Road to $100k - Week 12

Week 12 Performance Overview

- Current Account Balance: $6,529

- Market rebounded, led by semiconductor holdings ($SOXL).

- Big tech earnings (META, MSFT) boosted sentiment with increased CapEx and AI growth outlook.

- Market stabilized as trade deal talks continued.

- Watching for a potential golden cross (50SMA/200SMA) on SPX and QQQ, but caution remains as bear market risks persist.

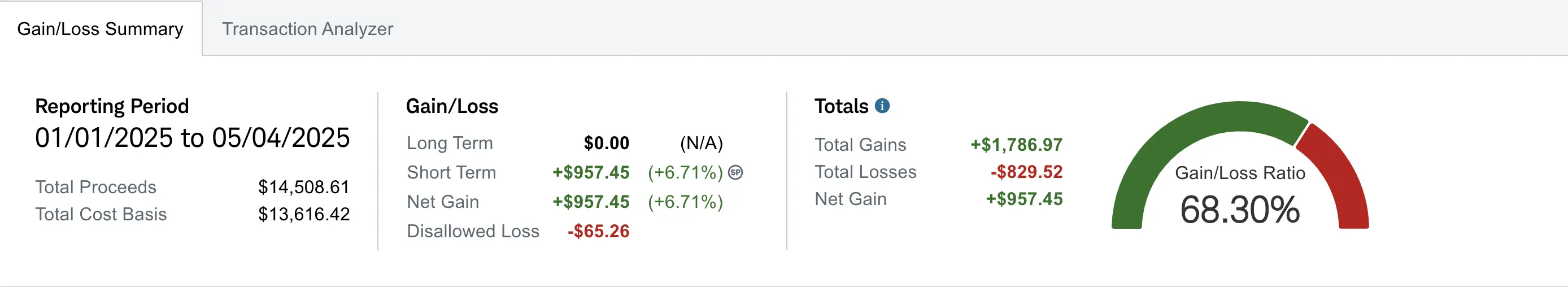

- Realized gain of $957.45 down -$7.07 from Week 11 due to taking a slight realized loss on SOXL to roll up and out.

- Win/loss ratio of 68.30% realized

My Week 12 Trades

$SOXL Position

I rolled both SOXL $15 calls to $15.5 calls expiring next week to avoid assignment, capture more upside potential, and collect additional premium. I'll continue rolling these calls to reduce my cost basis while generating income during the recovery period.

-

Trade Details:

- Buy to close 2 covered calls @ $15 strike (05/02 expiry), debit $20

- Sell to open 2 covered calls @ $15.5 strike (05/09 expiry), credit $44

- Net credit: $24

$NBIS Position

Sold a $28.5 weekly call expiring 05/02 for a $5 credit, choosing this strike based on the expected move and before the earnings date was announced. I plan to keep selling short-term calls above the expected move to collect premiums while waiting for NBIS earnings on May 20th.

-

Trade Details:

- Sell to open 1 covered call @ $28.5 strike (05/02 expiry)

- Net credit: $5

$EVGO Position

Sold a $3.5 call expiring next week to collect premium ahead of EVGO earnings. Waiting for updates on NEVI funds, expected before the end of Spring.

-

Trade Details:

- Sell to open 1 covered call @ $3.5 strike (05/09 expiry)

- Net credit: $5

What I'm Holding Now

As of May 4, 2025, here's what's in my portfolio:

- 115 shares of $EVGO (average cost: $3.47) with 1 covered calls at $3.5 strike (05/09 expiry)

- 3 shares of $GOOG (average cost: $167.69)

- 100 shares of $NBIS (average cost: $33.94) This week's covered calls expired worthless

- 200 shares of $SOXL (average costs: $15.35) with 2 covered calls at $15.5 strike (05/09 expiry)

- $539.68 worth of cash. I still deposit $100 weekly on Wed and Fri splits

My Next Moves

My plan is to keep building my cash position and lowering my cost basis on SOXL and NBIS with covered calls. I still think the market faces resistance as SPX and QQQ approach the 200SMA.

I'll continue monitor opportunities using our options scanner to identify trades with the best premium-to-risk ratios.