Road to $100k - Week 42

Week 42 Performance Overview

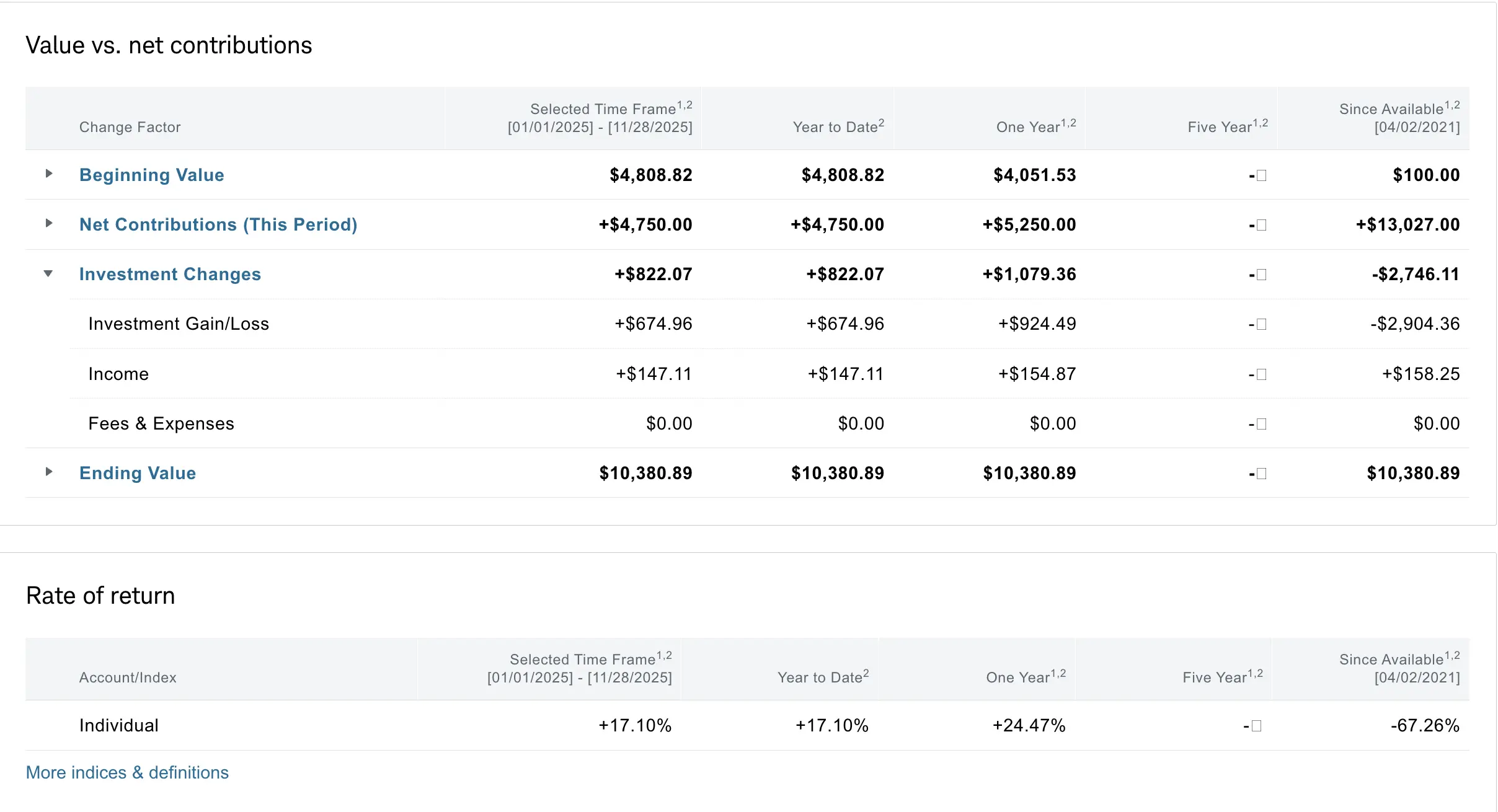

- Current Account Balance: $10,392

- Short week due to Thanksgiving holiday

- Trump vows to keep market high

- US online Black Friday sales hit record high

- Managed positions in $AES and $MSTX

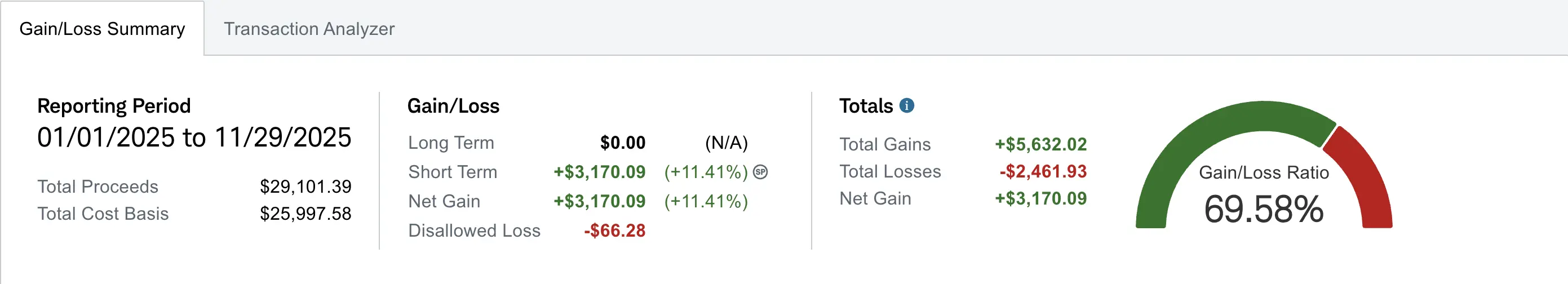

- Realized gain of $3,170 (up +$25 from Week 41)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about -$2,746 despite contributing over $13K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+24.47%) and YTD (+17.10%) performance metrics are what truly matter for tracking this journey.

Market Recap

This was a shortened trading week due to the Thanksgiving holiday. Market sentiment remained generally positive, influenced by former President Trump's vow to keep the market high. A notable economic headline was the report that US online Black Friday sales hit a record high, signaling strong consumer spending to kick off the holiday shopping season.

My Week 42 Trades

$AES

I sold to open two contracts of the $14 strike covered calls on $AES expiring 11/28, collecting a credit of +$28.97 (after fees). As of the Friday market close, the stock finished at $14.06. This means the call options are in the money and will more than likely be assigned, freeing up capital on Monday.

-

11/24/2025 Sell to Open:

- AES 11/28/2025 14.00 C

- Quantity: 2

- Credit: $28.97 (Net)

$MSTX

I opened three contracts of covered calls on $MSTX, expiring 12/05, for a total credit of +$13.46 (after fees) at $5 per contract. This is a strategy to capture small premium rather than collecting nothing while waiting for a more significant move in the underlying stock.

