Options Trading Journey: $6K to $100K - Week 17

Week 17 Performance Overview

- Current Account Balance: $8,774

- Multiple trades closed above 50% profit with over a week remaining

- Jobs report had less market impact than anticipated

- Monitoring China trade deal developments

- Building cash reserves for future opportunities

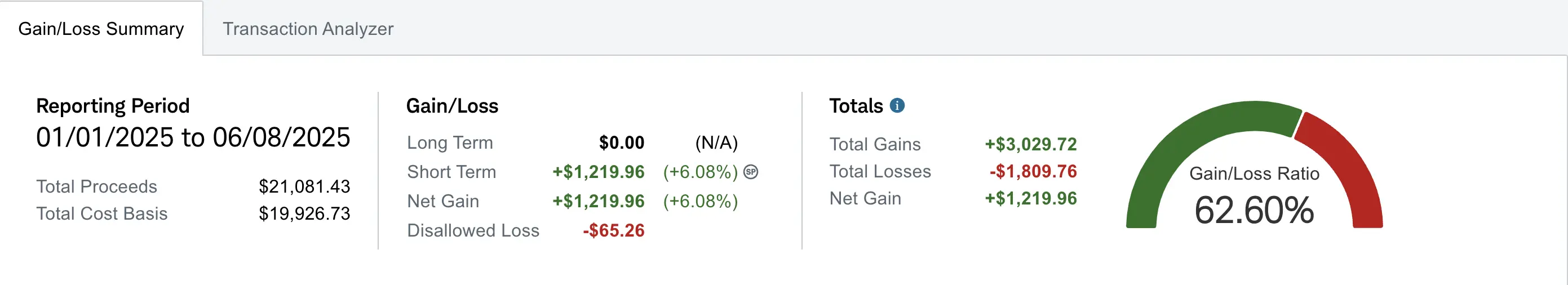

- Realized gain of $1,219.96 (up +$186.88 from Week 16)

