Options Trading Journey: $6K to $100K - Week 26

Week 26 Performance Overview

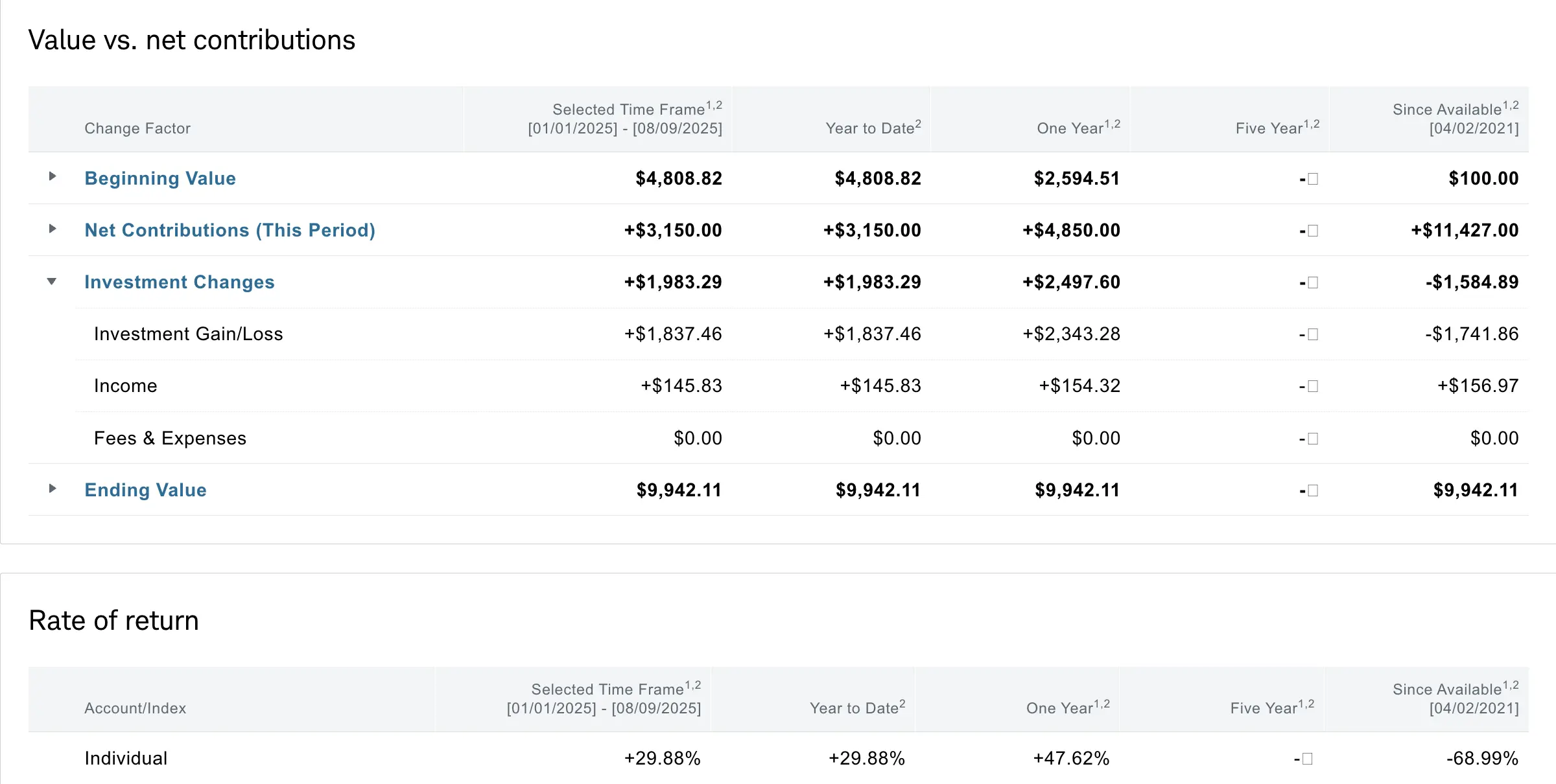

- Current Account Balance: $9,942

- Trump signed executive order opening 401ks and retirement plans access to Crypto and private companies

