Road to $100k - Week 36

Week 36 Performance Overview

- Current Account Balance: $11,677

- Renewed fears surrounding regional banks

- Jamie Dimon referenced “cockroaches” — implying more potential regional bank issues ahead

- China headlines cooled off after Trump said 100% tariffs are unsustainable

- Market sentiment remains cautious heading into late October

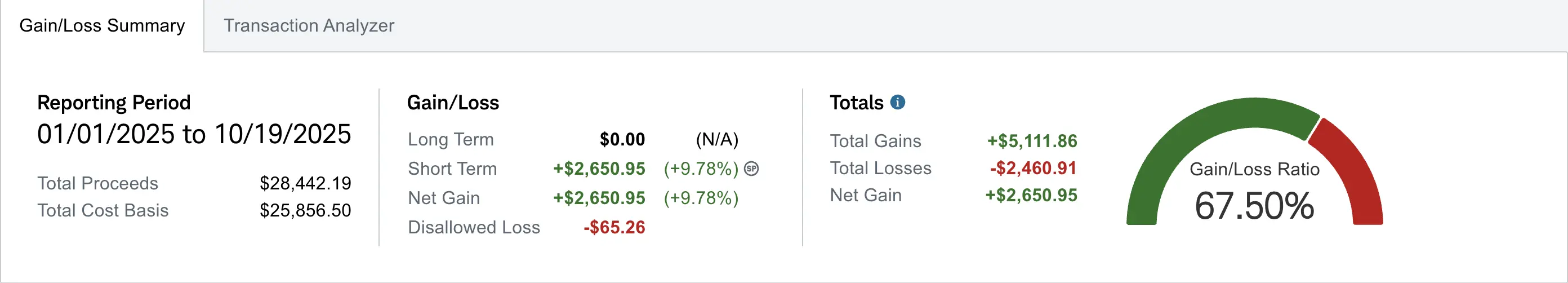

- Realized gain of $2,650 (up +$153 from Week 35)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $849 despite contributing over $12.4K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+59.95%) and YTD (+39.11%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week we experienced renewed fear surrounding regional banks. JPMorgan CEO Jamie Dimon compared the situation to “cockroaches,” suggesting that if one bank has issues, there may be more lurking. This comment added a layer of uncertainty to an already cautious market.

Meanwhile, the China headlines seemed to cool off slightly. Trump mentioned that his proposed 100% tariffs on China are “unsustainable,” which helped ease some of the geopolitical tension that dominated last week’s trading.

My Week 36 Trades

$BULL

I had 100 shares of $BULL that were assigned at $12.50 last week. My adjusted cost basis on those shares is $12.16 after accounting for the premium from prior cash secured puts. This week, I opened a covered call at the $12.50 strike for a credit of +$18. I plan to continue selling covered calls on this position to generate additional income.

-

10/13/2025 Sell to Open:

- BULL 10/17/2025 12.50 C

- Quantity: 1

- Credit: +$18

I also had a $12 strike cash secured put that was assigned this week. I collected +$50 on the original premium, which brings my adjusted cost basis to around $11.50 for those shares. With both assignments, my overall average cost basis across 200 shares of $BULL is approximately $11.74. I’ll be selling covered calls on both lots next week.

$AES

I sold to open another $AES $14 strike cash secured put expiring 10/17 for a credit of +$45.

-

10/13/2025 Sell to Open:

- AES 10/17/2025 14.00 P

- Quantity: 1

- Credit: +$45

I also had a $14 strike cash secured put opened last week for a +$50 credit. Toward the end of this week, I closed both contracts for -$5 each, totaling -$10 in debit. My combined profit on both trades comes to +$85 net.

-

10/16/2025 Buy to Close:

- AES 10/17/2025 14.00 P

- Quantity: 2

- Debit: -$10

$MSTX

Prior to the regional bank scare, I opened a $16 strike cash secured put expiring 10/24 for a credit of +$68. I'm keeping this position open and will monitor it closely next week.

-

10/15/2025 Sell to Open:

- MSTX 10/24/2025 16.00 P

- Quantity: 1

- Credit: +$68

I had a $17 strike cash secured put that I opened last week for a +$44 credit. This week I rolled it down and out to a $16 strike expiring 10/24 for a credit of +$62.

-

10/17/2025 Roll:

- Buy to Close: MSTX 10/17/2025 17.00 P (Debit: -$38)

- Sell to Open: MSTX 10/24/2025 16.00 P (Credit: +$100)

- Net Credit: +$62

After the regional bank scare caused a market sell-off, I took advantage of the heightened volatility and sold a $11 strike cash secured put expiring 10/24 for a credit of +$28.

-

10/16/2025 Sell to Open:

- MSTX 10/24/2025 11.00 P

- Quantity: 1

- Credit: +$28

I closed this position the next day for over 50% profit with more than a week left until expiration.

-

10/17/2025 Buy to Close:

- MSTX 10/24/2025 11.00 P

- Quantity: 1

- Debit: -$13

- Net Profit: +$15

$PSKY

I opened an additional $PSKY $17 cash secured put expiring 10/24 this week for a +$47 credit. $PSKY is in merger talks with $WBD, and if the merger occurs, this would become one of the pure media plays in terms of active monthly subscribers for a digital streaming service.

-

10/16/2025 Sell to Open:

- PSKY 10/24/2025 17.00 P

- Quantity: 1

- Credit: +$47

I had a $17 strike cash secured put that I opened last week for a +$38 credit. I rolled it at-the-money this week out to 10/24 at the $17 strike for a credit of +$41. My strategy is to continue collecting premium before potentially taking assignment.

-

10/17/2025 Roll:

- Buy to Close: PSKY 10/17/2025 17.00 P (Debit: -$16)

- Sell to Open: PSKY 10/24/2025 17.00 P (Credit: +$57)

- Net Credit: +$41

I also had an $18 strike cash secured put that I opened last week for a +$59 premium. This week I was assigned on that position, bringing my adjusted cost basis to $17.41 after accounting for the premium collected. I plan to sell covered calls on these shares next week.

What I'm Holding Now

As of October 19, 2025, here's what's in my portfolio:

- $1,527 cash on hand

- 200 shares of BULL at $11.74 adjusted cost basis

- 100 shares of PSKY at $17.41 adjusted cost basis

- MSTX 10/24/2025 16.00 CSP (2 contracts)

- PSKY 10/24/2025 17.00 CSP (2 contracts)

- Weekly $100 deposit split between Wednesday and Friday

Looking Ahead

I will be monitoring the regional bank crisis closely next week. The China situation seems to be cooling down given Trump's most recent comments about potentially still meeting with Xi. I'll continue selling covered calls on my BULL and PSKY positions while managing my open cash secured puts.