Road to $100k - Week 15

Week 15 Performance Overview

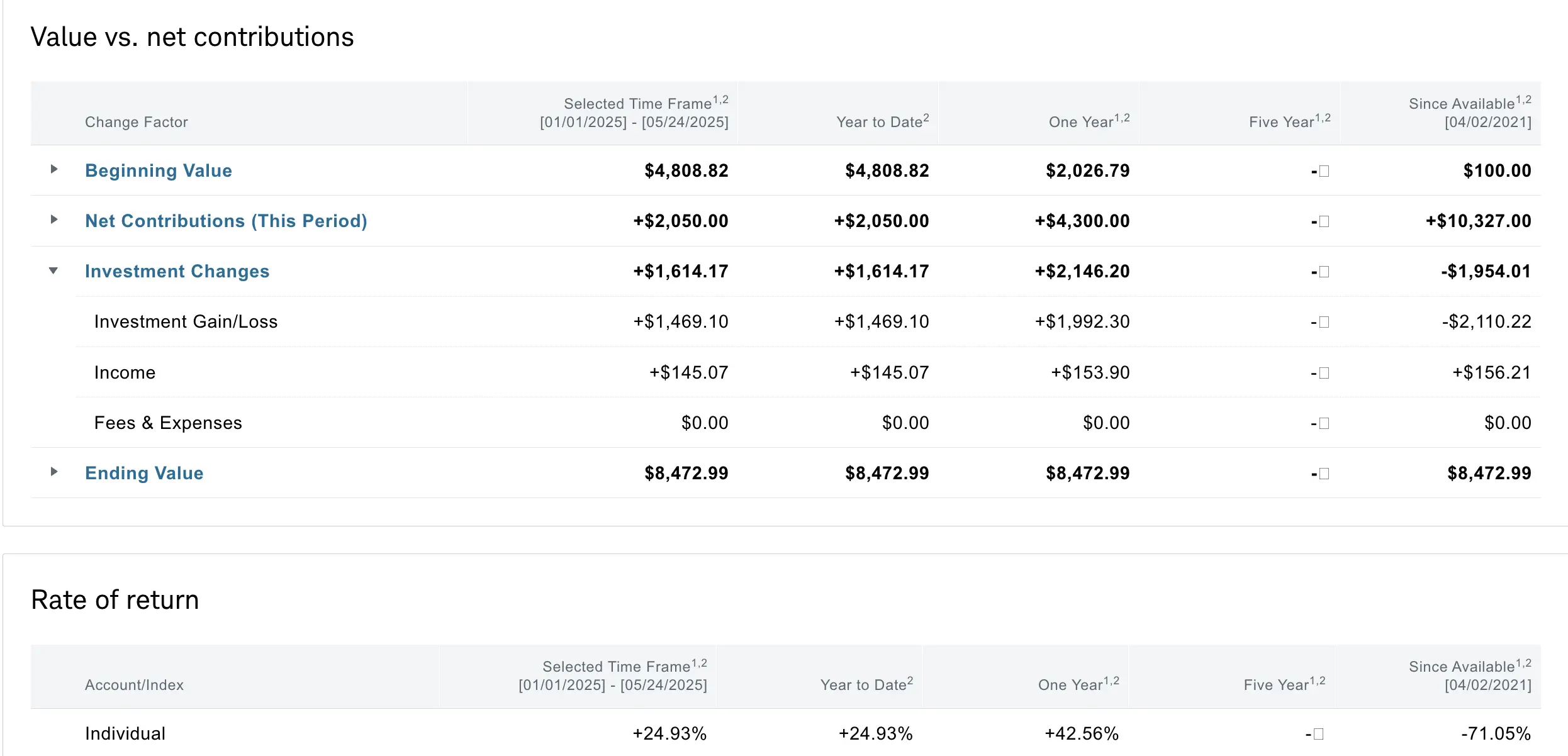

- Current Account Balance: $8,472

- Preparing for market pullback - maintaining higher cash position

- Closed NBIS cash secured put for profit and rolled covered calls for net credit

