Road to $100k - Week 9

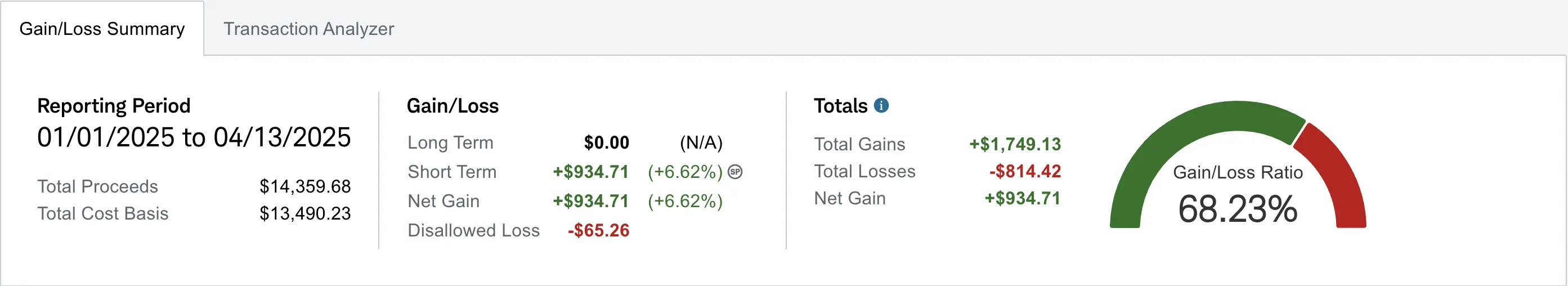

Week 9 Performance Overview

- Current Account Balance: $5,165

- Market Conditions: Extreme volatility with tariff policy shifts

Tariff Policy Developments

This week was marked by extraordinary market volatility driven by evolving tariff policies. Trump announced a pause on tariffs for countries that did not retaliate, triggering a market rally of nearly 10%, followed by a sharp 5% drawdown the next day. Base tariff policy of 10% still stands.

Notably, guidance from Customs and Border Protection indicated several products would be excluded from reciprocal tariffs, including smartphones, computers, routers, and most notably semiconductor chips. This development creates a window of opportunity for semiconductor-related positions like my $SOXL holdings.

My Week 9 Trades

Given the extreme market volatility, I limited my trading activity this week and focused on taking profits when available. As I've consistently maintained: even if it's just a $5 profit, that's $5 more than I started with.

$HOOD Swing Trade

I executed a quick swing trade on Robinhood ($HOOD):

-

Trade Details:

- Bought 2 shares @ $30.00 for -$60.00

- Sold @ $32.62 for +$65.24

- Net profit: $5.24

$MSTX Swing Trade

I also traded the Bitcoin-related leveraged ETF $MSTX:

-

Trade Details:

- Bought 1 share @ $16.70

- Bought 1 share @ $17.00

- Bought 3 shares @ $18.00

- Total investment: $87.70

- Sold all 5 shares @ $18.80 for +$94.00

- Net profit: $6.30

$SOXL Assignment and Covered Call Strategy

My $SOXL $19 cash secured puts got assigned early this week

-

$19 strike CSP: Assigned early on 04/11

- Immediately sold a covered call: SOXL 04/17/2025 $15 Call for a credit of $10

- $14 strike CSP: Will be assigned on Monday and will be selling covered calls

If I were to calculate my position based solely on the strike prices, my average cost would be $16.50 per share. However, after accounting for all the premiums collected from my cash secured puts, my adjusted cost basis is between $14-15. This is why I sold covered calls at the $15 strike - it's near my adjusted breakeven point.

The recent tariff exclusions for semiconductor chips provide an excellent opportunity to sell covered calls on $SOXL and collect premiums while the broader tariff situation continues to evolve. I am looking forward to Monday to capture this window of opportunity.

$NBIS Position Update

My $NBIS covered calls expired worthless this week, converting all previously collected premium from my rolling strategy into realized gains. This outcome demonstrates the power of covered calls to generate income during market turbulence. Moving forward, I'll continue writing covered calls on this position. Even at strikes below my adjusted cost basis if necessary—to steadily reduce my overall adjusted cost basis while waiting for the tariff situation to stabilize. I will continue to roll if needed.

Portfolio Addition

I added 1 share of $HIMS @ $26.17 for a potential swing trade into next week.

What I'm Holding Now

As of April 13, 2025, here's my current portfolio:

- 115 shares of $EVGO (average cost: $3.47)

- 1 share of $HIMS (average cost: $26.17)

- 3 shares of $GOOG (average cost: $167.69)

- 100 shares of $NBIS (average cost: $33.94)

- 100 shares of $SOXL (assigned at $19) with 1 covered call at $15 strike (04/17 expiry)

- 100 shares of $SOXL pending assignment at $14 strike

My Next Moves

Looking ahead to week 10, my strategy focuses on:

- Selling covered calls on my second $SOXL position once assigned to generate additional premium income

- Continuing to monitor the evolving tariff situation, particularly potential deals with South Korea, Japan, and other priority countries

- Maintaining my disciplined approach to taking profits in this volatile environment

- Looking for additional swing trade opportunities with $HIMS and other stocks

- Evaluating new opportunities using our options scanner to identify high-probability setups