Road to $100k - Week 7

Week 7 Performance Overview

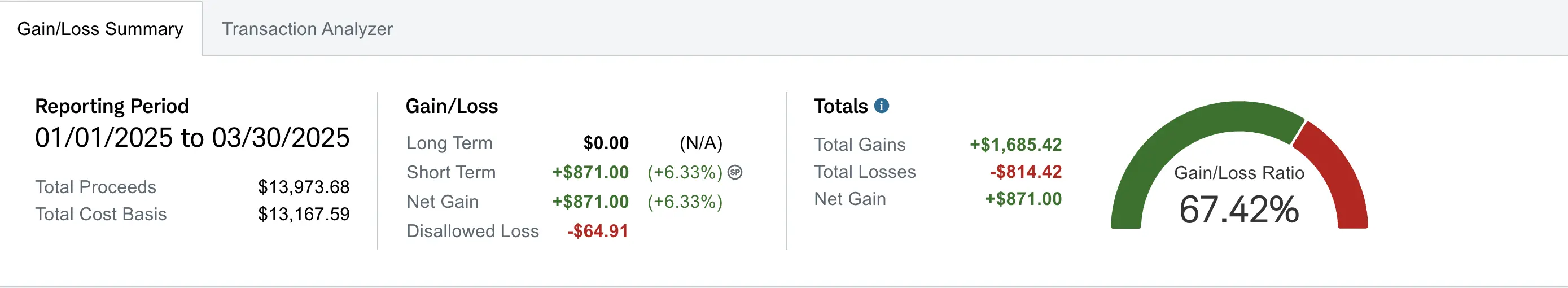

- Current Account Balance: $5,845

- YTD +$871 (6.33%)

- Win/loss ratio of 67.42%

- Market Conditions: Extreme volatility with significant pullback

My Week 7 Trades

This week was marked by extreme market volatility with dramatic swings in both directions. Despite these challenging conditions, I maintained my disciplined approach and emotional composure. My trading philosophy continues to guide my decisions: when a trade moves against me, I focus on "manufacturing the win" through strategic adjustments rather than panicking. I also embrace the power of compounding small victories—not every trade needs to be a home run to build significant returns over time. With these principles in mind, I executed several tactical trades to navigate this turbulent market:

$HIMS Swing Trading

I've been actively swing trading $HIMS this week with multiple entries and exits:

-

Initial Position:

- Sold all 13 shares at a profit of $26.51

-

First Re-entry (March 27):

- Bought 20 shares @ $32.33 for -$646.57

- Sold same-day @ $33.00 for +$659.98

- Quick profit: $13.41 (excluding fees)

-

Second Re-entry (March 29):

- Bought 3 shares @ $30.32

- Currently holding this position

This approach exemplifies my "small wins" philosophy - I'm not waiting for massive gains, but instead taking profits of $5-10 when available. These small wins compound over time and help build the account steadily.

$NBIS Covered Call Management

I rolled my $NBIS covered calls early in the week when the market was showing strength:

-

Roll Transaction:

- Buy to Close: NBIS 03/28/2025 $33 Call for -$8

- Sell to Open: NBIS 04/04/2025 $33 Call for +$38

- Net Credit: $30

This roll proved to be well-timed given the significant market pullback later in the week. Even though I remain underwater on my NBIS position, I continue to "manufacture the win" by collecting premiums that gradually reduce my adjusted cost basis. My trading philosophy remains consistent: collecting something is better than collecting nothing.

$EVGO Covered Call Strategy

I initiated a covered call position on my $EVGO shares:

- Sell to Open: EVGO 04/04/2025 $3.50 Call for +$5

While the premium is modest, this aligns with my strategy of generating consistent income from existing positions. Over time, these small premiums will significantly reduce my cost basis.

$AMD Position Exit

I sold my entire $AMD position (6 shares at $112.77 average cost) for a profit of approximately $8. In retrospect, this was a well-timed exit given the market's dramatic decline toward the end of the week."

$SOXL Cash Secured Put Management

I made two strategic moves with my $SOXL cash secured puts:

-

First Position Roll:

- Buy to Close: SOXL 04/04/2025 $19 Put for -$151

- Sell to Open: SOXL 04/11/2025 $19 Put for +$183

- Net Credit: $32

-

New Position and Roll:

- Sell to Open: SOXL 04/04/2025 $14 Put for +$10

- Later rolled to: SOXL 04/11/2025 $14 Put for additional credit of $24

These moves were made in anticipation of continued market volatility ahead of Trump's tariff announcement on April 2nd. By rolling these positions, I'm collecting premium while waiting for more clarity in the market, expecting a potential bounce once the uncertainty around tariffs is resolved.

Weekly Results

Combining all the net credits and profits from swing trades this week, I earned approximately $145. This demonstrates how small, consistent wins can add up even during highly volatile market conditions.

What I'm Holding Now

As of March 30, 2025, here's my current portfolio:

- 115 shares of $EVGO (average cost: $3.47) with 1 covered call at $3.50 strike (04/04 expiry)

- 3 shares of $HIMS (average cost: $31.30)

- 2 shares of $GOOG (average cost: $176.13)

- 100 shares of $NBIS with 1 covered call at $33 strike (04/04 expiry)

- 1 $SOXL CSP at $19 strike (04/11 expiry)

- 1 $SOXL CSP at $14 strike (04/11 expiry)

My Next Moves

Looking ahead to week 8, my strategy focuses on:

- Closely monitoring the market reaction to Trump's April 2nd tariff announcement, which could provide trading opportunities

- Continuing to manage my $NBIS covered calls and $SOXL cash secured puts

- Looking for additional swing trade opportunities with $HIMS and other stocks

- Maintaining my "small wins" philosophy - taking profits when available rather than waiting for home runs

- Evaluating new opportunities using our options scanner to identify high-probability setups in this volatile market