Road to $100k - Week 16

Week 16 Performance Overview

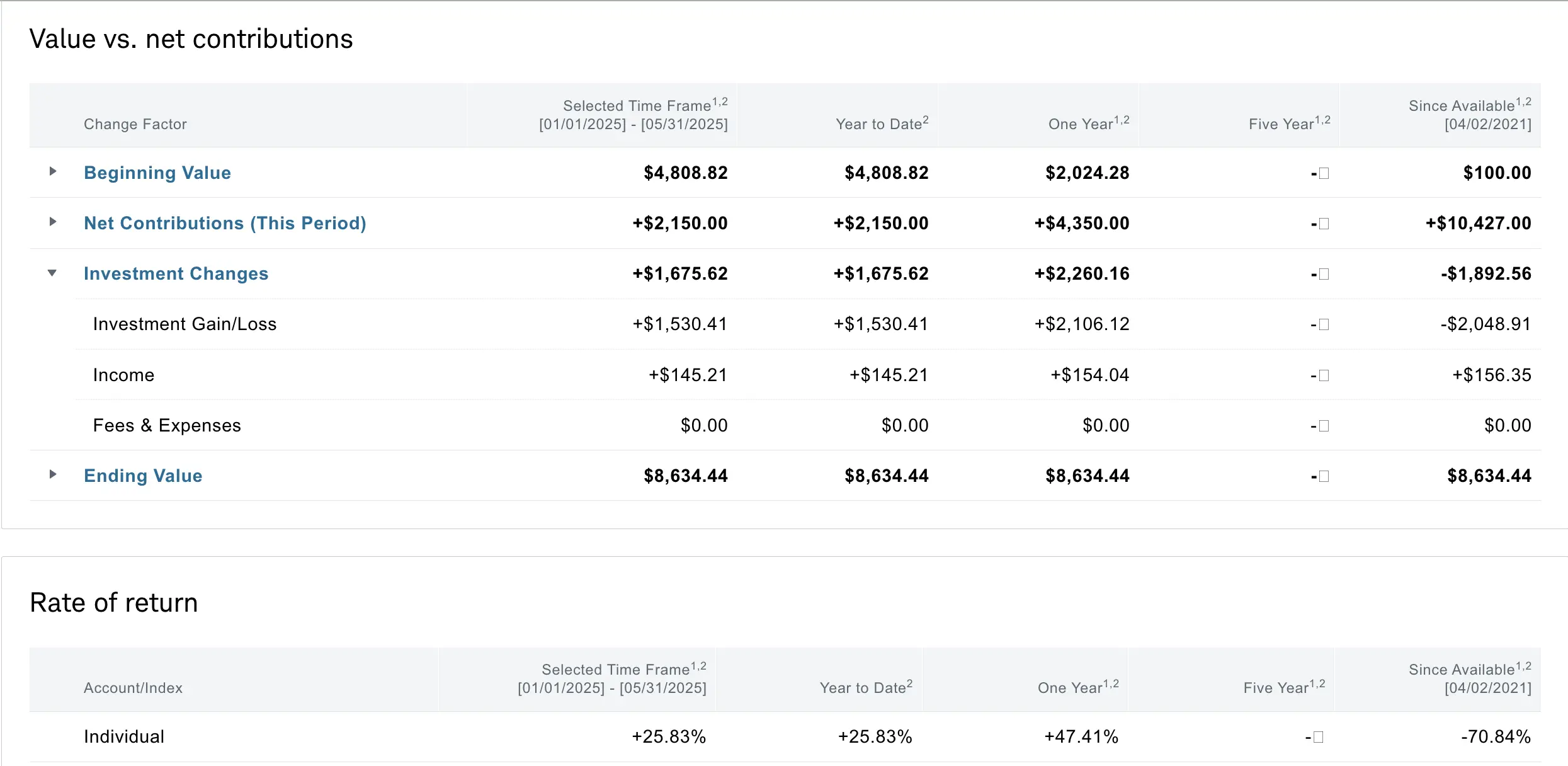

- Current Account Balance: $8,634

- Focus on Nvidia earnings and AI sector opportunities

- Closed multiple cash secured puts for profit

- Monitoring market conditions and Trump tariff discussions

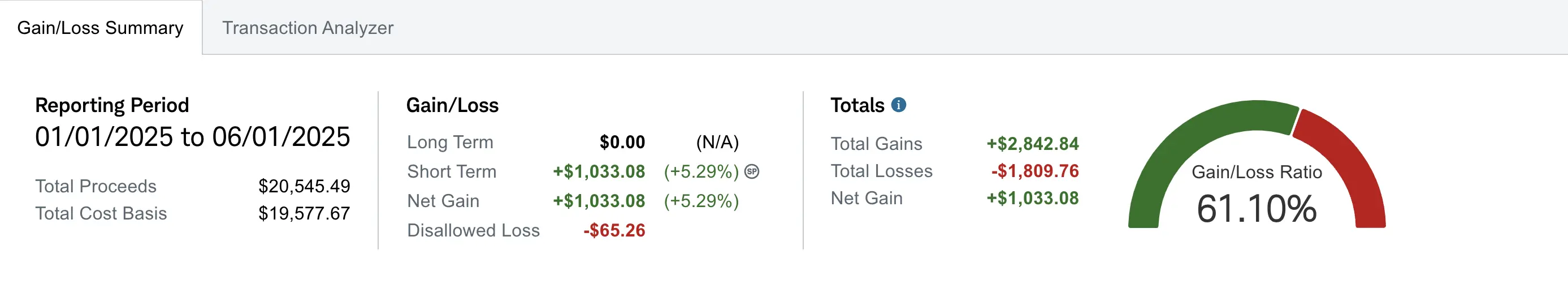

- Realized gain of $1,033.08 (Up $43.94 from Week 15)

- Win/loss ratio maintained above 60%

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,892 despite contributing over $10.4K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year and YTD performance metrics are what truly matter for tracking this journey.

My Week 16 Trades

Market Outlook

This week, my primary focus was Nvidia’s earnings. Despite headwinds from the China market being restricted by the Trump administration, the results were strong. The earnings call reinforced my belief that the AI wave is still in its early stages, with significant growth potential ahead. With that outlook, I positioned my trades to take advantage of opportunities in the semiconductor and AI sectors.

$SOXL Position

Heading into NVDA earnings, I held $13 cash-secured puts that I opened on 05/23 for a net credit of $25. I closed the position for $6, resulting in a total net profit of $19.

Trade details:

-

05/27/2025 Buy to Close:

- 1 SOXL 05/30/2025 13.00 P

- Debit: -$6

- Net Profit: $19

Toward the end of the week, as the market began to pull back, I opened another $SOXL cash-secured put expiring next Friday for a $17 net credit. Depending on how the market unfolds, I plan to either roll the position or close it next week for a profit.

Trade details:

-

05/30/2025 Sell to Open:

- 1 SOXL 06/06/2025 13.00 P

- Credit: $17

$NVDL Position

Ahead of NVDA’s earnings, I saw a quick “cash grab” opportunity and opened a position in NVDL, the leveraged version of NVDA, anticipating the options wouldn’t be assigned. Even if the price neared the strike, I had room to roll the position for additional credit. My confidence was rooted in the belief that the AI boom is far from over, with NVDA at the forefront. As CEO Jensen Huang noted during the earnings call, AI is becoming foundational infrastructure—like electricity or water. I sold $37 strike cash-secured puts for a $15 net credit and later closed the position for $3, securing a $12 profit.

