Options Trading Journey: $6K to $100K - Week 11

Week 11 Performance Overview

- Current Account Balance: $6,109

- Market Conditions: Signs of relief with potential trade deals and tariff negotiations.

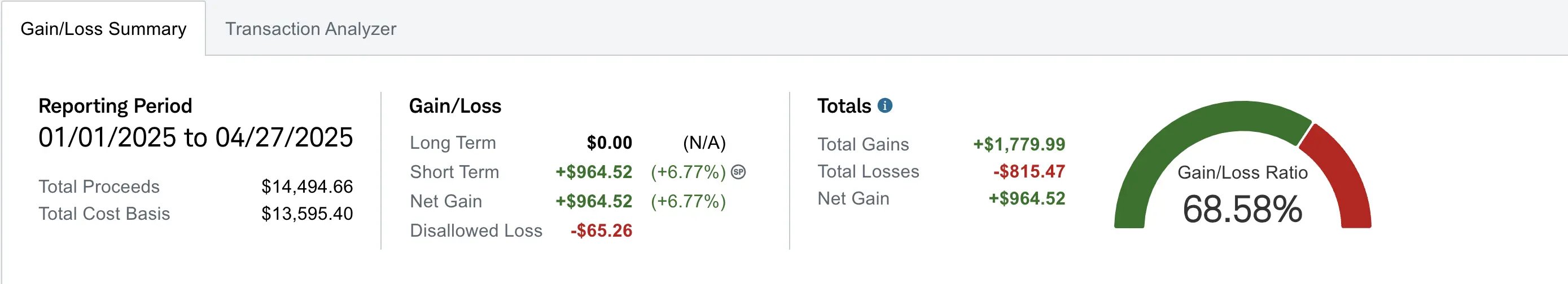

- Realized gain of $964.52 up +$18.14 from Week 10.

- Win/loss ratio of 68.58% realized

Market Overview

This week we saw the market bounce back as Trump's tariff stance on China eased. There was some back and forth between China and Trump regarding whether contact had been established. Despite this, the market remained optimistic that deals would eventually materialize. A key highlight included Vice President JD Vance finalizing terms for a potential trade deal in the future. Sectors such as Semiconductors and Technology rebounded strongly on signs of tariff relief, at least for now. Additionally, during Google's earnings call, they announced increased CapEx and reported higher AI usage by users, indicating growing demand. This is a positive sign for AI and Tech moving forward.

Week 11 Trades Breakdown

$EVGO Position

My $EVGO covered calls that I sold to open two weeks ago for $3 expired worthless. I know what you may be thinking—only $3? Hey, that's better than nothing while I await the National Electric Vehicle Infrastructure (NEVI) to provide further guidance on the funding that has been paused rather than completely cut.

$SOXL Position

I sold to open 2 contracts at a $14 strike early this week, receiving a $1 credit due to low premiums before the tariff relief news. After the announcement, I rolled the options to the following week at a $15 strike for a $6 credit, capturing more upside potential. I expect to collect better premiums next week as the market rebound continues.

-

Trade Details:

- Sell to open 2 covered calls @ $14 strike

- Net credit: $1.00

- Rolled to $15 strike (05/02 expiry)

- Roll credit: $6.00

$NBIS Position

For NBIS, there were misconceptions about earnings dates. I believed these were estimates rather than confirmed dates. Taking advantage of this uncertainty, I sold to open 1 contract of covered calls at a $27 strike for a net credit of $5. With no announcements or news, Nebius was unlikely to reach $27, and as expected, the contract expired worthless.

-

Trade Details:

- Sell to open 1 covered calls @ $27 strike

- Net credit: $5.00

$HIMS Trade

I executed another $HIMS swing trade this week for a small gain of $3.72, or approximately 4.8%, with 3 shares. I had purchased 3 shares at an average cost of $25.66 and sold them at $26.90.

What I'm Holding Now

As of April 27, 2025, here's what's in my portfolio:

- 115 shares of $EVGO (average cost: $3.47)

- 3 shares of $GOOG (average cost: $167.69)

- 100 shares of $NBIS (average cost: $33.94)

- 200 shares of $SOXL (average costs: $15.35) with 2 covered calls at $15 strike (05/02 expiry)

- $408.75 worth of cash. I still deposit $100 weekly on Wed and Fri splits

Week 11 Summary

Accounting for all the expired options and net credits, this week brings my total to around $18. If market conditions remain favorable next week, I expect to collect some meaningful premium on my SOXL and NBIS positions.

My Next Moves

Looking ahead to week 12, my strategy focuses on:

- Capitalizing on the increased volatility in $SOXL and $NBIS to collect higher premiums

- Monitoring the market's reaction to potential trade deals between the US and China

- Looking for additional swing trade opportunities in the tech sector

- Evaluating new opportunities using our options scanner to identify high-probability setups

Join our FREE trading community! Share ideas, learn strategies, and grow together:

Selling Options Discord