Road to $100k - Week 10

Week 10 Performance Overview

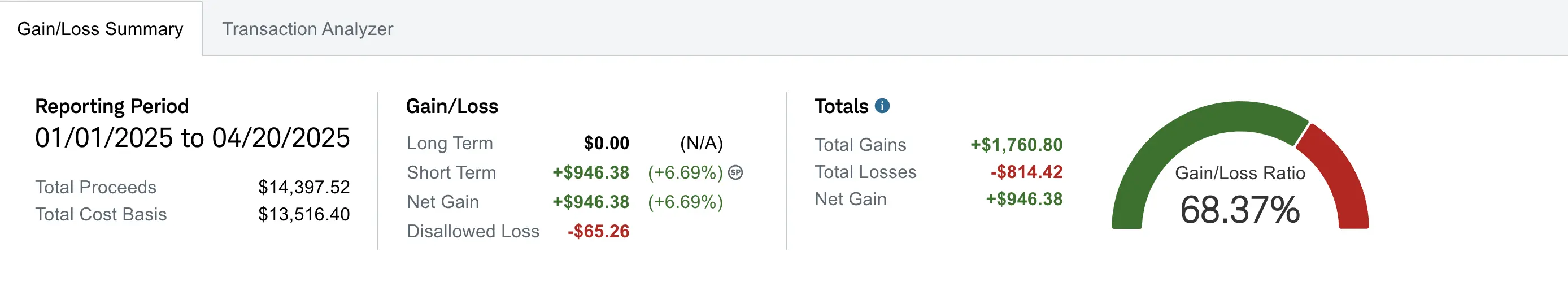

- Current Account Balance: $5,083

- Market Conditions: Slow week with continued tariff uncertainty

My Week 10 Trades

This was a relatively slow trading week with the market still digesting the tariff situation. My focus remained on generating income through covered calls while waiting for more clarity in the broader market.

$SOXL Wheel Strategy Continuation

Last week, I was assigned on my first $SOXL contract at the $19 strike and immediately sold a $15 strike covered call. This week, my second $SOXL position was assigned at the $14 strike, completing the transition from cash secured puts to covered calls for both positions.

-

$SOXL Position Management:

- First position: 100 shares assigned at $19 strike

- Second position: 100 shares assigned at $14 strike

- Sold covered calls on both positions at $15 strike expiring 04/17 for combined premium of $14

- Both covered calls expired worthless, allowing me to keep the full premium

My decision to use the $15 strike price for the covered calls was strategic. With my combined assignment prices of $19 and $14 averaging to $16.50, and accounting for all the premiums collected from my previous CSP rolls, my adjusted cost basis is between $14-15. This means that even if my shares get called away at $15, I'll still realize an overall profit on the position.

$HIMS Swing Trade

I executed a quick swing trade with my $HIMS position:

-

Trade Details:

- Purchased last week: 1 share @ $26.17

- Sold this week @ $28.35

- Net profit: $2.00

While a $2 profit might seem small, it aligns perfectly with my "every dollar counts" philosophy. In volatile market conditions, consistently capturing small gains adds up over time and helps maintain steady account growth.

$EVGO Covered Call Strategy

I continued generating income from my $EVGO position:

-

Trade Details:

- Sold 1 covered call: EVGO 04/25/2025 $3.50 Call for a credit of $3

This modest premium helps reduce my cost basis while I await further guidance on the EV funding pause that was anticipated for this spring. Even small premiums contribute to my overall strategy of consistent income generation.

$NBIS "Cash Grab" Opportunity

With $NBIS covered call premiums running low, I waited until Thursday of this short trading week to execute what I call a "cash grab" opportunity:

-

Trade Details:

- Sold 1 covered call: NBIS 04/25/2025 $24 Strike for a credit of $3

While the premium is modest, my philosophy remains consistent: generating some income is better than no income while waiting for market conditions to improve. These small credits continue to reduce my overall cost basis. I'll be closely monitoring $NBIS in the coming week as their earnings announcement is approaching, though the exact date hasn't been confirmed yet.

What I'm Holding Now

As of April 20, 2025, here's my current portfolio:

- 115 shares of $EVGO (average cost: $3.47) with 1 covered call at $3.50 strike (04/25 expiry)

- 3 shares of $GOOG (average cost: $167.69)

- 100 shares of $NBIS (average cost: $33.94) with 1 covered call at $24 strike (04/25 expiry)

- 200 shares of $SOXL (average costs: $15.35)

- $294.62 worth of cash. I still deposit $100 weekly on Wed and Fri splits

My Next Moves

Looking ahead to week 11, my strategy focuses on:

- Selling new covered calls on my $SOXL positions to continue generating premium income

- Continuing to monitor the evolving tariff situation for potential impacts on my semiconductor holdings

- Looking for additional swing trade opportunities

- Maintaining my disciplined approach to taking profits when available, no matter how small

- Evaluating new opportunities using our options scanner to identify high-probability setups