Road to $100k - Week 20

Week 20 Performance Overview

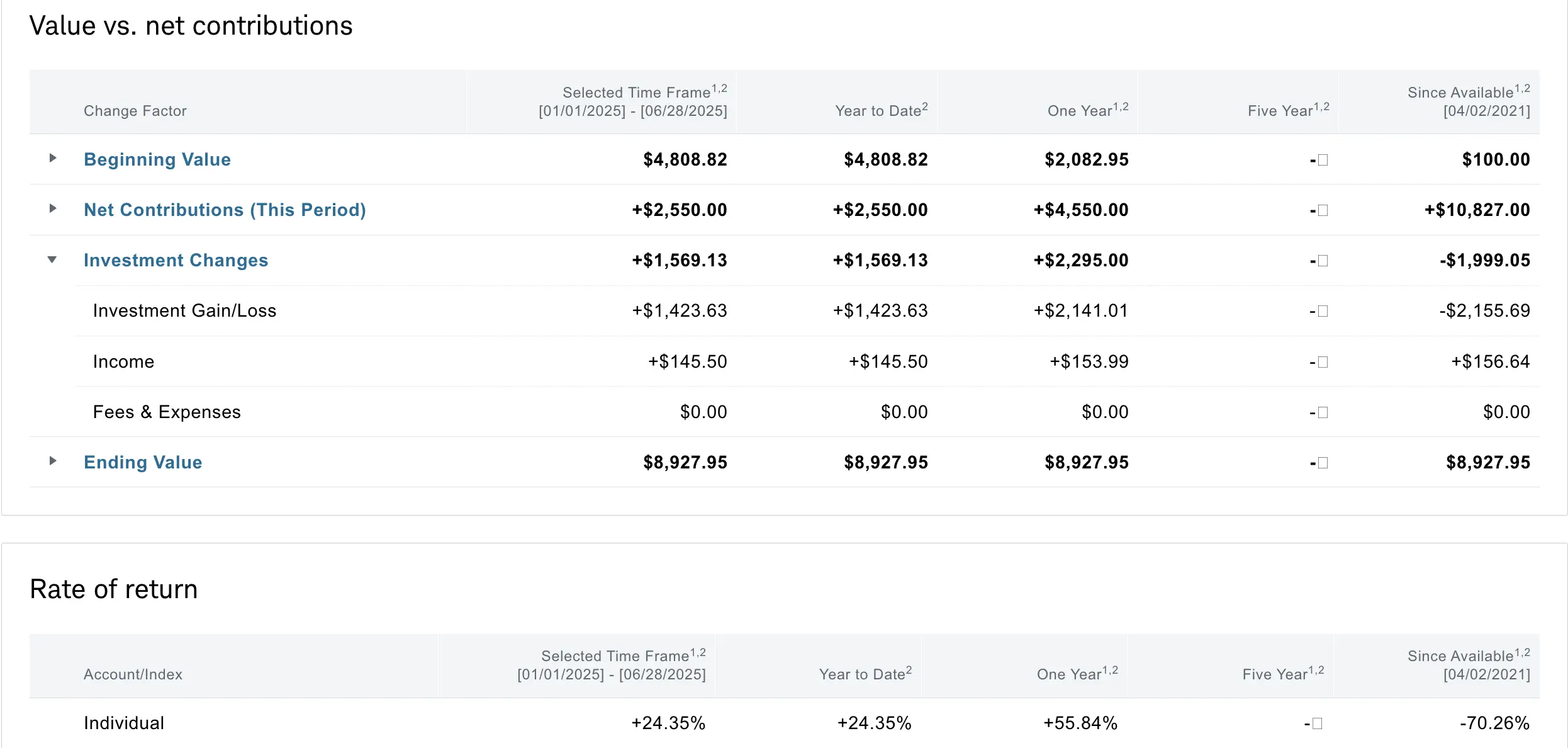

- Current Account Balance: $8,927

- Middle East conflict has deescalated as quickly as it started

- Broader indices making all-time highs, watching for potential pullback

- Treading carefully and stacking cash for future opportunities

- Added positions in $TSLL; managed positions in $IREN, $LUNR and $HIMS

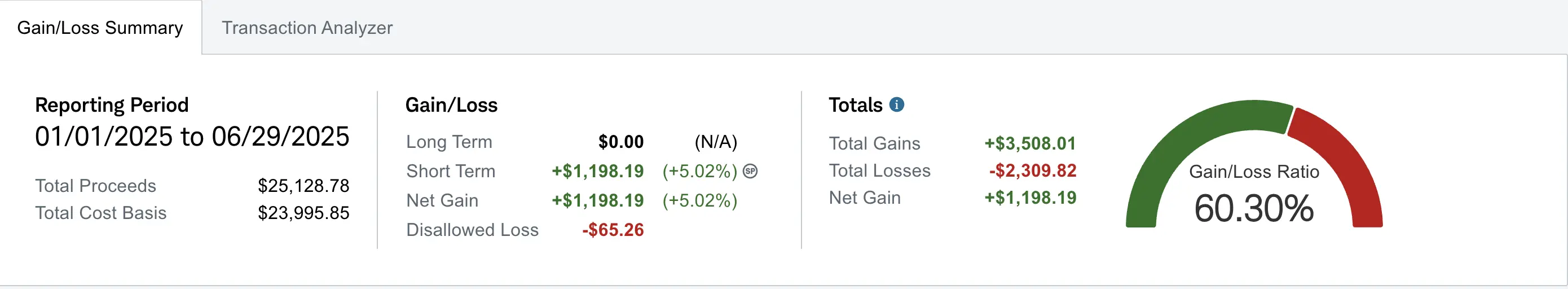

- Realized gain of $1,198.19 (up +$93.42 from Week 19)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,999 despite contributing over $10.8K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+55.84%) and YTD (+24.35%) performance metrics are what truly matter for tracking this journey.

Market Outlook

The previous week I was closely monitoring the conflict in the Middle East. That conflict has quickly deescalated as quickly as it started. With that conflict now behind us and the broader indices making all time highs I am setting my eyes on a potential pullback. So I am treading carefully and stacking on cash for any opportunities that may arise.

My Week 20 Trades

$HIMS

HIMS saw a significant drop this week after news broke that Novo Nordisk ended its partnership with Hims & Hers Health, Inc., citing concerns over illegal mass compounding and misleading marketing practices. I viewed the selloff as an opportunity to sell cash-secured puts, as HIMS isn't heavily reliant on GLP-1s for its core revenue. With a strong cash position and continued growth, I believe that even if the negative headlines linger, HIMS remains well-positioned for the long term.

-

06/23/2025 Sell to Open:

- HIMS 06/27/2025 38.00 P

- Net Credit: $64

-

06/24/2025 Buy to Close:

- Debit: -$28

- Net Profit: $36

I closed the trade the next day for a net profit of $36. Given the volatility in HIMS, I decided to exit early to lock in gains and reposition in case the stock continued to decline.

$TSLL

Following last Sunday's Robotaxi rollout, the market reacted with a classic "sell the news" response. In addition to the Robotaxi event a headline came out regading declining Tesla vehicle sales in Europe for the fifth month. I saw this as an opportunity and sold to open cash-secured puts on $TSLL for a net credit of $17. As $TSLA continued to decline, I opened an additional contract for a $22 credit. I plan to monitor TSLA closely this week and roll the positions if necessary as I remain a bullish outlook on Tesla as an AI/Robotics company.

