 P

- Quantity: 1

- Debit: -$15

- Net Profit: +$15

$KVUE

I opened a $16 strike cash secured put, which at the time was considered an in-the-money position. I don't do this often unless I'm really comfortable owning the underlying. In this case, I viewed KVUE's other product lines as unaffected by the recent public concerns about Tylenol, which is owned by KVUE's parent company. I closed it the same week for a net profit of +$40, which is over 78% of the original premium with more than a week left.

-

10/06/2025 Sell to Open:

- KVUE 10/17/2025 16.00 P

- Quantity: 1

- Credit: +$51

-

10/10/2025 Buy to Close:

- KVUE 10/17/2025 16.00 P

- Quantity: 1

- Debit: -$11

- Net Profit: +$40

$FLY

FireFly is a smaller-scale rocket company compared to RocketLab, focusing on smaller rocket payloads. I opened a $27 strike cash secured put for a credit of +$44 after they announced the acquisition of SciTec, which had previous contracts with the US military. At the end of the week, this position expired worthless, so my net profit is +$44.

-

10/06/2025 Sell to Open:

- FLY 10/10/2025 27.00 P

- Quantity: 1

- Credit: +$44

$MSTX

Prior to the Trump tariff announcement, I opened a $17 strike cash secured put expiring 10/17 for a credit of +$44. This position remains open, and I'll monitor it closely next week given crypto's recent drop and Trump's most recent announcement that has provided slight relief to the crypto sector.

-

10/07/2025 Sell to Open:

- MSTX 10/17/2025 17.00 P

- Quantity: 1

- Credit: +$44

On the day Trump announced his tariff plans, the crypto market dropped dramatically. I took advantage of the drop and opened a $16 strike cash secured put expiring 10/17 for a +$65 credit. I closed it shortly after as there was a slight bounce, capturing over 50% profit with more than a week left.

-

10/10/2025 Sell to Open:

- MSTX 10/17/2025 16.00 P

- Quantity: 1

- Credit: +$65

-

10/10/2025 Buy to Close:

- MSTX 10/17/2025 16.00 P

- Quantity: 1

- Debit: -$31

- Net Profit: +$34

$BULL

I had a $12.5 cash secured put expiring 10/10 that I opened last week for a +$34 credit. As Trump dropped the tariff announcement, the entire market flipped, including $BULL. I ended up getting assigned on the $12.5 strike cash secured put, so now I have 100 shares with an adjusted cost basis of $12.16 after accounting for the original $34 premium collected. I plan to start selling covered calls next week on this position.

Prior to the Trump announcement, I opened an additional $12 strike cash secured put for 10/17 expiration for a credit of +$50. I'll be monitoring this position closely next week given the recent uncertainty and volatility.

-

10/07/2025 Sell to Open:

- BULL 10/17/2025 12.00 P

- Quantity: 1

- Credit: +$50

$PSKY

This one recently came onto my radar as a potential merger play between $WBD and $PSKY. WBD currently owns HBO and PSKY owns Paramount. Combining both companies would create one of the most complete media ecosystems in the market; rivaling Netflix in scale, with a total subscriber count projected to exceed 200 million globally.

The merger is being led by SkyDance, founded by David Ellison, son of Larry Ellison of Oracle, which adds a layer of financial backing and political swings. I believe this deal has a decent probability of moving forward, and I’m more than comfortable getting assigned and starting to wheel this position if it comes to that.

-

10/09/2025 Sell to Open:

- PSKY 10/17/2025 18.00 P

- Quantity: 1

- Credit: +$59

-

10/10/2025 Sell to Open:

- PSKY 10/17/2025 17.00 P

- Quantity: 1

- Credit: +$38

What I'm Holding Now

As of October 12, 2025, here's what's in my portfolio:

- $2,946 cash balance awaiting opportunities

- 100 shares of BULL at $12.16 adjusted cost basis

- BULL 10/17/2025 12.00 CSP

- AES 10/17/2025 14.00 CSP

- MSTX 10/17/2025 17.00 CSP

- PSKY 10/17/2025 17.00 & 18.00 CSP

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I expect a lot more volatility in the coming weeks as the US-China trade situation develops. I'll be closely watching whether Trump extends the November 1st deadline or if a deal will be reached when Xi and Trump are scheduled to meet in two weeks.

For my BULL position, I plan to start selling covered calls next week to generate additional income while holding the shares. I'll also continue to monitor my open positions in AES, BULL, PSKY and MSTX, potentially rolling them if market conditions warrant it.

Join the FREE trading community focused on selling options, sharing setups, and building consistent income:

Selling Options Discord