Road to $100k - Week 43

Week 43 Performance Overview

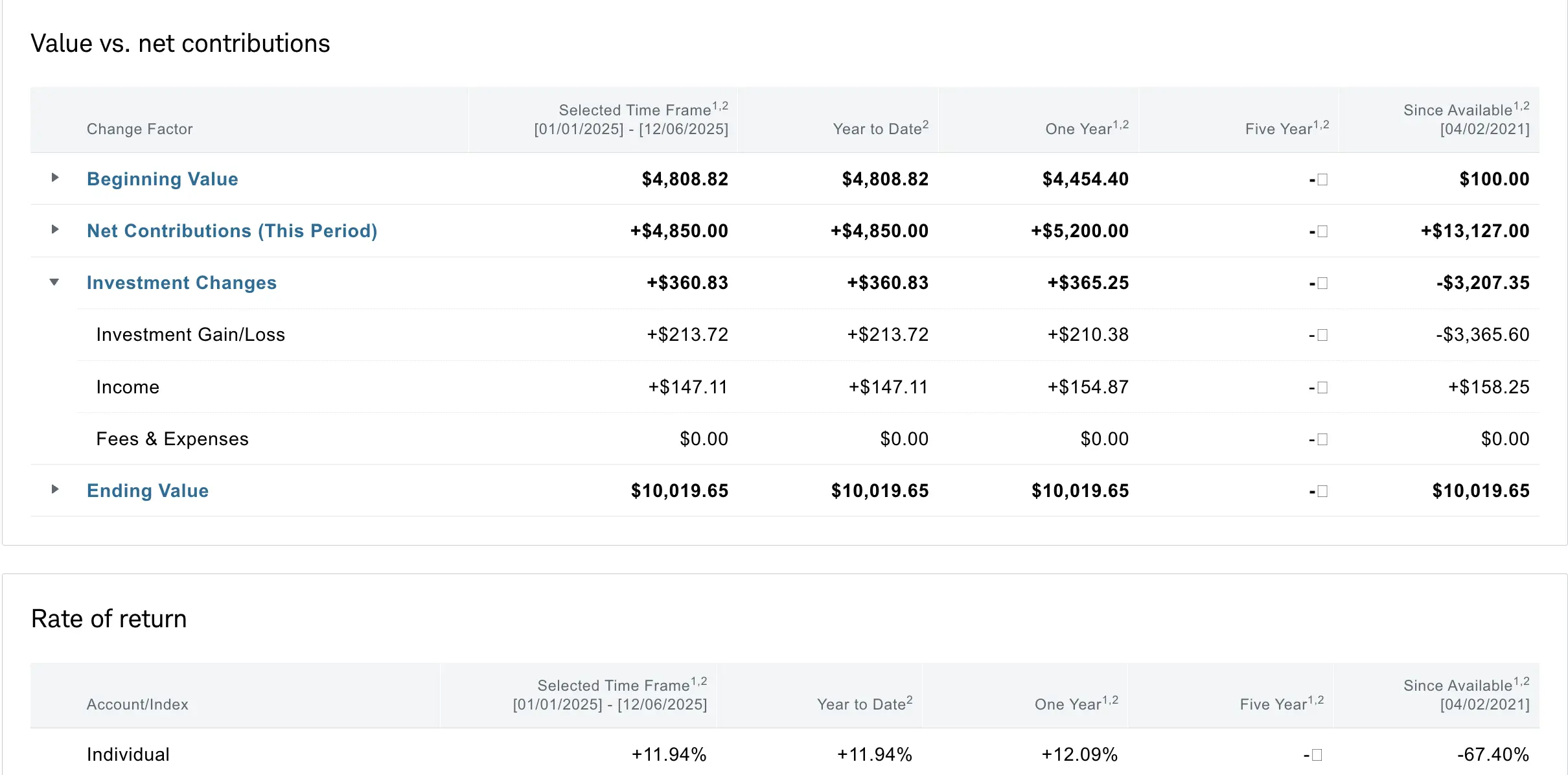

- Current Account Balance: $10,019

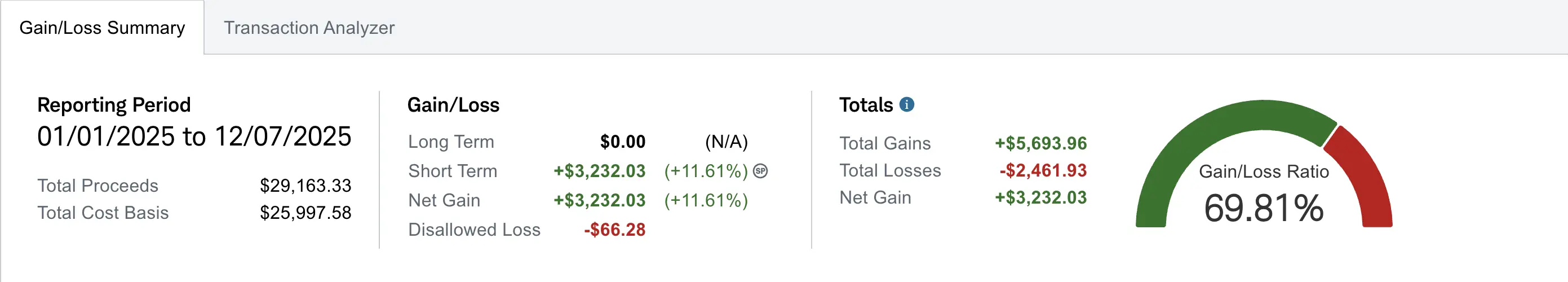

- Realized gain of $3,232 (up +$62 from Week 42)

- Fed rate cut probability rises to 90% amid cooling data

- Netflix emerges as the top bidder for Warner Bros. Discovery

- Opened a new Cash-Secured Put position in $LUNR

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about -$3,207 despite contributing over $13.1K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+12.09%) and YTD (+11.94%) performance metrics are what truly matter for tracking this journey.

Market Recap

Economic data pointed to a cooling labor market, with the November ADP report showing a decline of 32,000 private payrolls. Simultaneously, the Core PCE came in lower than expected at 2.8%. Fed rate cut at the upcoming meeting rised to 90%.

My Week 43 Trades

$AES

Despite the stock closing above the $14 strike on Friday, which I had anticipated would lead to assignment, the covered calls were not exercised. To keep the wheel turning, I sold to open an additional two contracts of covered calls at the $14 strike, this time expiring on 12/12. This brought in a net credit of +$72.97.

-

12/02/2025 Sell to Open:

- AES 12/12/2025 14.00 C

- Quantity: 2

- Credit: $72.97 (Net)

$PSKY (Paramount Skydance)

The merger saga for $PSKY took an unexpected turn as Netflix emerged as the winning bidder for Warner Bros. Discovery (WBD) with a deal valued at $82.7 billion. My initial expectation was that PSKY would be the most favorable suitor for WBD due to fewer potential regulatory hurdles. Given this new development, which could signal a major shift in the media landscape and potentially a hostile bid scenario for PSKY, my focus has shifted to exiting the position. I sold to open two contracts of covered calls at the $17 strike expiring 12/12 for a net credit of +$6.97. This is better than colecting nothing while i wait.