-

11/24/2025 Sell to Open:

- MSTX 12/05/2025 11.00 C

- Quantity: 3

- Credit: $13.46 (Net)

$BULL

I still hold 200 shares of $BULL and did not sell any covered calls on this position this week. It appears WeBull is starting to catch a bid, so I want to wait a bit more before selling covered calls to allow for potential upside.

$PSKY

I continue to hold 200 shares of $PSKY and chose not to sell any covered calls this week. The key focus remains on the merger talks which are ramping up, with the second round of bids due by December 1st. I'm holding off on selling calls to position for potential price volatility related to this event.

What I'm Holding Now

As of November 30, 2025, here's what's in my portfolio:

- $MSTX 09/12/2025 11.00 C (3 contracts)

- $AES 200 shares (Likely to be assigned on Monday)

- $BULL 200 shares (No covered calls sold this week)

- $PSKY 200 shares (No covered calls sold this week)

- $852 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

The upcoming week will be important for capital management. I'll be closely monitoring the assignment of my $AES covered calls, as this will free up a significant amount of capital early next week. I will also be watching the $PSKY merger development, with the December 1st bid deadline quickly approaching. For $BULL, I'll continue to observe its price action to determine the optimal time to sell covered calls. My cash position of $852 is currently low but will be significantly bolstered by the potential assignment of the $AES shares, giving me the flexibility to take advantage of new setups using the wheel strategy.