Road to $100k - Week 6

Week 6 Performance Overview

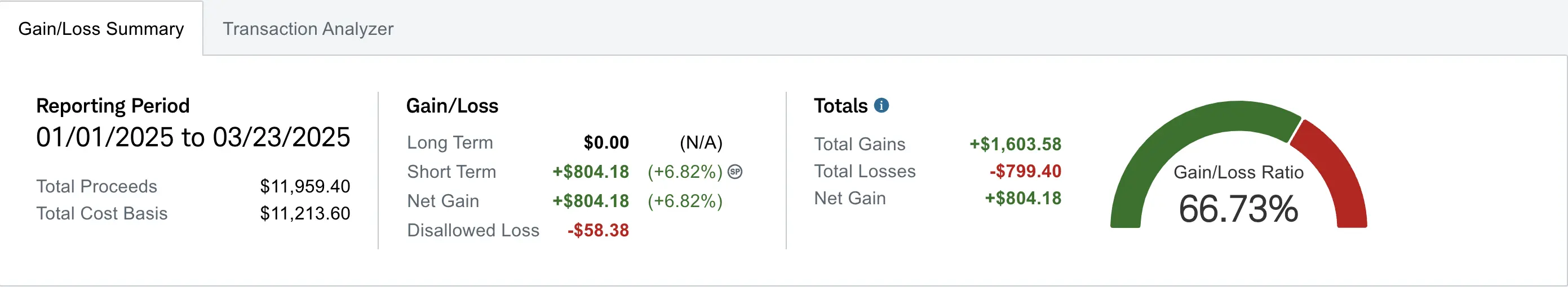

- Current Account Balance: $6,324

- Continued bounce back with expected continued volatility

My Week 6 Trades

This week focused on strategic position management and accumulation in key holdings:

$HIMS Position Building

I continued adding to my $HIMS position, bringing my total to 13 shares with an average cost of $34.05. My investment thesis for HIMS extends beyond the loss on GLP-1 shots offerings:

- Strong growth trajectory in future product offerings

- Continuous product innovation and expansion into new health verticals

- Scalable business model

When evaluating any position, I ask myself: "Will this company continue to innovate and expand its product offerings?" For HIMS, I believe the answer is yes, which is why I'm comfortable accumulating shares for both swing trades and potential long-term holding.

$NBIS Covered Call Management

I rolled my $NBIS covered calls from the $36 strike to a $33 strike with 3/28 expiration. This adjustment was strategic for several reasons:

- Premium at the previous $36 strike had significantly decreased

- My breakeven on NBIS is $33.94

- After accounting for all collected premiums, my adjusted breakeven is approximately $31-33

This roll exemplifies one of my core trading philosophies: "If a play goes against you, can you manufacture a win?" By continuously collecting premium through strategic rolls, I'm effectively lowering my cost basis while maintaining exposure to a company I believe in.

Trade Details:

-

Roll Transaction:

- Buy to Close: NBIS 03/21/2025 $36 Call for -$3

- Sell to Open: NBIS 03/28/2025 $33 Call for +$23

- Net Credit: $20

My bullish outlook on NBIS remains strong, particularly after NVIDIA's recent GTC event which highlighted several growth areas directly aligned with Nebius's business segments:

- Cloud AI providers (core to NBIS's data center business)

- Robotics and autonomous vehicles (through their AvRide subsidiary)

- Next-generation AI infrastructure development

$SOXL Cash Secured Put Roll

I rolled my $SOXL cash secured put to the 04/04 expiration. This allows me to maintain a position while waiting for the sector to boucne back.

- Continues to generate premium income during uncertain market conditions

- Maintains exposure to the semiconductor sector without direct ownership

Trade Details:

-

Roll Transaction:

- Buy to Close: SOXL 03/28/2025 $19 Put for -$123

- Sell to Open: SOXL 04/04/2025 $19 Put for +$168

- Net Credit: $45

This approach is a classic implementation of the "Wheel Strategy" - selling cash secured puts to collect premium, accepting assignment if it occurs, then selling covered calls on the assigned shares. This cyclical approach can generate consistent income while gradually reducing effective cost basis.

What I'm Holding Now

As of March 23, 2025, here's my current portfolio:

- 6 shares of $AMD (average cost: $112.77)

- 115 shares of $EVGO (average cost: $3.47)

- 2 shares of $GOOG (average cost: $176.13)

- 13 shares of $HIMS (average cost: $34.05)

- 100 shares of $NBIS with 1 covered call at $33 strike (03/28 expiry)

- 1 $SOXL CSP at $19 strike (04/04 expiry)

My Next Moves

Looking ahead to week 7, my strategy focuses on:

- Continuing to manage my $NBIS covered calls

- Continuing to deposit $100 weekly with Wed and Fri splits

- Monitoring the upcoming April 2nd tariff announcement for potential impacts on my $SOXL position

- Setting profit targets for my $HIMS position, looking for 2-5% gains in line with my "small wins" philosophy

- Evaluating new opportunities using our options scanner to identify additional premium-selling opportunities