Portfolio Performance

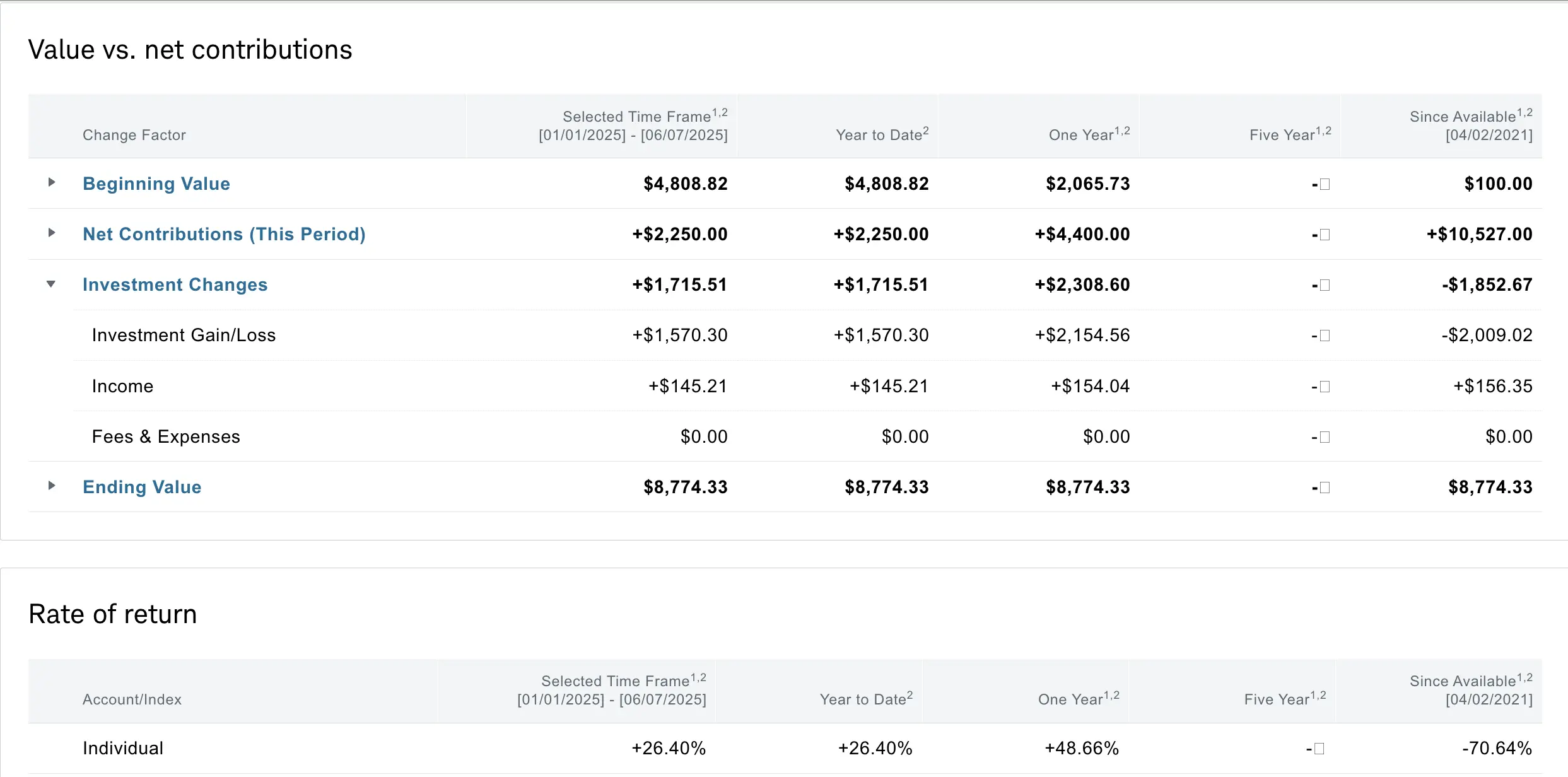

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,852 despite contributing over $10.5K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year and YTD performance metrics are what truly matter for tracking this journey.

Market Outlook

This week, I closed several trades for over 50% profit with more than a week left until expiration. The jobs report came out but didn’t move the market as much as anticipated. While I was previously expecting a broader pullback, it’s starting to look like the brief dip around May 25th may have been it—at least until we retest all-time highs. My outlook is mainly based on the strength of SPX and QQQ. Heading into next week, I’ll be watching developments around the China trade deal closely. Still building up cash in case a better entry shows up.

My Week 17 Trades

$LUNR Position

I sold to open $10 strike cash-secured puts for a $14 credit, then closed the position the same day for a $6 debit—locking in an $8 profit, or over 50% return in just one day.

Trade details:

-

06/02/2025 Sell to Open:

- LUNR 06/06/2025 10.00 P

- Net Credit: $14

-

06/02/2025 Buy to Close:

- LUNR 06/06/2025 10.00 P

- Debit: -$6

- Net Profit: $8

Later in the week, I sold another $LUNR cash-secured put at the $10.50 strike, expiring 06/13, for a $32 credit. I closed the position that same week for a debit after securing over 50% profit, with more than a week still remaining until expiration.

-

06/03/2025 Sell to Open:

- LUNR 06/13/2025 10.50 P

- Net Credit: $32

-

06/06/2025 Buy to Close:

- LUNR 06/13/2025 10.50 P

- Debit: -$15

- Net Profit: $17

I plan to continue selling options on $LUNR as opportunities arise, since I believe the stock has upside potential leading into their upcoming IM-3 mission. Even if I get assigned, I’m comfortable holding the shares. That said, if a trade is up over 50% with more than a week left, it's smart to lock in profits and free up capital to redeploy into other setups as they emerge.

