Road to $100k - Week 37

Week 37 Performance Overview

- Current Account Balance: $12,207

- Regional bank fears took a backseat to earnings season

- Federal Reserve lost access to ADP's private sector employment data

- CPI report came in cooler than expected

- SPX reached another all-time high

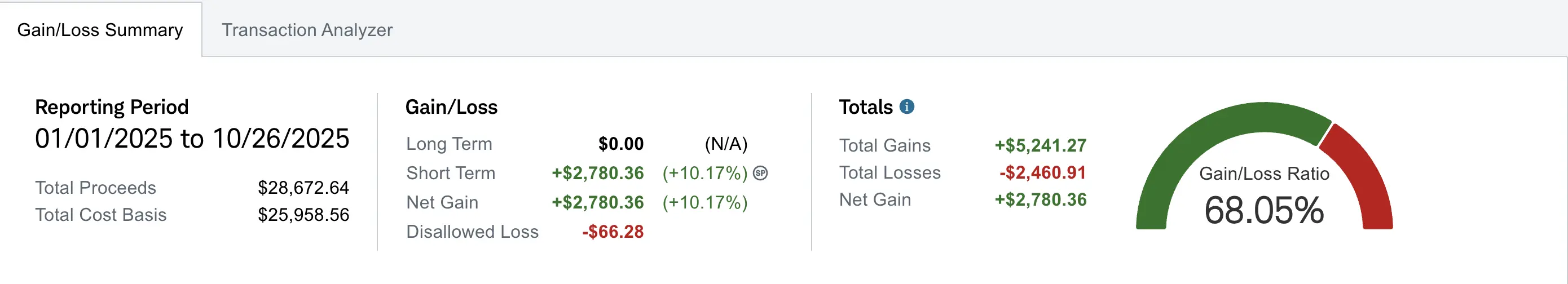

- Realized gain of $2,780 (up +$130 from Week 36)