- Initiated new SOXL cash secured put position

- Sold GOOG shares to free up additional cash

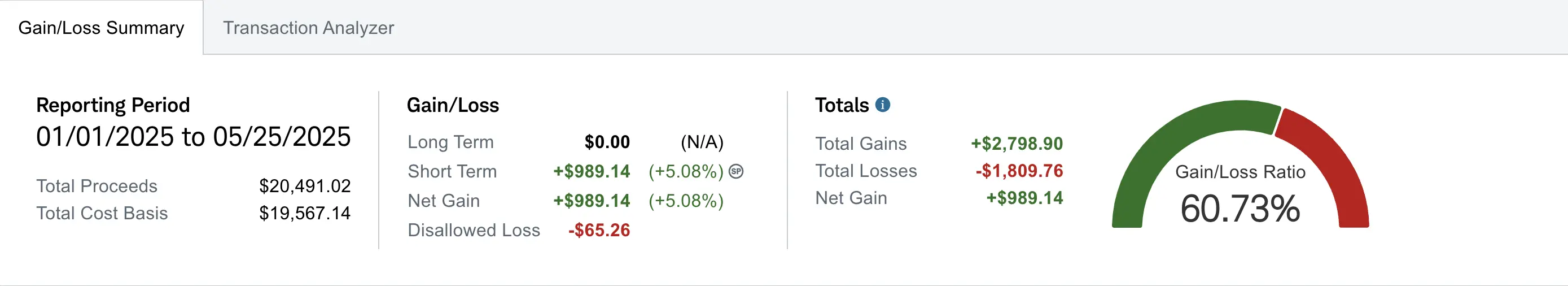

- Realized gain of $989.14 (Up $228.58 from Week 14)

- Win/loss ratio of 60.73% realized

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,954 despite contributing over $10.3K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year and YTD performance metrics are what truly matter for tracking this journey.

My Week 15 Trades

Market Outlook

This week not much trading activity occurred as I await a market pullback. I noticed that buying volume was exhausted on Monday, May 12th. The chart appears primed for a pullback to at least fill the closest gap on SPX around 5715ish.

$NBIS Position

I closed my $28.5 cash secured puts expiring 05/23 for a $5 debit. This trade resulted in a total profit of $45, as I had opened it for a net credit of $50 a week earlier.

Trade details:

-

05/20/2025 Buy to Close:

- 1 NBIS 05/23/2025 28.50 P

- Debit: -$5.00

I also rolled my $33 strike covered calls expiring 05/30 to the following Friday 06/06 for a net credit of $70. I made this roll in anticipation of an overall market pullback, wanting to stack up as much cash as possible while still maintaining a position in NBIS. I believe I can continue to collect premiums while recognizing that AI infrastructure remains crucial moving forward.

Trade details:

-

05/23/2025 Buy to Close:

- 1 NBIS 05/30/2025 33.00 C

- Debit: -$354

-

05/23/2025 Sell to Open:

- 1 NBIS 06/06/2025 33.00 C

- Credit: $424

$SOXL Position

As the market began to pull back this week, I initiated a new cash secured put position with a $13 strike expiring 05/30 for a net credit of $25. Depending on how the market plays out in the coming week, I may buy to close and secure the profit or roll down and out to a $12.5 strike while collecting additional net credits and lowering my adjusted cost basis.

Trade details:

-

05/23/2025 Sell to Open:

- 1 SOXL 05/30/2025 13.00 P

- Credit: $25

$GOOG Position

I sold my 3 shares of Google for a total net profit of $10.12. This decision wasn't due to bearish sentiment on Google. I still believe Google is one of the most undervalued AI plays out there and may revisit this play down the line for potential swings. I closed my position mainly to free up cash in preparation for more cash secured put deployments as I anticipate a market-wide pullback in the coming days or weeks.

Trade details:

-

05/21/2025 Sell Shares:

- 3 GOOG @ $171.065 (average cost of $167.69)

- Proceeds: $513.19

- Net Profit: $10.12

What I'm Holding Now

As of May 25, 2025, here's what's in my portfolio:

- 100 shares of $NBIS (average cost: $33.94) with 1 covered call at $33 strike (06/06 expiry)

- 1 cash secured put on $SOXL at $13 strike (05/30 expiry)

- $3,939.47 in cash - increased from previous week after selling GOOG shares and closing NBIS cash secured puts

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

I'm maintaining my cautious outlook on the market and continuing to prepare for a potential pullback. My increased cash position gives me flexibility to take advantage of buying opportunities if/when the market corrects.

For the coming week, I'll be monitoring my SOXL cash secured put position closely and may adjust it depending on market movement. I'll also continue to look for quick premium capture opportunities while maintaining my defensive posture overall.

I'll be using our options scanner to identify potential trades for the upcoming weeks.