$NBIS Position

I rolled my NBIS covered calls from the $33 strike expiring 06/06 to the same strike expiring 06/13—what I like to call milking cow (the cash cow). I'm continuing to squeeze as much net credit as possible from these contracts before they eventually get assigned. This latest roll brought in a $52 credit. With all the premiums I’ve collected from the initial cash-secured put assignment and the ongoing covered call rolls, my adjusted cost basis is now well below the original. So even if assignment happens, the overall NBIS trade will still end in net profit.

-

06/02/2025 Sell to Open:

- NBIS 06/13/2025 33.00 C

- Net Credit: $347

-

06/02/2025 Buy to Close:

- NBIS 06/06/2025 33.00 C

- Debit: -$295

- Net Profit: $52

$SOXL Position

I opened a $13 strike cash-secured put last week for a $17 credit and closed it this week for a $6 debit, locking in an $11 profit. I still believe the semiconductor sector is crucial to the growth and future of AI, so I’ll continue looking for cash-secured put opportunities in $SOXL as they come up.

-

06/02/2025 Buy to Close:

- SOXL 06/06/2025 13.00 P

- Debit: -$6

- Net Profit: $11

$BULL Position

This week, I spotted a potential falling wedge pattern on Webull’s 1-hour chart and took the opportunity to sell cash-secured puts, anticipating a bounce back toward the $11.50 resistance level. While the stock didn’t quite reach that target, I was still able to close the trade for nearly 50% profit with over a week remaining until expiration.

-

06/04/2025 Sell to Open:

- BULL 06/13/2025 10.00 P

- Net Credit: $31

-

06/04/2025 Sell to Open:

- BULL 06/13/2025 10.00 P

- Net Credit: $21

-

06/05/2025 Buy to Close:

- BULL 06/13/2025 10.00 P (2 contracts)

- Debit: -$24

- Net Profit: $28

I ended up closing the trade later that same week after Webull briefly broke out of the falling wedge but got rejected near the $11.25 level. I locked in profits and will be watching for a new opportunity to reenter with more cash-secured puts next week.

$TSLL Position

This week offered a strong setup for Tesla investors. While this account doesn’t have the capital to sell cash-secured puts directly on TSLA, I opted for TSLL—the 2x leveraged version—to gain exposure with a lower capital requirement. The tradeoff, of course, is heightened volatility. If you’re not comfortable with the sharp swings that come with leveraged ETFs, it’s best to steer clear.

-

06/05/2025 Sell to Open:

- TSLL 06/13/2025 11.00 P

- Net Credit: $33

I later opened an additional $TSLL contract at the $9.50 strike expiring 06/13 for a $30 net credit. There’s a strong chance I’ll get assigned on my $11 strike this week, and I’m fine with that. I’m prepared to start wheeling $TSLL—selling puts and covered calls—to collect net credits and lower my adjusted cost basis as needed. This is part of my strategy to manufacture a win. The $9.50 strike could also come under pressure, but if I can close that position for 50% or more profit before expiration, I’ll likely take the trade off.

-

06/05/2025 Sell to Open:

- TSLL 06/13/2025 9.50 P

- Net Credit: $30

What I'm Holding Now

As of June 8, 2025, here's what's in my portfolio:

- 100 shares of $NBIS (average cost: $33.94) with 1 covered call at $33 strike (06/13 expiry)

- 1 cash secured put on $TSLL at $11 strike (06/13 expiry)

- 1 cash secured put on $TSLL at $9.50 strike (06/13 expiry)

- Cash heavy of $3,580.92 maintained for potential opportunities.

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

Looking ahead, Elon agreed to ease tensions later that same night, following a massive social media outcry urging both him and Donald Trump to calm down and find common ground. This situation could create additional headwinds for TSLA as Robotaxi rollouts approach, so I’ll be monitoring closely and ready to roll positions as needed. I’m also anticipating updates from the China-US trade talks on Monday, along with any further developments in the Elon-Trump dynamic as their “bromance” faces turbulence.

I'll be using our options scanner to identify potential trades for the upcoming weeks.

Join our FREE trading community! Share ideas, learn strategies, and grow together:

Selling Options Discord