Portfolio Performance

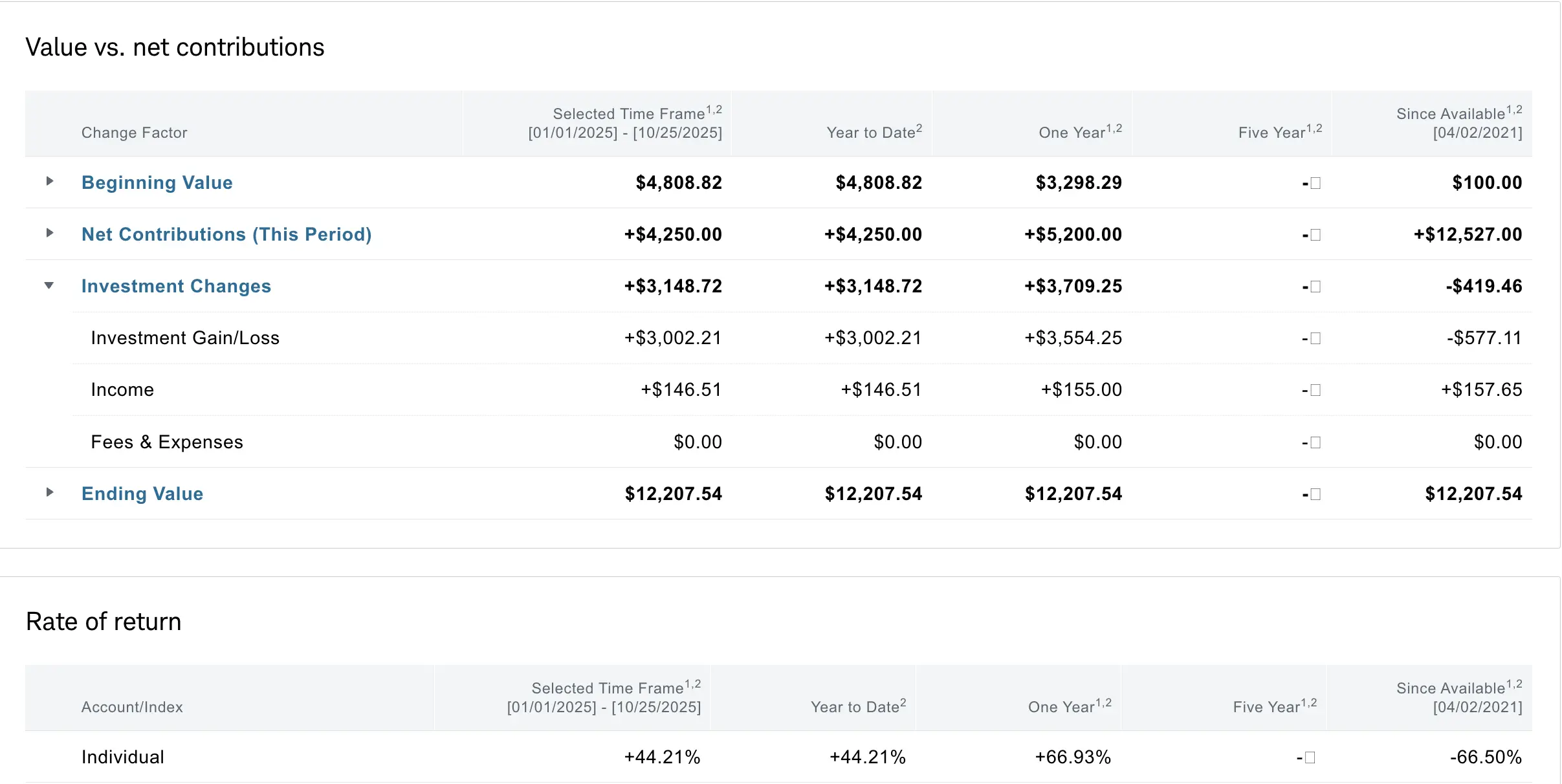

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $419 despite contributing over $12.5K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+66.93%) and YTD (+44.21%) performance metrics are what truly matter for tracking this journey.

Market Recap

The regional bank fears took a backseat to earnings season. The Federal Reserve lost access to ADP's private sector employment data in late August 2025. As the government continues to shut down the Fed will be navigating essentially blind going into FOMC next week in terms of jobs data.

CPI report came in on Friday cooler than expected, SPX reached another all-time high. Next week I expect a volatile week ahead with big tech earnings, FOMC and Trump meeting with Xi.

My Week 37 Trades

$PSKY

This week I was assigned from $PSKY $18 cash secured puts that expired ITM last week. My adjusted cost basis after assignment on that is $17.41. I sold $17.5 strike covered calls this week for a credit of +$20.

-

10/20/2025 Sell to Open:

- PSKY 10/24/2025 17.50 C

- Quantity: 1

- Credit: +$20

I also had 2 contracts of $PSKY $17 strike expiring on 10/24. I rolled one of the contracts out another week ATM to milk as much premium as I possibly can before I ultimately have to get assigned. This furthers lowers my adjusted cost basis.

-

10/24/2025 Roll:

- Buy to Close: PSKY 10/24/2025 17.00 P (Debit: -$47)

- Sell to Open: PSKY 10/31/2025 17.00 P (Credit: +$90)

- Net Credit: +$43

My other contract I put in a bid to close and to my surprised it closed for -$25 debit. According to Schwab metrics my overall net profit on that $17 strike CSP exp 10/24 that I closed it +$30. Accounting for the previous rolls.

-

10/24/2025 Buy to Close:

- PSKY 10/24/2025 17.00 P

- Quantity: 1

- Debit: -$25

- Net Profit: +$30

I will continue to sell $17.5 CCs next week on $PSKY and will continue to roll my $17 CSP as needed.

$BULL

I got assigned on $BULL $12 CSP with an adjusted cost basis of $11.51. I sold covered calls on $12 and $12.5 strikes for a credit of +$12 and +$8 for a combined net credit of +$20. Both of these expired worthless and I will continue to sell covered calls near my adjusted cost basis with the ladder approach. The $12 strike is meant to get assigned so I can free up my capital, the $12.5 strike is slightly out the money to capture some of the upside and to roll up and out as needed.

-

10/20/2025 Sell to Open:

- BULL 10/24/2025 12.50 C

- Quantity: 1

- Credit: +$8

-

10/20/2025 Sell to Open:

- BULL 10/24/2025 12.00 C

- Quantity: 1

- Credit: +$12

$AES

I opened $14 strike cash secured exp 10/31 for a credit of +$43. I closed it on Friday when it was over 50% with more than a week left for a debit of -$11 resulting in a net profit of +$32.

-

10/21/2025 Sell to Open:

- AES 10/31/2025 14.00 P

- Quantity: 1

- Credit: +$43

-

10/24/2025 Buy to Close:

- AES 10/31/2025 14.00 P

- Quantity: 1

- Debit: -$11

- Net Profit: +$32

$MSTX

Entering this week I had 2 contracts of $16 strike cash secured puts that I had been rolling from the previous week. This week I rolled down and out one contract to derisk while collecting net credit. The reason being there is a volatile week ahead so I wanted to prepare myself just in case.

-

10/24/2025 Roll:

- Buy to Close: MSTX 10/24/2025 16.00 P (Debit: -$16)

- Sell to Open: MSTX 10/31/2025 15.00 P (Credit: +$61)

- Net Credit: +$45

My other $16 strike expired worthless, freeing up cash for next week and the realized gain will reflect on Monday.

What I'm Holding Now

As of October 26, 2025, here's what's in my portfolio:

- $5,157 cash on hand

- 200 shares of BULL at $11.72 adjusted cost basis

- 100 shares of PSKY at $17.41 adjusted cost basis

- MSTX 10/31/2025 15.00 CSP (1 contract)

- PSKY 10/31/2025 17.00 CSP (1 contract)

- Weekly $100 deposit split between Wednesday and Friday

Looking Ahead

I expect a volatile week ahead with big tech earnings, the FOMC meeting, and Trump's meeting with Xi. These unpreditable events could significantly impact the market. I'll continue selling covered calls on my BULL and PSKY positions while managing my open cash secured puts on $MSTX during this potentially turbulent week.