- Elon Musk announced the end of project DOJO, with Tesla AI6 chips as the successor

- Stephen Miran nominated to replace Adriana Kugler at the Fed, potentially adding pressure for rate cuts

- Managed positions in $LUNR and $MSTX

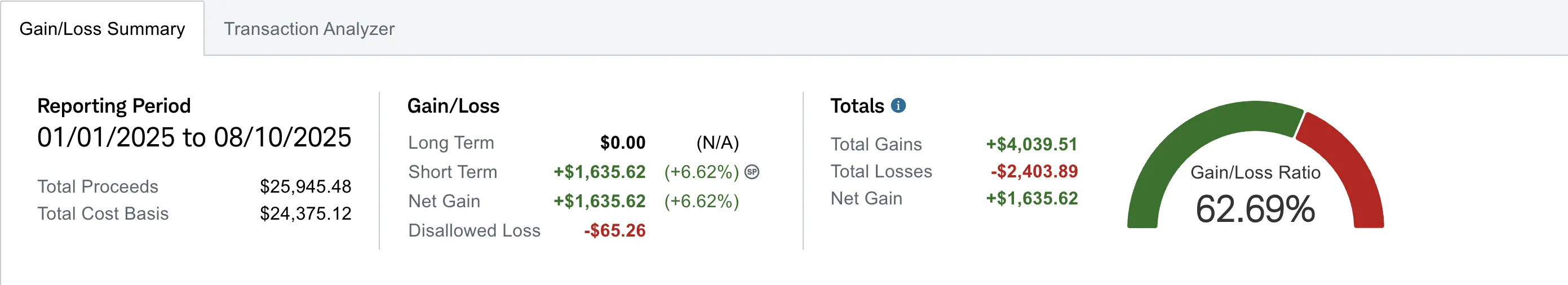

- Realized gain of $1,635 (up +$111 from Week 25)

Portfolio Performance

Moving forward I will also provide my portfolio performance on a weekly basis. Some context: prior to focusing on options selling, I used this Schwab portfolio for regular trading, often making poor investment decisions. Looking back, we all learn through experience. Last year, I took a significant loss on a penny stock ($BBIG), which impacted my all-time performance. Currently, I'm down about $1,584 despite contributing over $11.4K in deposits (last column). I began focusing exclusively on the wheel strategy in early 2024, which is why the past 1-year (+47.62%) and YTD (+29.88%) performance metrics are what truly matter for tracking this journey.

Market Recap

This week didn't have many market-moving headlines, but there were some notable developments. Trump signed an executive order opening 401ks and retirement plans access to Crypto and private companies. Elon Musk announced the end of project DOJO, which was a supercomputer aimed to train FSD data, confirming that Tesla AI6 chips will be the successor instead. Stephen Miran, a loyalist to Trump, has been nominated to replace Adriana Kugler for the remaining term until January 2026. This can be viewed as additional pressure for rate cuts ahead.

My Week 26 Trades

$LUNR

I previously had $9.5 cash secured puts going into earnings this week exp 08/08. I closed the cash secured puts for a net profit of $14 as I felt there would be other opportunities to redeploy the capital. Post earnings, $LUNR announced a delay to the IM-3 launch and the acquisition of KinetX. $LUNR still poses an entry opportunity but not at these levels. I expect further downside to test at least the $9.5 support, and when that happens, I'll be looking to bid for cash secured puts again.

