Road to $100k - Week 8

Week 8 Performance Overview

- Current Account Balance: $4,515

- Market Conditions: Significant pullback following tariff announcements

Market Analysis: Trump Tariffs Impact

You may be wondering why there's such a significant drop in my account value this week. This decline is primarily due to my heavy exposure to the semiconductor sector through the leveraged ETF $SOXL.

This week featured the highly anticipated Trump Tariff announcement, which established a baseline tariff of 10% along with reciprocal tariffs for various countries. The semiconductor industry took a substantial hit due to uncertainty and potential disruption to the global supply chain that's critical to semiconductor manufacturing and distribution.

Despite this short-term volatility, I maintain a positive outlook on the semiconductor industry, primarily due to increasing AI demand. As I've mentioned in previous updates, semiconductors are the backbone of artificial intelligence, enabling its incredible processing power and efficiency. As AI advances, so will the infrastructure needed to support it, with semiconductors playing a central role. Faster and more efficient chips will see increasing demand as we're only witnessing the beginning of the AI revolution.

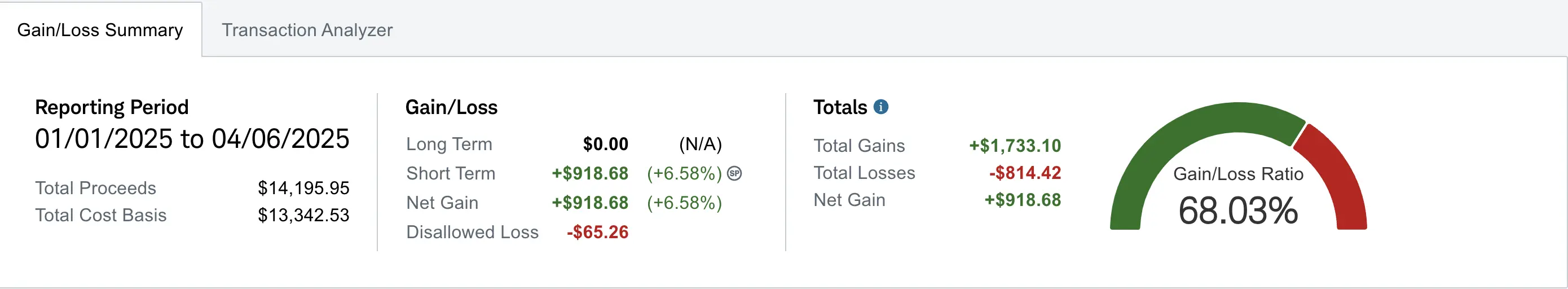

My Week 8 Trades

$SOXL Position Management

For $SOXL, I currently have two cash secured puts that have not yet been assigned:

- $14 strike (04/11 expiration)

- $19 strike (04/11 expiration)

While $SOXL has declined significantly this week, my strategy remains intact. Once I'm assigned shares, I plan to sell covered calls against those positions. This approach exemplifies the Wheel strategy I've discussed previously: sell cash secured puts, accept assignment when it occurs, then generate income by selling covered calls against those shares which will further lower my adjusted cost basis.

$HIMS Swing Trading

I executed multiple swing trades with $HIMS this week:

-

Initial Position:

- Sold 4 shares at $33.07 (average cost: $30.78)

- Net profit: $9.52

- Catalyst: HIMS announced they're adding Eli Lilly's weight loss medication Zepbound and diabetes drug Mounjaro, as well as the generic injection liraglutide, to their platform

-

Second Trade (April 4):

- Bought 2 shares @ $24.24 for -$48.47

- Sold @ $26.25 for +$52.50

- Quick profit: $3.68 (after fees)

While the second trade's profit might seem small at $3.68, it aligns perfectly with my "small wins" philosophy. With those 2 swing trades, I still made around $13. That is $13 more than I've started with.

$NBIS Covered Call Management

I rolled my $NBIS covered calls to the 04/11 expiration:

-

Roll Transaction:

- Buy to Close: NBIS 04/04/2025 $33 Call for -$3

- Sell to Open: NBIS 04/11/2025 $33 Call for +$10

- Net Credit: $7

I'll continue to roll these covered calls and collect premiums while waiting for the market to stabilize and eventually find a bottom. My AI thesis remains firm—I believe AI will play a vital role in the economy moving forward, and companies positioned to benefit from this trend, like NBIS, should perform well over the long term.

Portfolio Additions

I added 1 share to my $GOOG position this week, continuing my strategy of gradually building positions in high-quality companies.

What I'm Holding Now

As of April 6, 2025, here's my current portfolio:

- 115 shares of $EVGO (average cost: $3.47). Covered calls expired worthless from previous week.

- 3 shares of $GOOG (average cost: $167.69)

- 100 shares of $NBIS with 1 covered call at $33 strike (04/11 expiry)

- 1 $SOXL CSP at $19 strike (04/11 expiry)

- 1 $SOXL CSP at $14 strike (04/11 expiry)

My Next Moves

Looking ahead to week 9, my strategy focuses on:

- Preparing for potential $SOXL assignment and implementing covered call strategies if assigned

- Continuing to manage my $NBIS covered calls to generate income while waiting for market stabilization

- Looking for additional swing trade opportunities

- Evaluating new opportunities using our options scanner to identify multiple option chains with ROI, Delta, expiration and more.