-

12/05/2025 Sell to Open:

- PSKY 12/12/2025 17.00 C

- Quantity: 2

- Credit: $6.97 (Net)

$LUNR (Intuitive Machines) - New Position

I initiated a new cash-secured put position on $LUNR, selling one contract at the $9 strike expiring 12/19, collecting a net credit of +$19.49. Following a recent NASA appointee's statement highlighting the goal of getting America back onto the moon. Intuitive Machines is already a significant NASA partner, having been awarded a large-scale contract for lunar communication and navigation services.

-

12/05/2025 Sell to Open:

- LUNR 12/19/2025 9.00 P

- Quantity: 1

- Credit: $19.49 (Net)

$BULL

I continue to hold 200 shares of $BULL. I did not sell any covered calls this week as I am still observing its price action, waiting for a more pronounced upward move before selling calls against the position.

$MSTX

The 300 shares of $MSTX remain in my portfolio. This position is currently responsible for a large part of my unrealized loss due to the recent downturn in the crypto sector. I am considering selling monthly covered calls to collect something better than collecting nothing.

What I'm Holding Now

As of December 7, 2025, here's a snapshot of my portfolio:

- $AES 12/12/2025 14.00 C (2 contracts)

- $PSKY 12/12/2025 17.00 C (2 contracts)

- $LUNR 12/19/2025 9.00 P (1 contract)

- $BULL 200 shares (No covered calls sold this week)

- $MSTX 300 shares (No covered calls sold this week)

- $154 Cash reserves

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

I'll be keeping an eye on my $AES covered calls. Once those capital are freed up it should allow me more option to make my losses back. The $LUNR cash-secured put is a new position I'm eager to track. My cash reserves are currently low at $154, but with the weekly deposits and the potential for positions like $AES to close, I anticipate having significantly more cash available for new wheel setups.