-

06/25/2025 Sell to Open:

- TSLL 07/03/2025 10.50 P

- Net Credit: $17

-

06/25/2025 Sell to Open:

- TSLL 07/03/2025 10.50 P

- Net Credit: $22

$IREN

Last week, I opened a $9.50 strike cash-secured put on $IREN for a net credit of $14. I closed the position this week for a $1 debit to free up capital for other potential opportunities before the week ended. This trade resulted in a net profit of $13.

-

06/20/2025 Sell to Open:

- IREN 06/27/2025 9.50 P

- Net Credit: $14

-

06/25/2025 Buy to Close:

- IREN 06/27/2025 9.50 P

- Debit: -$1.00

- Net Profit: $13

$LUNR

This week, I continued to monitor $LUNR and took advantage of trading opportunities as they arose. I began by rolling my $10 strike cash-secured puts from the 06/27 expiration to 07/03, collecting a net credit of $16.

-

06/25/2025 Buy to Close:

- LUNR 06/27/2025 10.00 P

- Debit: -$12

-

06/25/2025 Sell to Open:

- LUNR 07/03/2025 10.00 P

- Credit: $28

- Net Credit from rolling: $16

-

06/26/2025 Buy to Close:

- LUNR 07/03/2025 10.00 P

- Debit: -$13

- Net Profit from all previous rolls: $40

The following day, I closed the rolled position for a $13 debit. After accounting for all previous rolls and the closing cost, the total net profit from the trade was $40.

$GME

Last week, I opened a $21.50 strike cash-secured put on $GME (opened 06/18/2025) for a net credit of $24. The contract expired worthless this week, resulting in a total net profit of $24. This realized gain should be reflected on Monday, as the position expired on Friday.

-

06/18/2025 Sell to Open:

- GME 06/27/2025 21.50 P

- Net Credit: $24

- Net Profit on expiration: $24

What I'm Holding Now

As of June 29, 2025, here's what's in my portfolio:

- 2 cash secured puts on $TSLL at $10.5 strike (07/03 expiry)

- $6,855.96 Cash reserves for potential market pullback opportunities

- I still maintain a weekly $100 deposit on Wed and Fri splits.

Looking Ahead

With the broader indices at all-time highs, I'm being cautious and building cash reserves for potential pullback opportunities. I'll continue to monitor $TSLA closely and manage my $TSLL positions accordingly. As always, I'll be scanning daily using the options scanner and staying flexible to adapt to market conditions.