-

08/01/2025 Sell to Open:

- LUNR 08/08/2025 9.50 P

- Quantity: 1

- Credit: $25

-

08/04/2025 Buy to Close:

- LUNR 08/08/2025 9.50 P

- Quantity: 1

- Debit: -$11

- Net Profit: +$14

After earnings, the stock dipped due to the delay and revenue miss. I opened a new cash secured put and closed it the next day due to the charts showing a DOJI candle followed by a bearish engulfing candle. This made me believe that there is more downside potential to the $9.5 area support. I'll be keeping a close eye on $LUNR ahead of the IM-3 launch, which is now pushed back to the second half of 2026.

-

08/07/2025 Sell to Open:

- LUNR 08/15/2025 9.50 P

- Quantity: 1

- Credit: $22

-

08/08/2025 Buy to Close:

- LUNR 08/15/2025 9.50 P

- Quantity: 1

- Debit: -$17

- Net Profit: +$5

$MSTX

Entering this week, I had 2 contracts of $25 strike MSTX cash secured puts exp 08/08. Early in the week, I rolled down and out 1 contract while keeping 1 contract at the $25 strike to capitalize on any further downside by rolling or just to see how MSTR would play out.

I rolled 1 contract down and out to 08/15 for a net credit of +$35.

-

08/04/2025 Buy to Close:

- MSTX 08/08/2025 25.00 P

- Quantity: 1

- Debit: -$22

-

08/04/2025 Sell to Open:

- MSTX 08/15/2025 24.00 P

- Quantity: 1

- Credit: $57

- Net Credit from rolling: +$35

Later during the week when Bitcoin spiked, I closed this $24 strike exp 08/15 for a debit of $20, bringing my net profit to +$36 from the roll which had opened a new contract at 08/15 for $57.

-

08/07/2025 Buy to Close:

- MSTX 08/15/2025 24.00 P

- Quantity: 1

- Debit: -$20

- Net Profit: +$36

For the other $25 strike exp 08/08, I misclicked and rolled down further with less credit than I intended, for a +$17 credit.

-

08/07/2025 Buy to Close:

- MSTX 08/08/2025 25.00 P

- Quantity: 1

- Debit: -$5

-

08/07/2025 Sell to Open:

- MSTX 08/15/2025 21.00 P

- Quantity: 1

- Credit: $22

- Net Credit from rolling: +$17

I also opened an additional $16 strike cash secured put exp 08/15 for a net credit of +$25. I later closed this same contract for $7 with a net profit of $18 (72% of the premium captured) with more than a week left to go. A general rule of thumb I've been sticking to is that if the trade is over 50% profitable with more than a week left, I like to close it and redeploy the capital elsewhere.

-

08/05/2025 Sell to Open:

- MSTX 08/15/2025 16.00 P

- Quantity: 1

- Credit: $25

-

08/07/2025 Buy to Close:

- MSTX 08/15/2025 16.00 P

- Quantity: 1

- Debit: -$7

- Net Profit: +$18

Finally, I opened another $MSTX contract going into next week with a $22 strike exp 08/15 for a net credit of $27. This was made possible due to me closing my previous rolled down and out strike of $24 from 08/08 to 08/15 for a $20 debit. By doing that, I was able to open a new cash secured put at a lower risk level and for more premium.

-

08/08/2025 Sell to Open:

- MSTX 08/15/2025 22.00 P

- Quantity: 1

- Credit: $27

What I'm Holding Now

As of August 10, 2025, here's what's in my portfolio:

- 2 cash secured puts on $MSTX: $21 and $22 strikes (08/15 expiry)

- $5,680 Cash reserves awaiting potential market opportunities

- Weekly $100 deposit on Wed and Fri splits

Looking Ahead

Going into next week, I'll be monitoring my $MSTX positions closely as they approach expiration. I'll also be keeping an eye on $LUNR for potential re-entry at lower levels, particularly around the $9.5 support area. With a healthy cash balance, I'm well-positioned to take advantage of any new opportunities that arise. I'll continue to use the options scanner to identify new setups while managing my existing positions.

Join the FREE trading community focused on selling options, sharing setups, and building consistent income:

Selling Options Discord