Trade details:

-

05/27/2025 Sell to Open:

- 1 NVDL 05/30/2025 37.00 P

- Credit: $15

-

05/29/2025 Buy to Close:

- 1 NVDL 05/30/2025 37.00 P

- PUT GRNITSHR 1.5X LNG NV$37 EXP 05/30/25

- Debit: -$3

- Net Profit: $12

$MRVL Position

I opened another “cash grab” opportunity on MRVL ahead of its earnings, this time based on technical analysis. Using Fibonacci retracement levels and candlestick patterns, I identified what I believed to be a safe strike price. I sold cash-secured puts at the $52 strike, expiring 05/30, for a net credit of $15. The day after earnings, I closed the position for $1, locking in a $14 net profit.

Trade details:

-

05/29/2025 Sell to Open:

- 1 MRVL 05/30/2025 52.00 P

- Credit: $15

-

05/30/2025 Buy to Close:

- 1 MRVL 05/30/2025 52.00 P

- Debit: -$1

- Net Profit: $14

$NBIS Position

No trades were executed on NBIS this week, although I did attempt to roll my $33 strike covered calls out one more week for a $70 net credit. The order didn’t fill, so I’ll try again next week. Each successful roll and credit received lowers my adjusted cost basis. So even if I get assigned at the $33 strike—below my original average cost of $33.94—the cumulative credits bring my adjusted cost basis below $33, ensuring the overall trade still ends in a net profit.

What I'm Holding Now

As of June 1, 2025, here's what's in my portfolio:

- 100 shares of $NBIS (average cost: $33.94) with 1 covered call at $33 strike (06/06 expiry)

- 1 cash secured put on $SOXL at $13 strike (06/06 expiry)

- Cash heavy of $4,075.55 maintained for potential opportunities ahead amid potential market pullback

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

Looking ahead, I’m closely watching the broader market and the ongoing rhetoric around Trump tariffs. This week, reports surfaced that Trump accused China of violating trade talks made in Geneva, adding to market uncertainty. I expect continued volatility and will be monitoring both the tariff situation and developments in the AI sector. In the meantime, I’m building up cash reserves to stay prepared for any market pullbacks that could offer compelling buying opportunities in the coming weeks.

I'll be using our options scanner to identify potential trades for the upcoming weeks.