Road to $100k - Week 38

Week 38 Performance Overview

- Current Account Balance: $11,965

- Big tech earnings were mostly in-line with expectations

- Capex spend for AI continues to increase

- Fed cuts interest rate by 0.25%, Powell stated December rate cuts not guaranteed and will be depending on data

- Government shutdown continues

- Trump met with Xi and came out with a trade deal

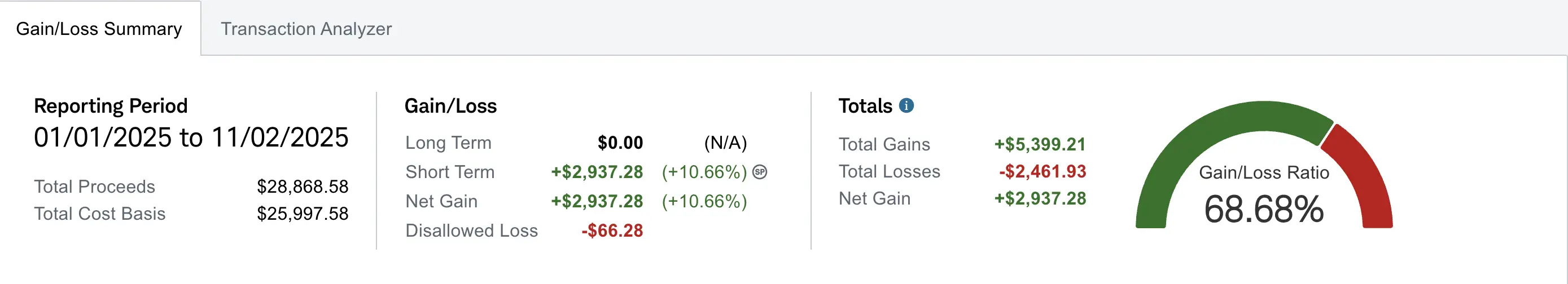

- Realized gain of $2,937 (up +$157 from Week 37)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $761 despite contributing over $12.6K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+60.48%) and YTD (+40.17%) performance metrics are what truly matter for tracking this journey.

Market Recap

Big tech earnings were mostly in-line with expectations, though the continued increase in AI-related capex spending remains a key theme. The Federal Reserve cut interest rates by 0.25%, but Powell's comments about December rate cuts not being guaranteed and being data dependent added some uncertainty given the current government shutdown with no end in sight.

My Week 38 Trades

$PSKY

I sold $17.5 covered calls on PSKY in the beginning of this week for +$17. I will continue to sell covered calls as I await the WBD and PSKY merger to play out. As of this week, Netflix came out with interest to buy out WBD as well, it seems like a bidding war is heating up. If PSKY finalizes the merger, they become one of the best pure media plays out there aside from NFLX in terms of subscriber count and market reach.

-

10/27/2025 Sell to Open:

- PSKY 10/31/2025 17.50 C

- Quantity: 1

- Net Credit: +$17

I also had $17 strike cash secured puts which I've been rolling. I got assigned on those this past Friday, going into next week I will have 200 shares of PSKY in which I will continue to sell covered calls on to further lower my adjusted cost basis.

$BULL

This week I sold $BULL $12 and $12.5 covered calls for a total net credit of +$48 for both contracts. I will continue to sell BULL covered calls to further lower my adjusted cost basis as the stock remains range-bound. Both of the contracts expired worthless.

-

10/27/2025 Sell to Open:

- BULL 10/31/2025 12.00 C

- Quantity: 1

- Net Credit: +$31

-

10/27/2025 Sell to Open:

- BULL 10/31/2025 12.50 C

- Quantity: 1

- Net Credit: +$17

$MSTX

In the beginning of this week, I opened $14 strike cash secured puts for +$20. In hindsight, I should have waited until big tech earnings, FOMC and Trump/Xi played out as there was a ton of volatility this week in MSTR.

-

10/27/2025 Sell to Open:

- MSTX 10/31/2025 14.00 P

- Quantity: 1

- Net Credit: +$20

I ended up rolling the $14 strike down to $13 strike exp 11/07 for another +$35 credit.

-

10/31/2025 Roll:

- Buy to Close: MSTX 10/31/2025 14.00 P (Debit: -$20)

- Sell to Open: MSTX 11/07/2025 13.00 P (Credit: +$55)

- Net Credit: +$35

As the market was dipping this week, I sold to open $13 strike cash secured puts exp 10/31 for +$30. This expired worthless as of Friday.

-

10/30/2025 Sell to Open:

- MSTX 10/31/2025 13.00 P

- Quantity: 1

- Net Credit: +$30

I also opened an additional $12 strike cash secured puts exp 11/07 for +$39.

-

10/29/2025 Sell to Open:

- MSTX 11/07/2025 12.00 P

- Quantity: 1

- Net Credit: +$39

Entering this week I had $15 strike cash secured puts which I've been previously rolling down and out and have now been assigned as of Friday. I will be selling covered calls on those 100 shares next week.

I will be monitoring MSTX $12 and $13 strike cash secured puts closely next week and will roll as needed.

$GLXY

GLXY this week announced a private offering of up to $1 billion, the stock dipped on this news. I took advantage of the drop and targeted the next level of support. I sold to open $33.50 cash secured puts exp 10/31 for +$39. I later closed it once it was over 50% profit same day.

-

10/28/2025 Sell to Open:

- GLXY 10/31/2025 33.50 P

- Quantity: 1

- Net Credit: +$39

-

10/28/2025 Buy to Close:

- GLXY 10/31/2025 33.50 P

- Quantity: 1

- Net Debit: -$18

- Net Profit: +$21

$AES

I sold to open $14 strike cash secured puts exp 11/07 for +$36. I will continue to bid $AES as the opportunity presents itself. There has been recent buyout interest from Blackrock which is slated to be finalized before end of the year. Given the rise of AI and the need for energy, I believe $AES will benefit greatly. As of lately, battery technology has been jumping and $AES has a joint venture with $FLNC, a company that specializes in battery storage and technology.

-

10/30/2025 Sell to Open:

- AES 11/07/2025 14.00 P

- Quantity: 1

- Net Credit: +$36

What I'm Holding Now

As of November 2, 2025, here's what's in my portfolio:

- $1,597 cash on hand

- 200 shares of BULL at $11.48 adjusted cost basis

- 200 shares of PSKY at $17.12 adjusted cost basis

- 100 shares of MSTX at $14.55 adjusted cost basis

- MSTX 10/31/2025 12 and 13 strike cash secured puts

- AES 11/07/2025 14.00 CSP (1 contract)

- Weekly $100 deposit split between Wednesday and Friday

Looking Ahead

Next week I'll continue to monitor my positions closely. With MSTX having multiple cash secured puts open, I'll be ready to roll as needed. The PSKY merger situation remains interesting with the potential Netflix bidding war, and I'll continue to sell covered calls on my other positions as opportunities arise.