Options Trading Journey: $6K to $100K - Week 5

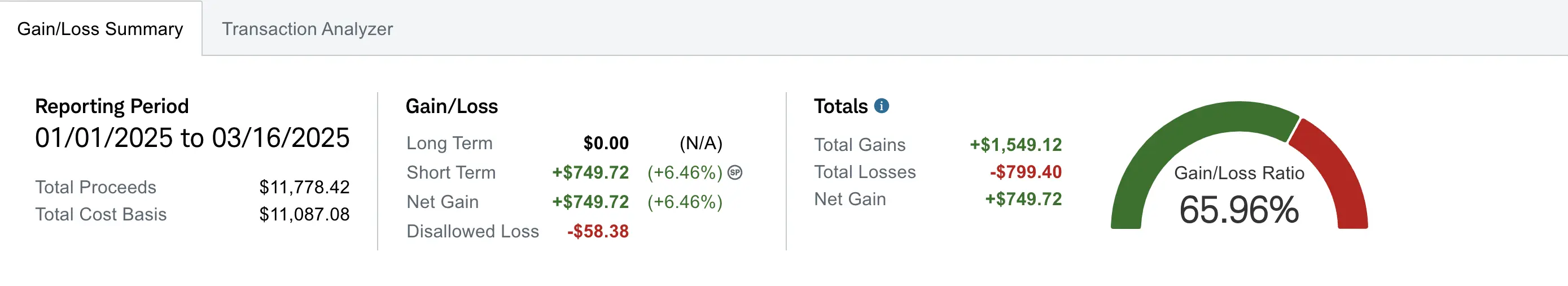

Week 5 Performance Overview

- Current Account Balance: $6,244

- Market Conditions: Continued volatility with sector rotation

My Week 5 Trades

This week focused primarily on rolling options and building swing positions. My approach has been to "milk the cow" - continuously collecting premiums while waiting for market conditions to stabilize.

$SOXL Option Rolls

I executed two strategic rolls on my $SOXL cash secured puts this week:

-

First Roll (March 10):

- Buy to Close: SOXL 03/14/2025 $19 Put for -$133

- Sell to Open: SOXL 03/21/2025 $19 Put for +$190

- Net Credit: $57

-

Second Roll (March 14):

- Buy to Close: SOXL 03/21/2025 $19 Put for -$111

- Sell to Open: SOXL 03/28/2025 $19 Put for +$157

- Net Credit: $46

These rolls allowed me to collect a total of $103 in additional premium while maintaining my position in the semiconductor sector.

$NBIS Covered Call Management

I adjusted my $NBIS position by rolling to a lower strike price:

- Buy to Close: NBIS 03/14/2025 $37.50 Call for -$8

- Sell to Open: NBIS 03/21/2025 $36 Call for +$25

- Net Credit: $17

I've deliberately held off on further rolls until after NVIDIA's upcoming AI conference, which could significantly impact the entire AI sector, including NBIS. This event will showcase current AI usage, trends, and upcoming products that could serve as catalysts.

$HIMS Swing Position Building

I continued adding to my $HIMS position on dips, building a swing trade opportunity. My current position stands at 11 shares with an average cost of $34.41.

My strategy with $HIMS exemplifies my "small wins" philosophy - I'm targeting a modest 2-5% gain rather than waiting for a home run. Not every trade needs to be a grand slam; consistently stacking small wins compounds effectively over time.

The "Milking the Cow" Strategy

A key aspect of my approach this week has been what I call "milking the cow" - continuously rolling options to collect premiums while awaiting more favorable market conditions. This strategy offers several advantages:

- Steady income generation through premium collection

- Gradual reduction of effective cost basis (original cost minus collected premiums)

- Flexibility to adjust to changing market conditions

- If assignment eventually occurs, I'll pivot to selling covered calls at or near my adjusted cost basis

What I'm Holding Now

As of March 16, 2025, here's my current portfolio:

- 6 shares of $AMD (average cost: $112.77)

- 115 shares of $EVGO (average cost: $3.47)

- 2 shares of $GOOG (average cost: $176.13)

- 11 shares of $HIMS (average cost: $34.41)

- 100 shares of $NBIS with 1 covered call at $36 strike (03/21 expiry)

- 1 $SOXL CSP at $19 strike (03/28 expiry)

My Next Moves

Looking ahead to week 6, my strategy focuses on:

- Monitoring NVIDIA's AI conference for potential impacts on my $NBIS position

- Setting a target exit price for my $HIMS swing trade

- Continuing my "milking the cow" strategy with $SOXL puts

- Evaluating new opportunities using our options scanner as market conditions evolve

Join our community of traders and investors to share ideas and learn together:

Selling Options Discord